Bessent Says Market „Corrections Are Healthy”, Offers „No Guarantees” There Won’t Be A Recession

Earlier today, Morgan Stanley’s Mike Wilson described several of the factors behind the recent market swoon (the 10% drop in 20 days was the 5th fastest ever correction in history; for context the fastest ever was 8 days during the onset of Covid on February 27, 2020), and besides the various fundamental causes, the strategist said that „perhaps more than anything else” what led to the most recent technical breakdown in the S&P 500 was „Trump recently indicating that he is not focused on the stock market in the near term as a barometer of his policies and agenda.” One could go further: and in fact, we did go further last week when we asked if Trump is actively seeking to push the US into a recession (one which he would correctly blame on Biden for reasons described in this post), just that by the time the US economy is once again firing on all cylinders and the market at all time highs, will be just in time for the mid-term elections in 2026.

Well, if Trump’s „let them eat stocks” attitude indeed was the biggest driver behind the recent selloff, then Friday’s furious rally may prove to be very short-lived, because speaking on Sunday’s episode of Meet the Press, Treasury Secretary Scott Bessent, a former hedge fund manager, not only said he’s not worried about the recent market downturn, but added that „there are no guarantees” there won’t be a US recession. In other words, the Trump put remains as nebulous as ever, and meanwhile statements like this one from Howard Lutnick that “the Donald Trump economy” would really start taking off “in the fourth quarter” suggest that pretty much anything goes in Q1, Q2 and Q3…. and whatever does happen will be blamed on Biden.

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said on NBC’s Meet The Press. And what he said next is absolutely spot on and something Biden’s puppetmaster should have been made aware of when they were juicing the economy with $1 trillion in debt every 100 days:

„What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis. It would have been much healthier if someone had put the brakes on in ‘06, ‘07. We wouldn’t have had the problems in ‘08. So, I’m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.”

Bessent’s comments come at amid investor concerns about the economic effects of the Trump administration’s moves around tariffs, immigration and cuts to the federal government, which wiped out trillions in market cap from the S&P 500 and pushed the S&P into a correction.

Losses deepened with mounting growth concerns and souring consumer sentiment, but Bessent isn’t losing much sleep over the market slide. Asked what he has to „say to Americans who have real concerns that their retirement savings may be in jeopardy”, the Treasury Secretary responded that „one week does not the market make. As Warren Buffett says, over the short term the market is a voting machine. Over the long term, it’s a weighing machine.. It would have been very easy for us to come in, run these reckless policies that have been happening before. We’ve got these large government deficits, 6.7% of GDP. We’ve never seen this when we’re not in war time, not in recession. We are bringing those down in a responsible way. We are going to have a transition. And we are not going to have a crisis.”

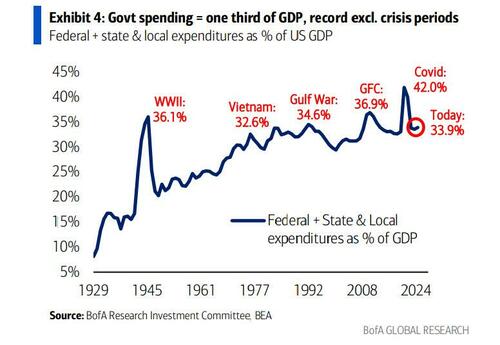

This is precisely what we noted last week when we showed that in 2024, one third of GDP came from government spending, a record high excluding periods of war or crisis; this was financed by 6-7% budget deficits, another unwelcome peacetime record, as Bank of America itself admitted.

„We are putting the policies in place that will make the affordability crisis go down, inflation moderate and as we set the sails I am confident that the American people will come our way,” said Bessent, who ran Key Square Group before joining the administration.

As the scope of President Donald Trump’s tariff policy broadens, consumers across the political spectrum have become increasingly concerned that the extra duties will lead to higher costs. Global tariffs are now in place on steel and aluminum and there’s an April 2 deadline pending for even broader levies. And while inflation cooled last month, any sustained pickup in price pressures risks causing households to limit discretionary purchases.

In the interview, Bessent said the American Dream isn’t contingent on being able to buy cheap goods from China. Families instead want to afford a home and see their children do better than they are.

