Futures Rebound After Historic Nvidia Rout; Dollar, Yields Bounce

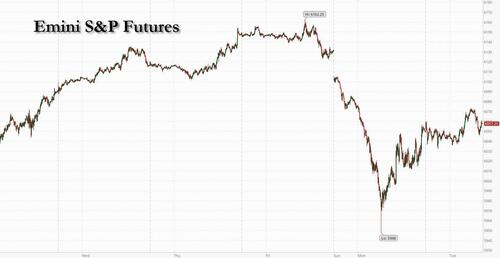

US futures rose slightly after Monday’s rout over valuations in the artificial-intelligence sector, while the dollar advanced after US President Donald Trump said he wants to enact across-the-board tariffs that are “much bigger” than 2.5%. After suffering a record drop on Monday, Nvidia led a rebound in premarket trading one day after Chinese upstart DeepSeek prompted traders to rethink the extent of US tech dominance. As of 8:00am ET, futures on the Nasdaq 100 rose about 0.2% after the tech index suffered its worst one-day drop since mid-December as Nvidia shares climbed as much as 5% in premarket, poised to claw back some of their 17% slump. Contracts tracking the S&P 500 gained 0.2% with semis poised to recoup some of yesterday’s losses. In Europe, stocks climbed on the back of upbeat earnings. Keep an eye on USD and bond yields, which moved higher as Trump looked set to add a blanket tariff on Feb 1 which could start with a 2.5% blanket tariff and ramp from there. The commodity complex is seeing strength in Energy, weakness in Ags, and Metals are mixed. Today’s macro focus is on Durable/Cap Goods, Housing Pricing, Consumer Confidence, and regional activity indicators ahead of tomorrow’s Fed decision. Starbucks, GM and Boeing are among companies to report results today.

In premarket trading, Nvidia jumped 4% after plunging 17% yesterday as Chinese artificial intelligence upstart DeepSeek prompted traders to rethink the extent of US tech dominance. Chip-related stocks advanced (Broadcom (AVGO) +2%, KLA Corp (KLAC) +1%, Marvell Technology (MRVL) +2%) as did AI infrastructure-related stocks (Constellation Energy (CEG) +2%, Oracle (ORCL) +1%, NuScale (SMR) +2%). Mag7 names were mostly higher after yesterday’s rout: Magnificent Seven: Alphabet (GOOGL) +0.7%, Amazon (AMZN) -0.5%, Apple (AAPL) +0.2%, Microsoft (MSFT) +0.1%, Meta Platforms (META) +0.5%, Nvidia (NVDA) +2% and Tesla (TSLA) -0.2%. Here are some other notable premarket movers:

- JetBlue (JBLU) falls 6% reporting fourth-quarter earnings.

- Royal Caribbean (RCL) climbs 5% after the cruise operator forecast adjusted earnings per share for 2025 that beat the average analyst estimate, and said its busiest booking period is off to a record start.

- Roper Technologies (ROP) rises 1% as TD Cowen upgraded the software firm to buy, citing revenue acceleration into 2025 and saying that the company’s “US centric portfolio” could also be attractive to many investor groups.

- Sanmina (SANM) gains 1% after the electronics contract manufacturing services company reported adjusted earnings per share for the first quarter above what analysts expected.

- Synchrony Financial (SYF) falls 5% after posting fourth quarter results.

Nvidia was poised to recover some of its 17% slump on Monday as DeepSeek’s cost-effective AI model added fuel to the debate over the outlook for big spending by tech companies on the chipmaker’s expensive products, when lower-cost solutions are possible by fine-tuning models. That potential threat to semiconductor demand — albeit too early to gauge, according to Bloomberg Intelligence — was enough to spur concerns among investors over whether the tech megacaps deserve their premium valuations.

“Nvidia has been the number one driver of S&P 500 earnings growth over the past 18 months,” said Mike O’Rourke, chief market strategist at Jonestrading. “If Nvidia does not deliver on earnings growth, an expensive S&P 500 becomes much more expensive.”

Meanwhile, the dollar strengthened against its major peers and copper fell on President Trump’s latest comments about tariffs to reporters on Monday night. The US president said he wants to enact across-the-board tariffs that are “much bigger” than 2.5%. In a speech from Florida, he also pledged tariffs on specific sectors, including semiconductors, pharmaceuticals, steel, copper and aluminum.

