Atrocious, Tailing 7Y Auction As Foreign Demand Craters

After a poor 2Y auction, a subpar 5Y yesterday, it only makes sense that the week’s final coupon auction – today’s sale of 7Y paper – was the ugliest yet.

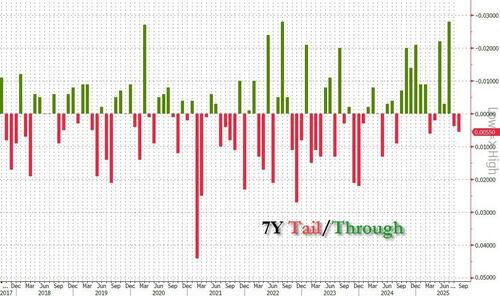

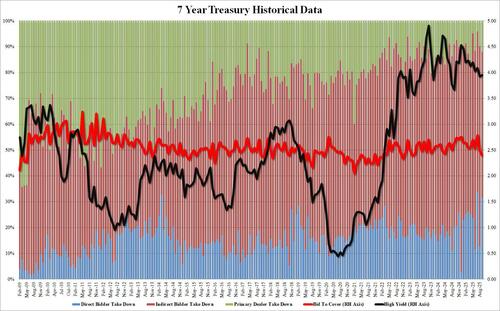

Stopping at a high yield of 3.953%, this was a slight pick up from last month’s 3.925%. It also tailed the When Issued 3.947 by 0.6bps, the biggest tail since August 2024.

The bid to cover was just 2.395, a big drop from 2.489 in August and the lowest since March 2023.

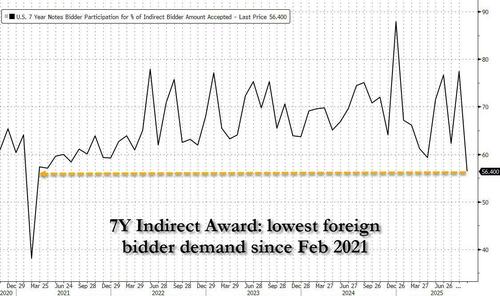

But it was the internals that were especially bad: Indirects, aka foreign buyers, plunged from 77.5% to 56.4%, the biggest monthly drop in 4 years. Worse, this was the lowest foreign demand since March 2021, when as veteran bond traders will recall, the US had a near-failed 7Y auction.

And with Directs taking 31.6%, or one of the highest on record, and surge from 12.8% in August, Dealers were left holding 12.0%, which was also higher than the 9.79% last month, in what can only be described as an absolutely abysmal breakdown of demand.

Overall, this was the ugliest 7Y auction we have seen since 2021, and one wonders if the coordinated selling across both stocks and bonds isn’t just another confirmation of the rollover across global markets that Goldman’s Bobby Molavi highlighted yesterday.

Tyler Durden

Thu, 09/25/2025 – 13:26

2 miesięcy temu

2 miesięcy temu