Hard-Landing Panic Leads To First Yield Curve Disinversion In Two Years, As Nvidia Plunge Continues

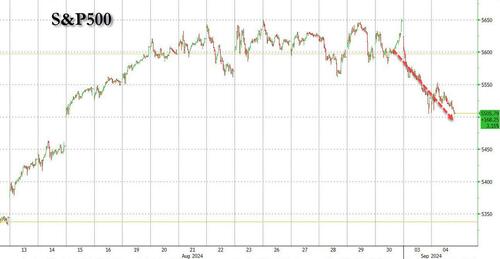

If yesterday’s market dump was a bang, today’s continued selling more of a whimper.

One day after the biggest drop in the S&P since the August 5 rout (which however was followed by a just as violent episode of BTFD) today stocks saw continued selling, with what little interest to buy the dip emerged promptly faded right around the time Europe closed for trading, prompting renewed if more gradual selling, which has pushed the S&P down 0.3%, a far cry from yesterday’s 2% dump, and sent it back to where it was after last month’s much stronger than expected retail sales report.

Under the surface it was more of the same: mounting fears of a hard landing, which after yesterday’s catastrophic manufacturing surveys (both ISM and PMI), were reinvigorated by today’s dire JOLTS report which saw a massive, 4-sigma miss in job openings, which not only printed below the lowest estimate…

… but also tumbled to the lowest level since January 2021 (after a sharp downward revision to the previous month of course), leaving Friday’s payrolls report in the lurch.

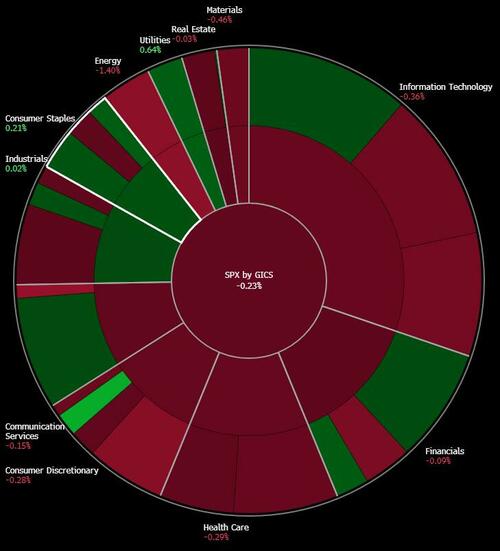

And since we are now squarely in a „bad data is bad news” regime, today’s rising hard-landing fears meant a 2nd day of uniform selling, with just Utilities and Consumer Staples – those pre-recession bond proxy sectors – that eeked out modest gains, with everything else a deep red.

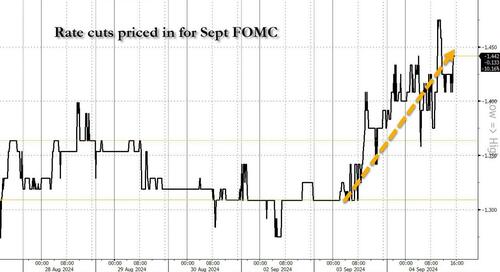

The continued barrage of bad news also means that what until yesterday was a 35% probability of a 50bps rate cut in the September FOMC (with one rate cut now guaranteed), rose as high as 50% just after the JOLTS shock, before easing back to 44%. In other words, ahead of Friday’s payroll, it is effectively a coin toss if the Fed cuts rates 25bps or 50bps in two weeks.

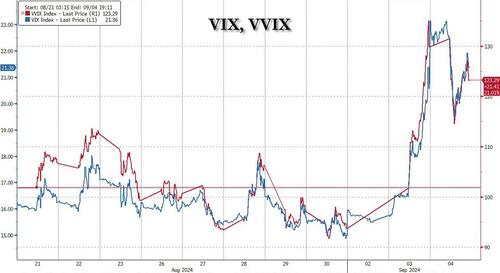

The hard-landing panic did not help either the VIX, or the volatility of the VIX (aka VVIX), with both indexes reversing an early morning drop and resuming their ascent for a 2nd day.

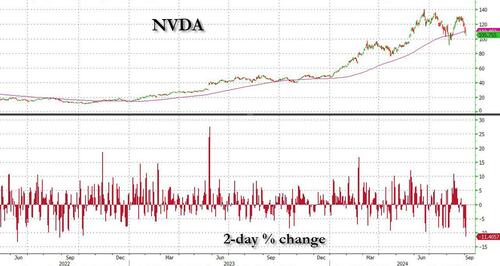

But while previous cases of hard-landing fears at least saw rotation out of everything and into AI, today the love was sorely lacking, and yesterday’s record plunge in NVDA only became bigger, as the stock lost another 2%, pushing it below both 100DMA (after it tripped the 50DMA yesterday) and bringing the two-day drop to 11.4%, or a massive $333 billion loss in market cap in two days. Yes, Nvidia has lost a third of a trillion in the past two days.

Yet while traders sold stocks first and asked questions later, or not at all, the money once again piled into bonds, with the 10Y yiel sliding for a second day, and dropping to 3.75%, the lowest print this year, and the lowest level since last July.

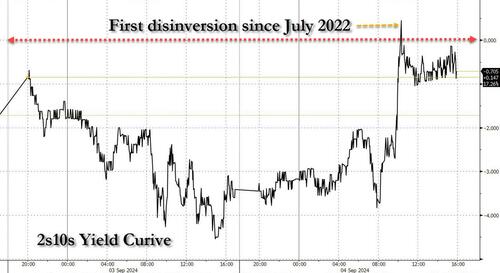

But while 10Y yields dropped, 2Y yields absolutely crumbled, leading to the first (brief) 2s10s yield curve disinversion since July 2022. For those who were just waiting for this event to being the countdown to the recession, because by now everyone knows that while the inversion is bad, it is the subsequent steepening that triggers the actual recession countdown, can start counting.

It wasn’t just yields that took out 2024 lows: so did oil, as not even a denial of the Reuters bullshit report from last week that OPEC+ would boost production, managed to lead to any buying impetus of the black oil, which tumbled another 2%, and dropped to the lowest level since last December.

In other words, it is once again up to China – and its stalled stimulus – to breathe some air into the slumping commodity market… if not all of it: since the next step by either the US, or China is more stimulus, whether monetary or fiscal, gold continues to await the next steps, and after tumbling yesterday, recovered much of its losses and is trading just shy of all time high.

Tyler Durden

Wed, 09/04/2024 – 16:16

1 rok temu

1 rok temu

![Grzegorz Braun „nagrodzony” przez białoruską organizację, działającą na rzecz Rosji [NEWS OKO.PRESS]](https://cdn.oko.press/cdn-cgi/image/trim=420;0;448;0,width=1200,quality=75/https://cdn.oko.press/2025/11/SK250915_0001823.jpg)