“I remain an equity bull, and would view this as a dip to be bought,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “That said, understandably, conviction to ‘catch a falling knife’ might be a little lacking for the time being.” The new US administration has been debating trade levies through January, with FT reporting Trump’s advisers were considering a gradual increase of about 2% to 5% a month.

European stocks also gain with the Stoxx 600 rising and set for a record close thanks to upbeat earnings offering additional support while SAP and Siemens Energy gain after upbeat results. Retail and utilities are the best performing sectors with miners and banks lagging behind. Europe’s largest lender HSBC will wind down some of its investment banking operations in Europe, the UK and the Americas as part of its restructuring efforts. Here are some of the biggest movers on Tuesday:

- Sartorius shares jump as much as 17%, the most since Oct. 17, after the German lab equipment maker reported better-than-expected adjusted Ebitda for the full year and said it expects a moderate increase in sales revenue in 2025.

- Siemens Energy shares gain as much as 5.1% after it pre-released strong fiscal 1Q results.

- Mercedes shares rise as much as 2.4% after a pre-close call late Monday during which the German automaker indicated it had a stronger-than-expected end to the year, according to analysts.

- SAP shares rise as much as 3.1% to an intraday record, after the software company raised full-year guidance on cloud revenue and operating profit, helped by its clients’ migration to cloud.

- Comet shares jump as much as 6.3%, the most since October, after the Swiss supplier of radio-frequency tools to the semiconductor industry posted a strong revenue growth update that shows recovery has gained momentum, according to ZKB.

- Foxtons shares rise as much as 6.7% after the London-focused estate agent said annual earnings for 2024 will be ahead of expectations.

- Xvivo Perfusion gains as much as 14%, the most since July, after Bryan Garnier & Co raised its view on the Swedish organ-transplant technology firm to buy from neutral, saying solid 4Q financials bolstered the broker’s view on the firm.

- Schneider Electric falls as much as 4.9%, extending declines following a DeepSeek-driven selloff. Citi (neutral) said valuation support may be 20% below Monday’s closing price.

- Swatch shares fall as much as 2.1% after Morgan Stanley downgrades the watchmaker to underweight from equal-weight ahead of earnings, flagging further softness in the Swiss watch industry.

- Netcompany falls as much as 17%, the most in two years, after the Danish IT consultancy reported adjusted Ebitda, revenue, margins and gross profits for the fourth quarter that missed average analyst estimates.

Earlier in the session, Asian shares fell on concerns surrounding AI-inflated tech valuations, while several markets were closed or held shortened trading sessions for the Lunar New Year holiday. The MSCI Asia Pacific Index fell as much as 0.6%. Japanese chip-tester maker Advantest and Australian data center REIT Goodman were among the biggest decliners after DeepSeek’s cheap AI model triggered a selloff in related stocks. Stocks edged higher in Hong Kong, as Tencent and other Chinese internet stocks extended gains. Large-cap shares in India advanced, while Japan’s benchmarks were mixed. Bourses in mainland China, South Korea and Taiwan were shut.

“It’s too early to call the future impact from DeepSeek, but what it has demonstrated is the crowded positioning within the potentially impacted sectors,” said Matthew Haupt, a fund manager at Wilson Asset Management. “Questions around growth outlooks are now not a 100% foregone story, so probabilities have shifted and that’s all that’s needed for a selloff.”

In FX, the Bloomberg Dollar Spot Index rose 0.3% as the dollar strengthened against most major currencies after comments from US President Trump and his Treasury Secretary stoked concern about widespread US trade tariffs. The Japanese yen and euro are among the weakest of the G-10 currencies, each falling around 0.6% against the greenback.

In rates, treasuries fell with US 10-year yields rising 2 bps to 4.56%. Bunds also dip while gilts slightly outperform Treasuries and bunds across the curve.

In commodities, oil prices advance, with WTI rising 0.5% to $73.50. Spot gold is steady around $2,744/oz. Bitcoin rises toward $103,000.

