Fedthink! The Fed Is Incompetent By Design And Can’t Be Fixed

Authored by Mike Shedlock via MishTalk.com,

Is the Fed playing politics? Does the Fed know what it’s doing at all?

Fedthink!

Today I coined a new word, Fedthink. I hope it catches on.

Here are some reader thoughts and my comments on them from a recent post.

Regarding Fedthink

Reader: Sometimes I wonder if people like Mish really think that the Fed plays it straight in times like this, versus telling us what is ostensibly the straight dope while they are actually playing some complex metagame.

Mish: I have commented on this before. The Fed believes the nonsense they preach on 2% inflation, inflation expectations, the Phillips curve and other economic nonsense that amusingly even the Fed’s own studies prove wrong.

There is no diversity in thought at the Fed. You get in the position of Fed Governor or President by thinking the same way as the rest of the members.

People confuse diversity with race and sex. True diversity is in thought. But there is no diversity of thought at the Fed. They have all been trained to be ignorant. And you do not get into the group unless you believe the same things.

This we call Fedthink.

Regarding Debasement

Mish: [Regarding why gold was $43 per ounce when Nixon killed gold convertibility, and is over $2,800 now.] “What’s changed is persistent Fed and government-sponsored inflation.”

Reader’s Accurate Assessment: Or to put it another way, it’s currency debasement. The dollar is not sound, it is a sliver of a fraction of itself from early last century, but has held its position relative to other currencies.

Regarding Platinum

Reader: Platinum, which is much scarcer than Gold, hasn’t budged in price in 5 years. It remains around $1000 per oz. Based on the gold price it should be something like 30-40K an oz.

Mish: Platinum is nearly 100% an industrial commodity and has to compete with palladium. Also the primary industrial use is in catalytic converters of which there is no need in EVs. Gold’s primary use is as a monetary metal.

Regarding Jewelry

Reader: 50% of gold is used for jewelry.

Mish: Nearly 100% of gold ever mined is still in existence. Yearly production is miniscule. The supply of gold is 100% of gold ever mined minus what is lost at sea, buried and forgotten, on in valuable art pieces in museums. Of the rest nearly all in bars. You confuse the supply of gold with annual production, a major error.

I looked this up and there is more gold in jewelry than I thought but less than my reader thought.

USGS says there are about 244,000 metric tons of gold of which 57,000 metric tons are in underground reserves. 92,000 tons of gold are currently used in jewelry according to the World Gold Conference. That’s about 37.7 percent is in jewelry, much higher than I expected, but still consider a monetary use.

Finally, I have no idea how much of that jewelry is in priceless museum pieces, not for sale, and not really part of overall supply of gold. The same applies to old gold coins that are worth much more than their weight in gold. So 37.7 percent is in practice overstated.

Regarding Bitcoin

The supply of Bitcoin is every Bitcoin ever mined minus lost keys.

Many Bitcoin advocates confuse halving (the rate of increase in supply of Bitcoin) with actual supply. Bitcoin is not getting scarcer over time.

Regarding Short Term Interest Rates

Many readers said the market, not the Fed, sets interest rates.

If that was true, then the Fed would be irrelevant and could not wreak the havoc that it has.

I discussed this paradox at length several times previously. But let’s go back to my original post.

The Fed Uncertainty Principle

Please consider The Fed Uncertainty Principle written April 3, 2008 before the collapse of Lehman Brothers and Bear Stearns.

Does the Fed Follows the Market?

Most think the Fed follows market expectations.

However, this creates what would appear at first glance to be a major paradox: If the Fed is simply following market expectations, can the Fed be to blame for the consequences? More pointedly, why isn’t the market to blame if the Fed is simply following market expectations?

This is a very interesting theoretical question. While it’s true the Fed typically only does what is expected, those expectations become distorted over time by observations of Fed actions.

If market participants expect the Fed to cut rates when economic stress occurs, they will take positions based on those expectations. These expectation cycles can be self-reinforcing.

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg’s Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

A good example of this is the 1% Fed Funds Rate in 2003-2004. It is highly doubtful the market on its own accord would have reduced interest rates to 1% or held them there for long if it did.

What happened in 2002-2004 was an observer/participant feedback loop that continued even after the recession had ended. The Fed held rates rates too low too long. This spawned the biggest housing bubble in history. The Greenspan Fed compounded the problem by endorsing derivatives and ARMs at the worst possible moment.

In a free market it would be highly unlikely to get a yield curve that is as steep as the one in 2003 or as steep as it was just weeks ago when short term treasuries traded down to .21%.

The Fed has so distorted the economic picture by its very existence that it is fatally flawed logic to suggest the Fed is simply following the market therefore the market is to blame. There would not be a Fed in a free market, and by implication there would be no observer/participant feedback loop.

