US Credit Card Defaults Soar To Crisis Highs As Inflation Storm Crushes Working-Poor

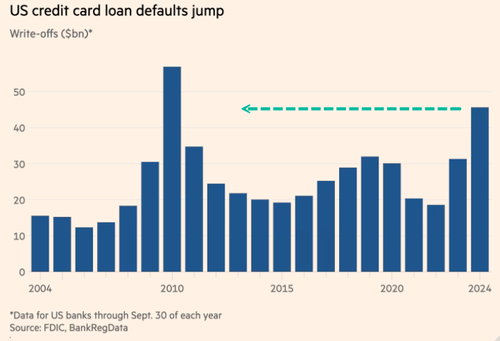

The party is long over for the bottom third of US consumers, as maxed-out credit cards and depleted personal savings have pushed credit card loan defaults to their highest level since the 2008 financial crisis.

Financial Times cited new data from BankRegData revealing that credit card companies wrote off $46 billion in „seriously delinquent loan” balances in the first nine months of the year—an alarming 50% increase from the same period last year and the highest level in 14 years.

Source: Financial Times

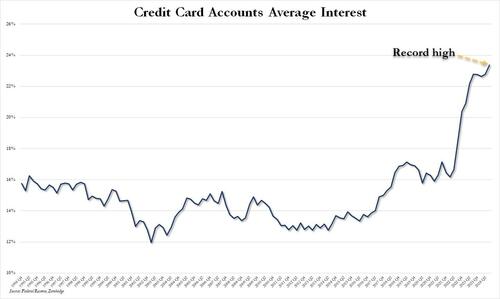

Source: Financial Times US credit debt recently surpassed $1 trillion and continues to expand rapidly. Making matters worse, annual percentage rates (APRs) on credit card debt have hit record highs, compounding the financial misery for cash-strapped consumers in the era of failed 'Bidenomics’.

Despite the interest rate cut, the average APR on credit card debt reached a new record at the end of the third quarter.

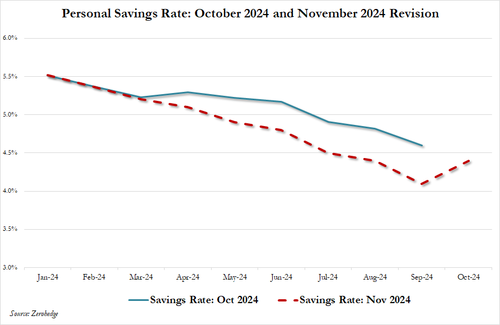

With the election over, the Biden administration’s Department of Commerce revised personal savings data downward by a staggering $140 billion. In other words, radicals in the Biden administration and far-left Democrats pushed nothing more than economic propaganda.

The head of Moody’s Analytics, Mark Zandi, noted, „High-income households are fine, but the bottom third of US consumers are tapped out,” adding, „Their savings rate right now is zero.”

This collapse in personal savings, combined with insurmountable credit card debt, largely explains why the bottom third of Americans are not only living paycheck to paycheck but also have financially committed suicide with the explosive use of toxic Buy Now, Pay Later services.

„Consumer spending power has been diminished,” Odysseas Papadimitriou, head of consumer credit research firm WalletHub, pointed out.

WalletHub’s Papadimitriou warned, „Delinquencies are pointing to more pain ahead.”

Tyler Durden

Mon, 12/30/2024 – 16:40

2 dni temu

2 dni temu