„The American dream is not let them eat flat screens. If American families aren’t able to afford a home, don’t believe that their children will do better than they are, the American dream is not contingent on cheap baubles from China, that it is more than that. And we are focused on affordability, but it’s mortgages, it’s cars, it’s real wage gains… Access to cheap goods is not the essence of the American dream. The American dream is rooted in the concept that any citizen can achieve prosperity, upward mobility and economic security.”

Finally when asked if the US will have a recession, Bessent said „there are no guarantees. Who would have predicted COVID, right? So I can predict that we are putting in robust policies that will be durable.”

„And could there be an adjustment? Because I tell you that this massive government spending that we’d had, that if that had kept going, we have to wean our country off of that. And on the other side, we are going to invigorate the private sector. I had a meeting with small bankers last week. And they are ready to start lending. And I can tell you that Main Street is going to do well.”

Our Administration and the American people are focused on the real economy, not fake news polling or “vibecessions.”

After four disastrous years for families and workers, President Trump has the track record and vision to deliver the most vibrant economy and capital markets in… pic.twitter.com/Z3hdg5Wp39

— Secretary of Treasury Scott Bessent (@SecScottBessent) March 16, 2025

Or as we said on Friday, „Wall Street Finally Admits DOGE’s Work To „Detox” Government Is Critical, But Will Be Brutally Painful.„

Amid concerns about the US economy, the Fed is due to meet this week and keep rates on hold. Fed Chair Powell emphasized earlier this month that the central bank doesn’t need to be in a hurry to cut rates – which is strange since Powell was clearly in a hurry to cut rates back in September ahead of the presidential election when the economy was „supposedly” doing so much better than it is now – and the Fed chair will be pressed about the uncertainty and risks emerging.

Some other highlights from the full 10 minute interview:

I am confident that the American people will come our way” on Trump tariff policy

KRISTEN WELKER: A majority of Americans say they disapprove of President Trump’s handling of the economy. Consumer sentiment plunged this week to a 29-month low. JP Morgan, Goldman Sachs slashed growth expectations. Why are all of those folks wrong and President Trump is right about his tariff policy?

SEC. SCOTT BESSENT: Well, Kristen, and thanks for having me here. And look, what I am not going to say, that went on for a long time under the Biden administration, and for a lot of — lot of the media, and I’m not going to point fingers, but they used to say it was a vibe session, and the American people don’t know what they talk about. And Donald Trump, his administration, myself, all believe that the American people know what they’re feeling and that we believe that our policies will change that. Clearly, they are traumatized from what’s happened with this affordability crisis that was brought on the – by the previous administration. They want relief. We’ve been in for eight weeks. We’re putting the policies in place that will make the affordability crisis go down, inflation moderate, and that the – as we set the sails, I am confident that the American people will come our way, even if some of the media narrative doesn’t.

“I’m not worried about the markets” following worst week in stock market in two years

KRISTEN WELKER: And just to be clear, I mean, these are polls that are taken two months into President Trump’s presidency. But let’s talk about what happened in the stock market this week, worst week for the market in two years. Does that worry you, Mr. Secretary?

SEC. SCOTT BESSENT: Not at all. I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal. What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis. It would have been much healthier if someone had put the brakes on in ‘06, ‘07. We wouldn’t have had the problems in ‘08. So, I’m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.

„One week does not the market make”

KRISTEN WELKER: I hear you say you’re not worried about the markets, but nearly 60% of Americans are invested in the markets. That’s their retirement savings. What do you say to Americans who have real concerns that their retirement savings may be in jeopardy?

SEC. SCOTT BESSENT: I say that one week does not the market make. As Warren Buffet says, “Over the short term, the market is a voting machine. Over the long term, it’s a weighing machine.” And again, Kristen, it would have been very easy for us to come in, run these reckless policies that have been happening — happening before. We’ve got these large government deficits, 6.7% of GDP. We’ve never seen this when we’re not in war time, not in recession. We are bringing those down in a responsible way. We are going to have a transition, and we are not going to have a crisis

There are no guarantees that there won’t be a recession

KRISTEN WELKER: Mr. Secretary, can you guarantee the American people here and now that there will be no recession on President Trump’s watch?