On today’s calendar, we get the December durable goods orders (8:30am), November FHFA house price index, S&P CoreLogic home prices (9am), January consumer confidence and Richmond Fed manufacturing index (10am) and January Dallas Fed services activity (10:30am)

Market Snapshot

- S&P 500 futures up 0.2% to 6,061.75

- MXAP down 0.5% to 182.26

- MXAPJ down 0.3% to 572.54

- Nikkei down 1.4% to 39,016.87

- Topix little changed at 2,756.90

- Hang Seng Index up 0.1% to 20,225.11

- Shanghai Composite little changed at 3,250.60

- Sensex up 0.6% to 75,821.14

- Australia S&P/ASX 200 down 0.1% to 8,399.07

- Kospi up 0.8% to 2,536.80

- STOXX Europe 600 up 0.5% to 532.45

- German 10Y yield little changed at 2.56%

- Euro down 0.5% to $1.0442

- Brent Futures up 0.6% to $77.55/bbl

- Gold spot up 0.1% to $2,743.52

- US Dollar Index up 0.44% to 107.82

Top Overnight News

- Trump spoke after the Mon close and said “in the very near future” he would be placing tariffs on computer chips, semiconductors, pharmaceuticals, steel, aluminum, and copper. BBG

- Trump said he wants universal tariffs much larger than 2.5% and has a tariff level in mind but had not set it yet, which followed an earlier report in FT that Treasury Secretary Bessent is pushing for a gradual 2.5% universal tariffs plan in which the 2.5% levy would move higher by the same amount each month.

- Trump said he will work with Congress on a plan to secure the borders and that they need a massive increase in funding for border security, while he will work with Congress on tax cuts and must permanently extend tax cuts previously passed under the Trump administration. Trump reiterated „drill baby drill” and said he will give fast approval to anyone building a plant for electric generation. Trump also stated that tariffs will be placed on computer chips in the near future and he will place tariffs on producers of pharmaceuticals, while he added that steel and other industries will be considered for tariffs and tariffs will also be placed on aluminium and copper. Furthermore, he said if you want to stop placing the tariffs, companies need to build plants in the US and it is good that companies in China have come up with a faster method of artificial intelligence whereby Chinese startup DeepSeek should be a wake-up call.

- US Senate voted 68-29 to confirm Scott Bessent as Treasury Secretary who is pushing for new universal tariffs on US imports to start at 2.5% and rise gradually. The 2.5% levy would move higher by the same amount each month, giving business time to adjust and countries a chance to negotiate with the Trump’s administration. FT

- Speaker Johnson said he doesn’t think Trump’s tariffs will hit “whole countries or whole industries with across-the-board levies.” Politico

- NVDA (Nvidia) said on Monday that the need for its chips would rise as a result of increased demand for DeepSeek’s services (Nvidia also said that DeepSeek appears to be telling the truth when it said its model was made without access to the highest-end GPUs). BBG

- Pimco and Apollo are among asset managers considering buying a portion of the next $3 billion of debt tied to Elon Musk’s buyout of X, people familiar said. BBG

- Japan’s government risks rejection of its annual budget if it doesn’t concede more ground to a small opposition party seeking a larger tax-free allowance. BBG

- Japan is considering an ordinance to allow GPIF to participate directly in government bond auctions, people familiar said. The fund at present purchases JGBs from auctions via securities companies. The change will make it easier for the fund to rebalance its portfolio. BBG

- Prime Minister Keir Starmer said the UK economy is starting to turn around and indicated he wanted a better trading relationship with the US. BBG

- A handful of GenAI stocks are pushing higher in the pre-mrkt: NVDA +5% (>8mn shares already trading) and ALAB, GEV, VRT, AVGO types up 4%+ on light volume.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed amid holiday-thinned conditions on Chinese New Year’s Eve and after the recent US tech sell-off. ASX 200 traded rangebound on return from the long weekend as gains in the consumer, healthcare, telecoms and financial sectors offset the losses in real estate, utilities, tech and miners, while improved Business surveys did little to spur demand. Nikkei 225 extended on the recent selling but was off worst levels amid a weaker currency and softer Services PPI data. Hang Seng kept afloat but with upside capped amid the absence of mainland participants and Stock Connect flows, while markets in Hong Kong closed early ahead of Chinese New Year celebrations.

Top Asian News

- US President Trump said they will have a lot of people bidding on TikTok and don’t want China involved in TikTok, while he confirmed Microsoft (MSFT) is in talks on TikTok and said he would like a bidding war over TikTok.

- US federal maritime official said the US is not without options in addressing the growing presence of China and Chinese companies in Panama, while the US seeks to increase support for American companies in Panama and throughout the Americas, ensuring Chinese companies are not the sole bidders on contracts.

