Conference Board Confidence Continues To Collapse Post-Election…

Americans’ consumer confidence fell for the second month in a row in January according to The Conference Board, dropping from an upwardly revised 109.5 (how do you revise 'confidence’?) to 104.1 (vs 105.7 exp) with expectations and current conditions both falling (from upwardly revised data)…

Source: Bloomberg

That is a four month low in consumer confidence… despite most other indications of confidence and animal spirits having surged since Trump’s election…

Source: Bloomberg

“Consumer confidence has been moving sideways in a relatively stable, narrow range since 2022. January was no exception. The Index weakened for a second straight month, but still remained in that range, even if in the lower part,” said Dana M. Peterson, Chief Economist at The Conference Board.

“All five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline. Notably, views of current labor market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row.

Meanwhile, consumers were also less optimistic about future business conditions and, to a lesser extent, income.

The return of pessimism about future employment prospects seen in December was confirmed in January.”

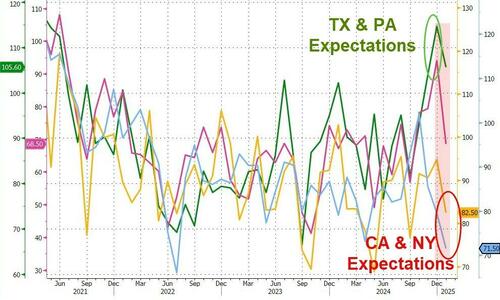

Even the Trump-favoring states saw expectations plunge apparently – after surging in December…

Source: Bloomberg

After 3 months of rebounding, labor market conditions slumped in January…

Source: Bloomberg

Buying conditions for big-ticket items such as cars, houses and appliances softened.

Inflation and interest rate expectations rose while stock market expectations dipped in January…

Source: Bloomberg

Nonetheless, there were positive notes in other aspects of the survey. Peterson added that „consumers’ views of their Family’s Current Financial Situation were more positive, and six-month expectations for family finances reached a new series high. The proportion of consumers anticipating a recession over the next 12 months was stable near the series low.”

Tyler Durden

Tue, 01/28/2025 – 10:20

2 dni temu

2 dni temu