SEC. SCOTT BESSENT: Well, Kristen, you — you — you know that there — there are no guarantees, like, who — who would have predicted Covid? So I — I can predict that we are putting in robust policies that will be durable. And could there be an adjustment, because I — I tell you, this massive government spending that we’re — we’d had that, if that had kept going, we — we have to wean our country off of that. And on the other side, we are going to invigorate the private sector. I had a meeting with small bankers last week, and they are ready to start lending. And I can tell you that main street is going to do well.

KRISTEN WELKER: So, what exactly do you mean when you say “adjustment?” Could that potentially lead to a recession?

SEC. SCOTT BESSENT: I — there’s no reason that it has to. But, you know, I can tell you that if we kept on this track, what I couldn’t — what I could guarantee is we would have had a financial crisis. I’ve studied it, I’ve taught it, and if we had kept up at these spending levels that — everything was unsustainable. So we are putting that — we are resetting, and we are putting things on a sustainable path.

On “cheap goods” comment from last week: “The American dream is not contingent on cheap baubles from China”

KRISTEN WELKER: Mr. Secretary, are you there essentially saying that the Trump administration is comfortable to have consumers pay more for goods in America?

SEC. SCOTT BESSENT: Not at all, Kristen. What I’m saying is the American dream is not “let them eat flat screens.” That if American — if American families aren’t able to afford a home, don’t believe that their children will do better than they are, the American dream is not contingent on cheap baubles from China, that it is more than that. And we are focused on affordability, but it’s mortgages, it’s cars, it’s real wage gains.

KRISTEN WELKER: Do you acknowledge, though, that tariffs will ultimately drive up prices, at least in the short term? That’s what economists, that’s what business leaders, that’s what CEOs say.

SEC. SCOTT BESSENT: Well, they don’t have to because I believe, especially with the China tariffs, that Chinese manufacturers will eat that – will eat the price or eat the tariffs. I believe that the currency adjust. And I believe if we look during President Trump’s first term, that all the other things we do if we’re deregulating for getting energy prices down, then if we look across the spectrum, Americans will realize lower prices and better affordability.

On IRS job cuts: “We are doing a big review”

KRISTEN WELKER: Let me ask you about some of these cuts to the federal government. Obviously President Trump’s been very clear. He thinks that no agency should be spared, a lot of focus on the IRS. How much of the work force do you think will be cut from the IRS?

SECRETARY SCOTT BESSENT: Well, I will tell you that there were about 15,000 probationary employees that we could have let go. We kept about 7,500, 8,500 because we viewed them as essential to the mission. And, you know, we will know once we get inside. But what I can tell you is that we are doing a big review. We’re not doing anything. Right now is playoff season for us. April 15th is game day. And even employees who could take voluntary retirement, the rest of the federal work force, their date was in February. Our date for them is in May. So I have three priorities for the IRS: collections, privacy, and customer service. And we’ll see what level is needed to prioritize all those.

Strikes on Houthi rebels in Yemen are “not a one-off”: “The Houthis, the Iranians should expect that this is the beginning”

KRISTEN WELKER: I do want to ask you about the breaking news overnight, the Trump administration launching large-scale military strikes against Yemen’s Iranian-backed Houthis. What exactly is the message that President Trump is trying to send to Iran?

SEC. SCOTT BESSENT: So, it’s a very strong message and very different than the previous administration. So the Houthis, the Iranians should expect that this is the beginning, this is not a one-off. And we are doing this because they are blocking freedom of passage for global shipping. And Kristen, back to the economy, back to inflation that closing the Suez Canal slows global commerce and increases inflationary pressure for both us and our allies. So we are sending a message: this is unacceptable. Two weeks ago, the president announced a maximum pressure strategy on Iran. Their economy is in disarray. The previous administration let their oil exports go up to about 1.5 million a day, and our target is to get it to zero.

Full interview below

Tyler Durden

Sun, 03/16/2025 – 19:50

5 miesięcy temu

5 miesięcy temu

![Pseudokibice szykowali się na ustawkę pod Strzelinem. Powstrzymali ich policjanci [WIDEO]](http://www.radiowroclaw.pl/img/articles/153704/tA8H9YLIvR.jpg)