Is Lisa Cooked?

By Molly Schwartz, cross-asset macro strategist at Rabobank

Yesterday, the Department of Justice opened an investigation into Fed Governor Lisa Cook, probing allegations of mortgage fraud. This comes after a series of tweets from Bill Pulte, Director of the Federal Housing Finance Agency, with supposed evidence supporting claims that she was not living at her home in Ann Arbor, MI. Questions, however, still remain as to if she is even guilty, given that she has not yet been convicted (though the DOJ probe might change that) and whether this is even fair grounds to fire her from her position on the Board of Governors in the first place.

Cook’s legal team maintains that she “never committed mortgage fraud,” asserting that discrepancies in her mortgage paperwork were already flagged and addressed during her 2022 confirmation process. Indeed, her legal team has filed a lawsuit against Trump over his attempts to remove her. The rest of the Governing Board, including Chair Powell, were also named in the suit, though they are “being sued only to the extent that they are able to effectuate President Trump’s purported termination of Governor Cook.”

Whether Cook is guilty or not, there are clear political incentives for Trump to fire her. As it stands, Trump has two Governors, Waller and Bowman, ready and willing to vouch for cuts if it means it will get them on the short list for Fed Chair. Meanwhile, Stephen Miran is on deck to replace Kugler, who stepped down shortly after the July FOMC decision. With Cook still employed, Trump sympathizers are capped at a 3-4 minority. If Trump can stack the Fed with another pick of his own to replace Cook and pull in a sympathetic outsider to act as Fed Chair when Powell steps down, Trump would achieve a 5-2 majority on the Board in 2026.

But before Miran can step into Kugler’s shoes, he must be confirmed by the Senate. Yesterday, Miran testified before the Senate Banking Committee, making his case for confirmation. According to Senator Moreno, Miran is already ahead, having confirmed that Miran has “never lied on a mortgage application.” Miran made sure to emphasize his commitment to Fed independence in his prepared statement. However, Senator Warren challenged this, asking Miran several pointed questions, including whether Trump lost the 2020 election. Miran avoided a direct answer, stating only that Congress confirmed Biden’s victory. Other questions included if he believed the Bureau of Labor Statistics falsified data ahead of the 2024 election (in an attempt to sway public sentiment in favor of Harris) and if he thought tariffs had caused tangible price increases. Warren criticized Miran’s responses, saying he had “blown it” and made his loyalty to Trump clear.

Another point of contention among Democratic senators was Miran’s dual role as Chairman of the Council of Economic Advisers (CEA) and his nomination to the Fed. Miran stated he would take an unpaid leave of absence for the remainder of Kugler’s term – about four and a half months – as advised by counsel, but that he would resign from the CEA if granted a longer term. Still, senators expressed concern that even on leave, Miran remains functionally employed by the Trump Administration and therefore may be influenced to make decisions that serve political interests rather than economic ones.

Another major proponent of “imposing bans on the revolving door between the executive branch and the Fed” is none other than Stephen Miran himself, as explained in a co-authored paper published in March of 2024. In the article, Miran (and Katz) take aim at Chicago Fed President Austan Goolsbee, indirectly referring to him as a “Biden campaign surrogate.” While complimenting Goolsbee’s talents as an economist, Miran and Katz went so far as to argue that “to pretend that one can easily shift between highly political and allegedly nonpolitical roles without letting political biases inform policy is, at best, naïve – and, at worst, sinister.”

While perhaps a tad melodramatic, it’s an unfortunate position for Miran to be in the hot seat and have his own words spun back at him by Elizabeth Warren. But question remains if Miran is the exception to his own rule.

