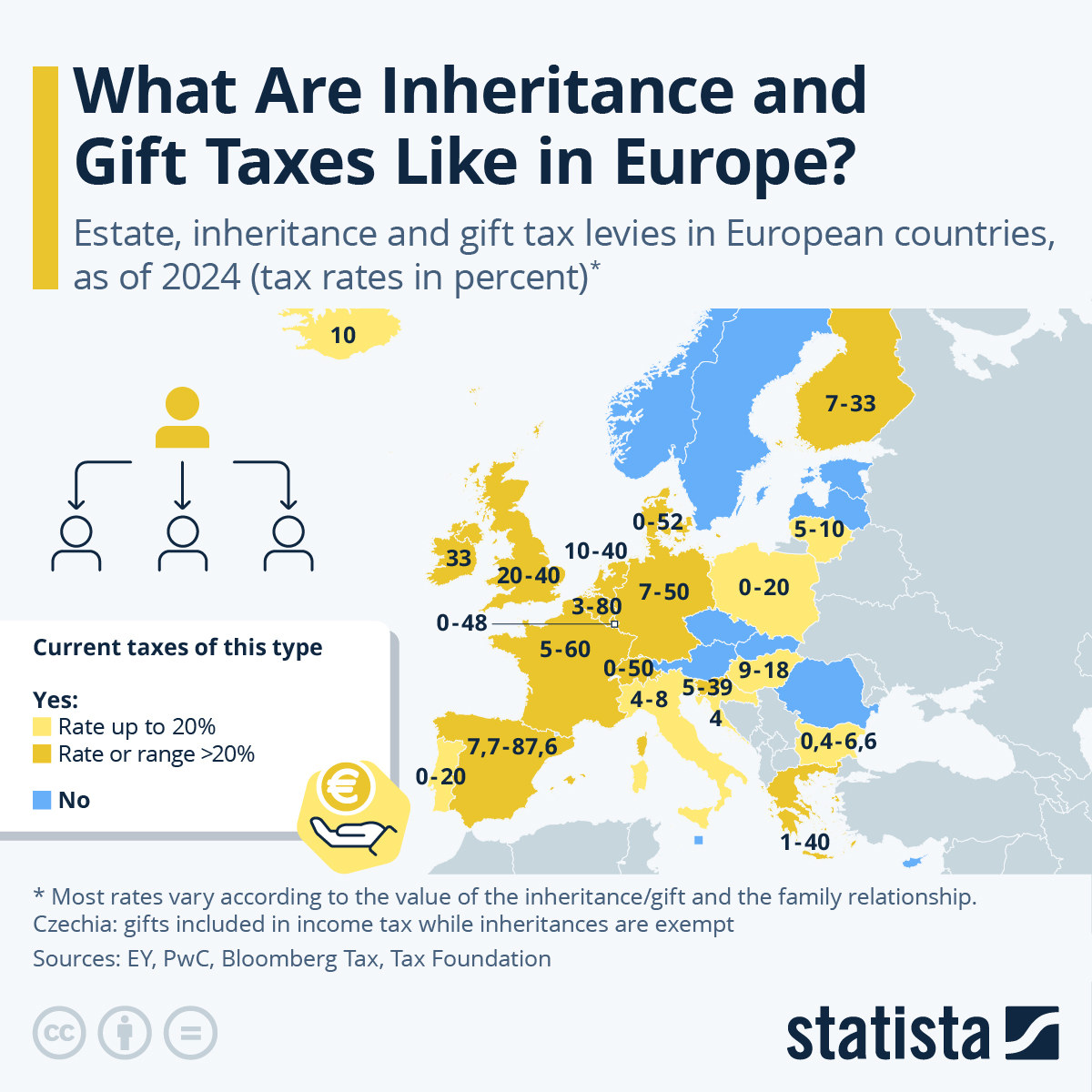

What Are Inheritance And Gift Taxes Like In Europe?

An estimated $2 to $3 trillion were inherited globally in 2024, according to consulting firm EY. As EY analysts highlight, the impending inheritance to be passed on from the baby boomer generation will marks the biggest transfer of wealth in modern financial history.

Against this backdrop, we’re turning our attention to the topic inheritance and gift taxes.

Statista’s Anna Fleck reports that data compiled by the Tax Foundation (as of 2024) reveals that the approach to inheritance and gift tax varies considerably across Europe.

You will find more infographics at Statista

In France, tax rates generally range from 5 percent to 45 percent, depending on the value of the transfer and the degree of kinship, but can climb as high as 60 percent for distant relatives.

The range is similar in Germany, where rates vary from 7 percent to 50 percent, depending on the amount and relationship between the parties.

Only two other European countries have higher top rates: Belgium (3 percent to 80 percent) and Spain (7.7 percent to 87.6 percent).

In the UK, the range is narrower, with rates between 20 percent and 40 percent, while Ireland applies a flat rate of 33 percent.

At the other end of the spectrum, some of the lowest inheritance and gift tax rates in Europe can be found in Bulgaria (0.4 percent to 6.6 percent), Croatia (4 percent), Italy (4 percent to 8 percent), Lithuania (5 percent to 10 percent), Iceland (10 percent), Portugal and Poland (both with 0 percent to 20 percent).

Around ten other European countries – including Sweden, Norway, Austria, Estonia, and Romania – do not impose any inheritance or gift taxes at all.

Tyler Durden

Wed, 07/16/2025 – 04:15

5 miesięcy temu

5 miesięcy temu