WTI Tops $70 – 3-Week Highs – After Across-The-Board Inventory Draws

Oil prices are higher this morning (with WTI topping $70 for the first time in three weeks) following an across the board inventory draw reported by API overnight. Additionally, concerns over supply strained by U.S. sanctions on Iran and Venezuela are also supporting the commodity.

„Although the immediate market impact might be minimal, apart from supporting additional short covering from underinvested hedge funds, this action indicates a definite change, potentially signalling the White House’s willingness to sacrifice low oil prices to achieve wider strategic objectives-isolating Iran and Venezuela and increasing pressure on China,” Ole Hansen, head of commodity strategy at Saxo Bank, noted.

The upside for oil prices from the U.S. actions is likely limited by coming supply additions as OPEC+ will begin to return 2.2-million barrels per day of production cuts in 18 monthly tranches starting in April, while supply from countries outside of the cartel are also on the rise.

Will this morning’s official data confirm the API drawdowns…

API

-

Crude -4.60mm (-2.50mm exp)

-

Cushing -600k

-

Gasoline -3.3mm

-

Distillates -1.3mm

DOE

-

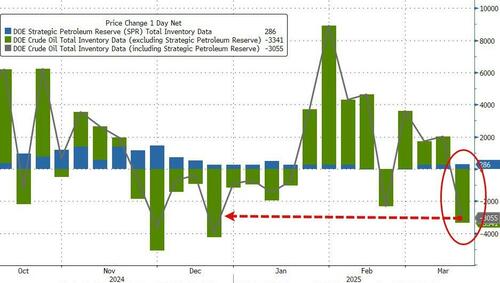

Crude -3.34mm (-2.50mm exp) – biggest draw since Dec 2024

-

Cushing -755k

-

Gasoline -1.45mm

-

Distillates -421k

The official data confirmed API”s report – with drawdowns across all cohorts with crude stocks dropping most since mid-December…

Source: Bloomberg

Despite the 286k barrel addition to the SPR, total crude inventories still tumbled notably…

Source: Bloomberg

US Crude production pushed back near record highs as drill-baby-drill prompts a pick up in rig counts…

Source: Bloomberg

Is Trump cracking down on Iran and Venezuela to make more room for US production?

Trump cracking down on Venezuela and Iran oil production (~5MM bpd) while backchanneling with Saudis/UAE to allow OPEC+ to boost overall output in April, and leaving some space for US producers. https://t.co/flVwSmEUKr

— zerohedge (@zerohedge) March 24, 2025

WTI topped $70 for the first time in three weeks ahead of the DOE data…

Energy appears to be attracting investors fleeing the problem areas of the market, like tech and consumer discretionary stocks.

Being the „best house on a bad block” can lead to outperformance, but in this case it looks fleeting.

The main stocks still tend to trade with oil prices, which look shaky. Starting next month, OPEC and its allies will start to restore some production that they had been holding off the market to boost prices. Even Goldman Sachs, which has been steadily bullish about oil prices, is less upbeat.

With „recession risks rising and elevated spare capacity, medium term risks to our price forecast remain to the downside,” wrote analyst Callum Bryce.

Tyler Durden

Wed, 03/26/2025 – 10:36

6 miesięcy temu

6 miesięcy temu