- Japan’s government nominated Waseda University professor Junko Koeda as BoJ Board Member to replace Board Member Adachi whose term ends on 25th March 2025.

Sentiment has stabilised vs the considerable tech-induced losses seen in the prior session. NVIDIA (+5%) is higher in the pre-market, after sinking as much as 17% on Monday. US equity futures are mixed, but with very clear outperformance in the tech-heavy NQ +0.7% as AI-names jump higher in the pre-market, following the tech-rout seen in the prior session; NVDA +5.0%, AVGO +4.0%, MSFT +0.8%. In Europe, the Tech sector is found towards the middle of the pack; ASML (+0.8%), BE Semi (+0.3%) are both a little higher, but were initially on the backfoot. SAP (+0.2%) post earnings where the name lifted FY25 guidance. European bourses (Stoxx 600 +0.5%) opened the session on a modestly firmer footing, and have generally traded sideways throughout the morning thus far. SAP (SAP GY) Q4 Earnings: Beat on Revenue, Net Income, adj. EBIT and Cloud Revenue. Lifts FY25 guidance and expects strong FY Cloud Revenue growth. CEO: Our strong position in data and business AI gives us additional confidence that we will accelerate revenue growth through 2027”.

Top European News

- ECB Euro area bank lending survey: Credit standards tightened for firms in the fourth quarter of 2024, driven by higher perceived risks and lower risk tolerance. Credit standards remained unchanged for loans to households for house purchase but continued to tighten for consumer credit. Housing loan demand continued to rebound strongly, while demand for firm loans remained weak.

- German economy output forecast to fall by 0.1% in 2025, according to BDI, while global economy expected to grow by 3.2%; must assume a leading role in Brussels with ambitions economic policy agenda.

- German Regulator BaFin says property markets correction among top risks in 2025; other top risks include financial market corrections and corporate loan defaults

- UK PM Starmer has reportedly requested that the relinking of the UK and EU emissions trading scheme is on the agenda for spring talks, via FT citing EU officials.

FX

- USD is bouncing back after being sold yesterday alongside the sell-off in the large cap global tech stocks and failing to act as a safe-haven. The rebound has been bolstered by overnight commentary from US President Trump who pushed back on reports that his administration could impose a gradual 2.5% universal tariff that would increase by 2.5% each month. DXY briefly made its way onto a 108 handle with a current session peak at 108.02.

- EUR is softer vs. the USD and to a lesser extent the GBP. Despite the global risk-aversion yesterday, EUR was actually able to eke out gains vs. the USD. However, this upside has been swiftly reversed on account of the aforementioned inflammatory tariff rhetoric from Trump overnight. EUR/USD is below yesterday’s trough at 1.0453 and the 50DMA at 1.0433.

- JPY has given back the bulk of yesterday’s gains vs. the USD that were triggered by the sell-off in global large-cap tech stocks. However, this move has been tempered during today’s session in the wake of the broadly stronger USD, which has been bolstered by inflammatory tariff rhetoric from US President Trump. USD/JPY is currently tucked within yesterday’s 153.71-156.24 range.

- GBP is softer vs. the USD but firmer vs. the EUR. Fresh macro drivers for the UK are light aside from the BRC Shop Price Index for January showing a 0.7% Y/Y decline vs. prev. 1.0%. Cable matched the bottom-end of yesterday’s 1.2426-1.2524 range.

- Another session of losses for the antipodes after suffering yesterday alongside the tech sell-off. This time around, the broader recovery in the USD is acting as a drag.

Fixed Income

- Overall, USTs are pulling back this morning as tech/market sentiment looks set to attempt a slight recovery from the substantial pressure seen on Monday, with NVDA higher by around 5% in pre-market trade. Supply the scheduled point of focus for the session ahead. Follows on from mixed auctions on Monday where the 2yr tap was a soft auction but was followed by the 5yr which experienced a much better reception. Today, USD 44bln of 7yr Notes are on offer after a 2yr FRN sale. As it stands, USTs are softer to the tune of c. 10 ticks at a 108-25+ low.

- Bunds are pulling back in tandem with the above though magnitudes are slightly more contained today on account of Bunds, relatively speaking, paring more of Monday’s upside in that session than USTs managed to do. No reaction to the latest ECB Bank Lending Survey or Germany’s BDI Industry Association forecasting a domestic output contraction in 2025. Bunds at a 131.42 base vs Monday’s 132.14 high, as such Bunds are back to within touching distance of Monday’s 131.38 opening level/trough.