In my post, I provided four key corollaries with discussion. Here is a short synopsis condensed from the full post.

Fed Uncertainty Principle: The fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market, and by implication, there would not be observer/participant feedback loops either.

Corollary Number One: The Fed has no idea where interest rates should be. Only a free market does. The Fed will be disingenuous about what it knows (nothing of use) and doesn’t know (much more than it wants to admit), particularly in times of economic stress.

Corollary Number Two: The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Corollary Number Three: Don’t expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.

Corollary Number Four: The Fed simply does not care whether its actions are illegal or not. The Fed is operating under the principle that it’s easier to get forgiveness than permission. And forgiveness is just another means to the desired power grab it is seeking.

The Fed Uncertainty Principle is still my all-time favorite post.

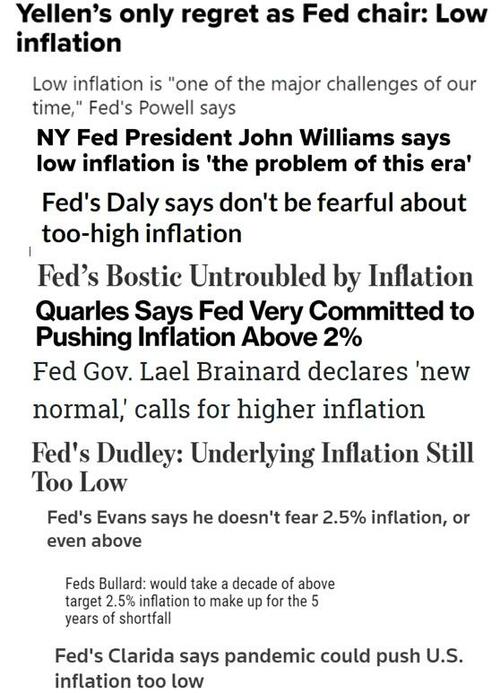

Asinine Proposition on Low Inflation

Please recall this Asinine Fed Proposition on Inflation by Rudy Havenstein: “It would take a decade of above 2.5 percent inflation to make up for 5 years of shortfall“

Former Fed Chair Janet Yellen said her only regret was “low inflation”

As you can see by that excellent composition, Fedthink on too low inflation was widely believed and practiced.

The Fed wanted more inflation, got it in spades, and never apologized for its role.

Fed Studies Debunk the Phillips Curve

- Fed Study Shows Phillips Curve Is Useless

- Yet Another Fed Study Concludes Phillips Curve is Nonsense.

Both studies were done by Fed research staffers.

Yet, Fed Chairs Janet Yellen and Jerome Powell did not believe the Fed’s own studies.

in March of 2017, then Fed Chair Janet Yellen commented the “Phillips Curve is Alive“.

A Fed Economist Concludes the Widely Believed Inflations Expectations Theory is Nonsense

On October 21, 2021 I commented A Fed Economist Concludes the Widely Believed Inflations Expectations Theory is Nonsense.

The research department had these two amusing quotes in its report.

- It is far, far better and much safer to have a firm anchor in nonsense than to put out on the troubled seas of thought. John Kenneth Galbraith (1958).

- Few things are harder to put up with than the annoyance of a good example. Mark Twain, The Tragedy of Pudd’nhead Wilson (1894)

May 2, 2024: Home Prices Hit New Record High, Don’t Worry, It’s Not Inflation

The Case-Shiller national home price index hit a new high in February. That’s the latest data. Economists don’t count this as inflation.

December 24, 2024: Dear Fed, Please Shut Up Already, Stop the Forward Guidance

Danielle DiMartino Booth claims the Fed should be cutting more, not less. I have a different suggestion.

Since the Fed has no idea, it should stop forward guidance that the market front runs thereby amplifying the feedback looks discussed above.

More accurately, there should not be a Fed at all. It’s proven clueless.

May 1, 2023: The Fed Admits a Mistake in Collapse of SVB, Seeks More Power Anyway

If I am not mistaken, that is a perfect example of Fed Uncertainty Corollary Number 2, Number 3, and Number 4.

Gold Hits New Record High, Dear Jerome Powell, Is Everything Under Control?

This post was triggered by reader responses to Gold Hits New Record High, Dear Jerome Powell, Is Everything Under Control?

Gold does not believe the Fed has things under control and neither do I.

Today’s Pertinent Conclusion

We are trapped in “Fedthink”, especially the nonsensical proposition that two percent inflation is a good thing despite the fact that the Fed is clueless on how to measure inflation in the first place.

Tyler Durden

Mon, 02/03/2025 – 13:25

7 miesięcy temu

7 miesięcy temu