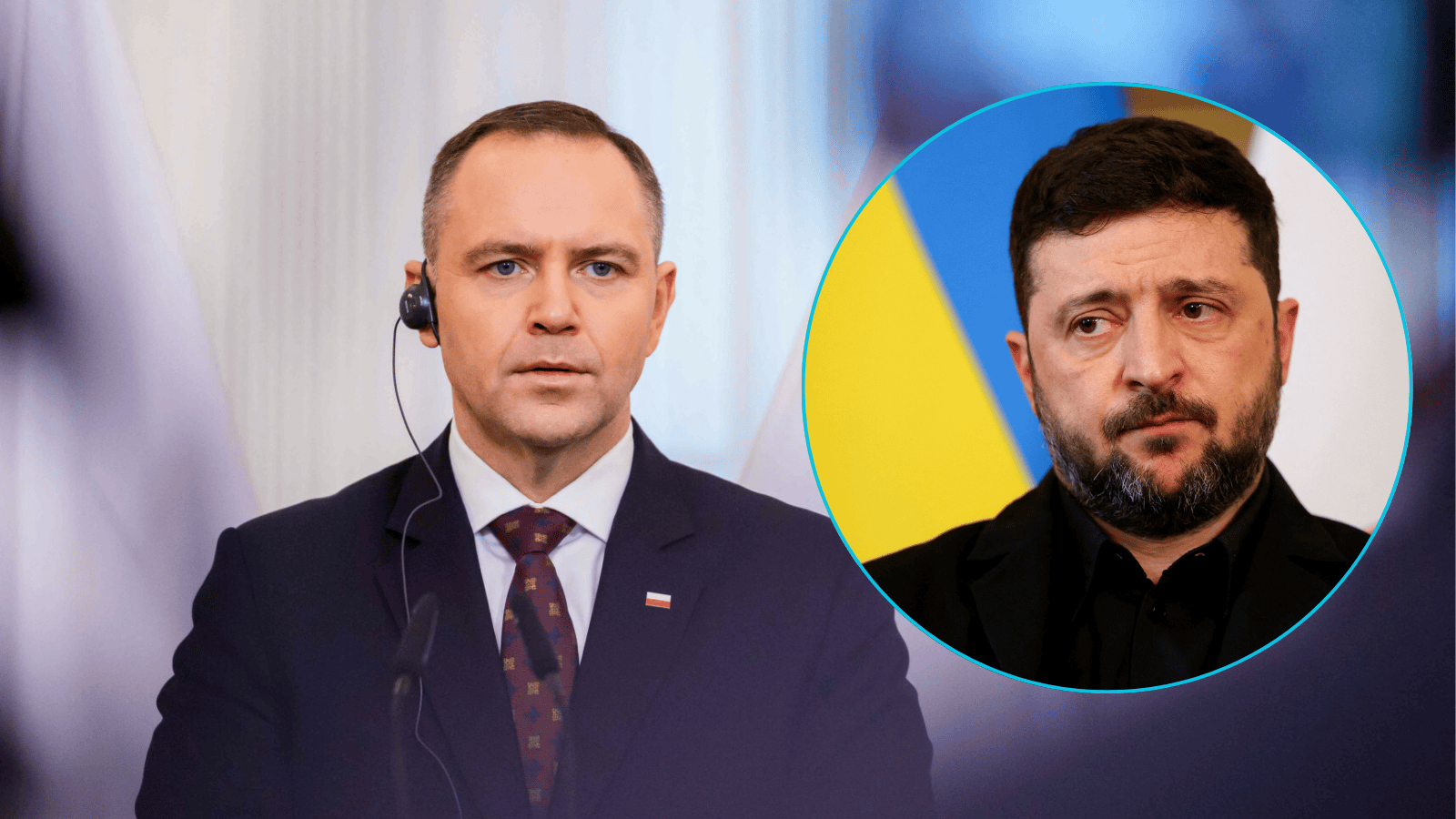

Across the Atlantic, European leaders gathered at the Coalition of the Willing Summit – seated on bouclé chairs – to discuss the future of Ukrainian security. According to Macron, 26 countries agreed to support Ukraine, including sending troops if necessary. Zelenskiy tweeted after the event, speaking of a “long and detailed conversation” with Trump and thanked him for his support, though he did not elaborate on what exactly that support entailed and what commitments the US would make towards Ukrainian security going forward. He did, however, hint at the continued use of US sanctions and tariffs, citing “strong economic measures to force an end to the war.” Zelenskiy also praised the NATO’s Prioritized Ukraine Requirements List (PURL) initiative, agreed upon in July of this year, which helps to supply Ukraine with American weapons.

In an absence of data yesterday on the Eastern Hemisphere, we once again turn our focus back to the United States. Yesterday morning, ADP employment data registered only 54k payrolls added to the economy, down from 104k the month prior, for the fifth sub-100k print year-to-date. This was followed by similarly weak data in ISM services employment at 46.5, fueling the ever-increasing likelihood of a Fed cut at the September meeting. Surprisingly enough, despite slipping yields, USD was still the strongest performing G10 currency. We also saw economic activity data from south of the U.S. border, suggesting continued economic lethargy in Mexico as gross fixed investment contracted at a rate of 6.4% year-over-year and 1.4% month-over-month in June. Meanwhile, the Canadian trade balance, which registered its deepest deficit in April, has shown some improvement in July, with the deficit creeping back up to “only” -$C 4.94 billion, which is at least better than the April 2020 deficit.

Tyler Durden

Fri, 09/05/2025 – 13:45

3 miesięcy temu

3 miesięcy temu

![Straż Rybacka i ucieczka przez rzekę. Wędkarz porzucił sprzęt i wskoczył do Wisłoka [ZDJĘCIA]](https://esanok.pl/wp-content/uploads/wp-post-thumbnail/DO0jRu.jpg)