- Gilts are echoing the above, at a 92.13 trough vs Monday’s 92.68 peak. A low which brings Gilts comfortably below the week’s 92.32 open and at an incremental fresh low for the week.

- UK DMO announces gilt tender for up to GBP 1.5bln of their 0.125% 2026 conventional gilt on Jan 30th.

- Netherlands sells EUR 2.45bln vs exp. EUR 2-2.5bln 2.50% 2030 DSL; average yield 2.493% (prev. 2.481%)

- UK sells GBP 1.5bln 1.125% 2035 I/L Gilt Auction: b/c 3.12x and real yield 1.128%.

- Italy sells EUR 3bln vs exp. EUR 2.75-3.0bln 2.55% 2027 BTP & EUR 2-2.5bln 1.50% 2029 & 1.80% 2036 BTP€i.

Commodities

- The crude complex is a little firmer and ultimately taking a breather from yesterday’s losses, whilst prices could also be underpinned to an extent from reports that protesters at Libya’s Es Sidra port prevent tankers from loading, according to engineers cited by Reuters. Brent Apr resides in a USD 76.12-76.90/bbl parameter.

- Mixed/flat trade across precious metals as prices take a breather from yesterday’s volatility and with newsflow somewhat light during European hours awaiting any impulse from Wall Street. Spot gold currently resides in a USD 2,734.81-2,745.30/oz range.

- Mixed trade across metals amid an overall cautious tone in the market and with Trump tariff threats continuing to cap gains. Adding to bearish sentiment, US President Trump is reportedly set to impose tariffs on steel, aluminium, and copper imports. 3M LME copper resides in a USD 9,016.00-9,115.50/t range

- Russia’s Kremlin says Russia is interested in the continuation of gas transit via Ukraine.

- Saudi’s Energy Minister met with Iraqi and Libyan counterparts and discussed efforts to support stability in energy markets, according to the Saudi state news agency.

- Petrobras CEO told Brazilian President Lula that the company will readjust diesel prices with the readjustment expected to occur in the next weeks.

- Slovakian Foreign Minister said they welcome the European Commission statement on gas supplies through Ukraine and see Ukraine’s willingness to discuss transit of non-Russian gas as a return to a solution they have proposed, such as Azeri gas.

- Protesters at Libya’s Es Sidra port prevent tanker from loading, according to engineers cited by Reuters. Protestors have halted oil loading operations at Libya’s Ras Lanuf port, according to Reuters sources.

- India is set to invest nearly USD 2bln to develop the critical minerals sector, according to Reuters sources

Geopolitics: Middle East

- US Secretary of State Rubio had a call with Jordan’s King Abdullah and discussed the implementation of a ceasefire in Gaza, the release of hostages and a pathway for stability in the region.

- „Iranian foreign minister told Sky News: If Iran’s nuclear facilities are attacked, it will be answered „immediately and decisively””, according to Sky News Arabia.

- „Hamas: Mediators have begun the process of taking the pulse of the two sides to start the second phase of the agreement”, according to Al Arabiya.

Geopolitics: Other

- US President Trump to sign an order to begin the process of creating the next generation of missile defence, while the order will call for the creation of an 'Iron Dome’ for the US.

- UK Foreign Secretary Lammy and US Secretary of State Rubio spoke on the phone and said the UK and US will work together in alignment to address the situation in the Middle East, Russia’s war in Ukraine and challenges posed by China.

