Stellar 7Y Auction Sees Highest Stop Through Since 2022, Record Low Dealers

It’s only fitting that a week of impressive coupon auctions would conclude with what was the strongest 7Y auction in years.

Moments ago, with the nervous bond market still on edge over the recent bond collapse in Japan, the Treasury concluded the week’s final auction when it sold $44 billion in 7Y paper. It was spectacular.

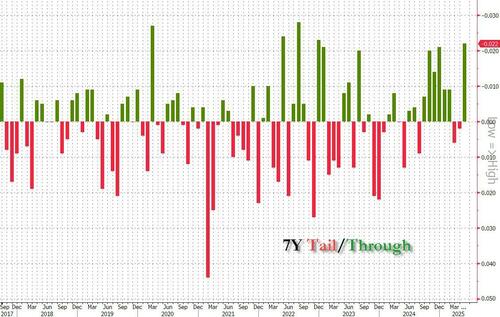

The high yield was 4.194%, which while 7bps higher than last month, stopped through the When Issued 4.216% by 2.2bps, the biggest stop through since Dec 22.

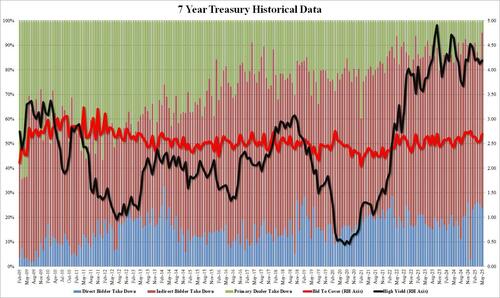

The bid to cover rose from 2.55 to 2.70, the highest since December and well above the six-auction average of 2.64.

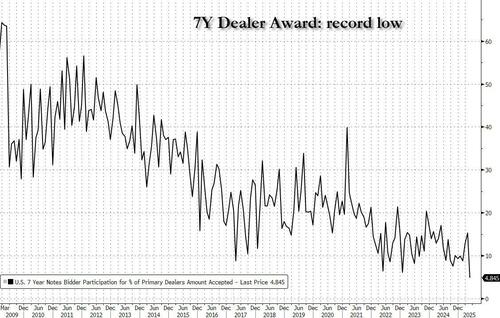

The internals were most remarkable, however, with Indirects surging from 59.3% to 71.5%, the highest since December’s record 87.9%. And with Directs taking down 23.6%, down modestly from 25.4% in April, Dealers were left holding just 4.85%, the lowest on record.

Overall, this was one of the best 7 Year auctions in a long time…

… with stellar results even as yields hit session lows just around the time of the auction. Not surprisingly, 10Y yields dripped to fresh session lows just around 4.42 after the results hit, although they recovered some of the move in the minutes since.

Tyler Durden

Thu, 05/29/2025 – 13:31

5 miesięcy temu

5 miesięcy temu

![Ponad 40 strażaków podniosło swoje kwalifikacje [FOTO]](https://swidnica24.pl/wp-content/uploads/2025/11/strazacy-kurs-14.jpg)