US Event Calendar

- 08:30: Dec. Durable Goods Orders, est. 0.6%, prior -1.2%

- 08:30: Dec. Durables Less Transportation, est. 0.3%, prior -0.2%

- 08:30: Dec. Cap Goods Ship Nondef Ex Air, est. 0.2%, prior 0.3%

- 08:30: Dec. Cap Goods Orders Nondef Ex Air, est. 0.3%, prior 0.4%

- 09:00: Nov. S&P/CS 20 City MoM SA, est. 0.30%, prior 0.32%

- 09:00: Nov. FHFA House Price Index MoM, est. 0.3%, prior 0.4%

- 09:00: Nov. S&P CS Composite-20 YoY, est. 4.24%, prior 4.22%

- 10:00: Jan. Conf. Board Present Situation, prior 140.2

- 10:00: Jan. Conf. Board Expectations, prior 81.1

- 10:00: Jan. Richmond Fed Business Conditio, prior 14

- 10:00: Jan. Richmond Fed Index, est. -10, prior -10

- 10:00: Jan. Conf. Board Consumer Confidenc, est. 105.9, prior 104.7

- 10:30: Jan. Dallas Fed Services Activity, prior 9.6

DB’s Jim Reid concludes the overnight wrap

This morning I’ve just released my latest chartbook, which is called “Deeply Seeking Comparisons to 2000”. We’d been working on a chartbook comparing today with 2000 for a couple of weeks (both positives and negatives), but with the emergence of DeepSeek and the selloff yesterday, it’s hopefully even more relevant now. It takes a look at crude equity valuations, looks at the earnings growth of the Mag 7 (past and future expectations), and shows how the largest stocks in the index today hold a much larger weight than they did in 2000. At a macro level, we’re in a much higher profit era relative to GDP than in 2000 which helps justify higher equities returns to some degree, even if growth is now much slower. The report should offer a framework for working out if today’s valuations are worryingly similar to 2000, or whether this time is different. See the pack for much more and remember Microsoft, Meta and Tesla report tomorrow with Apple on Thursday so there’ll be no shortage of Mag-7 headlines this week.

In terms of the last 24 hours, markets have experienced an aggressive selloff led by US tech, as there were growing questions about the sustainability of their valuations given DeepSeek’s new AI model. We’ll look at the situation in more depth shortly, but in terms of the headline moves, it meant the S&P 500 (-1.46%) and NASDAQ (-3.07%) posted their biggest declines of 2025 so far, with Nvidia down by a huge -16.97%, erasing $593bn of market cap value in a single day. In fact, it was the biggest single-day loss in a stock’s market cap ever in absolute terms. In fact Nvidia make up 8 of the top 10 on that list. Yesterday’s decline was larger than the total market cap of the likes of ExxonMobil and Mastercard. The effects were clear across the board as well, with the 10yr Treasury yield falling back to its lowest level since the start of the year (-8.7bps to 4.535%), whilst investors poured into havens like the Japanese Yen and the Swiss Franc.

Fundamentally, the reason that this DeepSeek release is such an issue is because the performance of global equities since late-2022 has been powered by US tech stocks. For instance, Nvidia was up +239% in 2023, and then another +171% in 2024, surging rapidly to become the world’s most valuable company by market cap as recently as Friday (down to third yesterday). And more broadly, this rally for the S&P 500 has been an unusually narrow one in terms of the companies pushing the index higher, of the sort we haven’t seen since the dot com bubble in the late-1990s. So while that doesn’t make it unsustainable per se, it means that it’s highly vulnerable to a correction among that Magnificent 7 group.

In terms of the specific moves yesterday, chipmakers were hit hardest, with Nvidia (-16.97%) and Broadcom (-17.40%) seeing sharp moves lower. The Philadelphia Semiconductor index (-9.15%) had its worst day since March 2020, while in Europe ASML was down -7.01%. But the largest declines within the S&P 500 came for electric power companies Vistra Corp (-28.27%), GE Vernova (-21.52%) and Constellation Energy (-20.85%), all three of which had been up over +150% in the past year benefiting from expected growth in power demand for data centres. By contrast, other Mag-7 stocks saw a mixed day, with the more AI-linked Alphabet (-4.20%) and Microsoft (-2.14%) losing ground but Apple (+3.18%) rising to again become the world’s most valuable company.

But outside of US tech, it really wasn’t a bad day for equities, with the equal-weighted S&P 500 (+0.02%) little changed on the day. In fact, nearly 70% of the S&P 500 constituents moved higher, with strong rotation into more defensive sectors including consumer staples (+2.85%) and health care (+2.19%). From March 2000 to the end of that year, after the tech bubble burst, there was a huge rotation into defensives such as utilities, consumer staples and healthcare. They were up around 40% over the 9 plus months.

If you’re looking for positives it was that the S&P traded in a very narrow range yesterday and closed towards the top end of it so the story didn’t accelerate to the downside once the US was in. And this morning US futures are fairly calm with S&P 500 futures -0.14% and Nasdaq futures flat.

In terms of macro I don’t think it’s an exaggeration to say the launch of ChatGPT played a notable role in helping the US avoiding a recession over 2023. Despite the most aggressive Fed rate hikes in a generation, the ChatGPT’s launch coincided roughly with the bottom for equities, before the market went on a tremendous bull run, which boosted animal spirits and wealth. The S&P is up around 50% since and has helped eased financial conditions. So while it was far from the only factor, the boost helped consumers to keep spending at a time when there was a lot of downward demand pressure from other sources. See Matt Luzzetti’s piece yesterday here on the impact of equity performance on consumer spending in recent quarters and what the implications could be going forward.

In terms of other snap analysis on the situation, Adrian Cox on my team (link here) sees DeepSeek’s release challenging the dominance of large computationally intensive AI models, suggesting that hardware scaling is less critical and that AI models may become commoditised. For FX, George Saravelos argued (link here) that if this becomes a sustainable trend it would work in a dollar negative direction, and the clearest analogy is the unwinding of the dot com bubble in the early 2000s, where the equity selloff spilled over into the real economy, leading to a mild recession, and in turn a more dovish Fed. In the meantime, Henry’s a bit more sanguine (link here), and makes the point that the Mag 7 fell -18% in the space of a month last summer, before rebounding back to record highs. So we’ve seen worse in recent months, and this decline still keeps the S&P and the Mag 7 inside their post-election range.

Amid public reactions to the news, Nvidia called DeepSeek’s new model an “excellent AI advancement” that “illustrates how new models can be created” using the Test Time Scaling technique. Meanwhile, Trump commented that DeepSeek “should be a wake-up call” to the US tech industry.

We also had new comments from Trump on trade yesterday evening. When asked on the possibility of a 2.5% across-the-board tariff, hinted at by Bessant, Trump said he wanted a rate that is “much bigger”. He also threatened tariffs on a range of sectors including semiconductors, pharmaceuticals, steel, copper and aluminum, while also singling out auto imports from Canada and Mexico. Off the back of this, the US dollar index is trading +0.52% higher this morning after a fairly steady session yesterday (-0.09%).

In Asia, most of the major markets (Chinese, South Korean & Taiwanese) are closed for the Lunar New Year Holidays. In terms of specific index moves, the Nikkei (-1.02%) is underperforming but with no additional follow through to the US weakness. On the contrary, the Hang Seng (+0.14%) is inching higher in holiday-thinned trade and is set to close early today. Elsewhere, the S&P/ASX 200 (+0.08%) is fairly flat ahead of key fourth-quarter CPI data due tomorrow. Meanwhile, 10yr USTs yields have edged +1.5bps higher to 4.55%, slowly reversing some of the big rally yesterday.

Given the scale of the equity slump yesterday, investors dialled up their expectations for Fed rate cuts this year. For instance, the amount priced in by the Fed’s December meeting moved up +7.8bps on the day to 50bps, though this has reversed by around -1.5bps this morning. So markets are now pretty much in line with last month’s dot plot that penciled in 50bps for this year. It’ll be interesting to see if Chair Powell backs up that assessment at tomorrow’s press conference. That shift helped support a sizeable rally for Treasuries, with the 2yr yield (-6.9bps) down to 4.20%, whilst the 10yr yield (-8.7bps) fell to 4.535%.

Over in Europe, markets put in a relatively stronger performance yesterday, with the STOXX 600 only down -0.07% on the day. In reality, there was a fair bit of regional divergence, with sharper losses for the DAX (-0.53%), and minor gains for the FTSE 100 (+0.02%) and the IBEX 35 (+0.12%). Meanwhile for bonds, there was an advance across the continent as we approach this week’s ECB meeting, with yields on 10yr bunds (-3.7bps), OATs (-3.1bps), and BTPs (-2.3bps) all moving lower.

Looking at yesterday’s other data, Germany’s Ifo business climate indicator ticked up to 85.1 in January (vs. 84.8 expected). However, the expectations reading fell to its lowest level in a year, at 84.2 (vs. 85.0 expected). Over in the US, we also had new home sales for December, which came in at an annualised pace of 698k in December (vs. 675k expected).

To the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for January, the preliminary reading for durable goods orders in December, and the FHFA’s house price index for November. Otherwise, we’ll get French consumer confidence for January. From central banks, we’ll hear from the ECB’s Villeroy and Cipollone, and we’ll also get the ECB’s Bank Lending Survey. Finally, earnings releases include Boeing, Starbucks and General Motors.

Tyler Durden

Tue, 01/28/2025 – 08:23

7 miesięcy temu

7 miesięcy temu