WTI Holds Gains After Big Gasoline Inventory Draw, US & OPEC Production Jump

Oil prices are rising again this morning, despite a surge in OPEC+ production reported for February and also in spite of a large crude build reported by API last night.

The rise comes after the Energy Information Administration on Tuesday said it expects the market to remain under supplied until the third quarter.

Last month, the agency forecast that inventories would begin rising by the end of June.

A weakening greenback is also supporting prices as the currency suffers from chaotic U.S. trade policy.

„The lack of coherent policies is the primary trigger of the current dollar malaise. Confusion reigns. Will the situation worsen or brighten and the sell-off will change course? Clarity on US economic policies could steady the dollar boat,” PVM Oil Associates noted.

So all eyes on the official data this morning to see if it confirms the big crude build.

API

-

Crude +4.25mm

-

Cushing

-

Gasoline -4.56mm

-

Distillates +421k

DOE

-

Crude +1.45mm

-

Cushing -1.23mm

-

Gasoline -5.74mm – biggest draw since Oct

-

Distillates -1.559

Crude stocks rose last week (but less than API reported), but it was the major draw in gasoline stocks that caught traders’ eyes…

Source: Bloomberg

For the first time in four weeks, the Trump admin added to the SPR (+275k barrels)…

Source: Bloomberg

US crude production rose back near record highs last week…

Source: Bloomberg

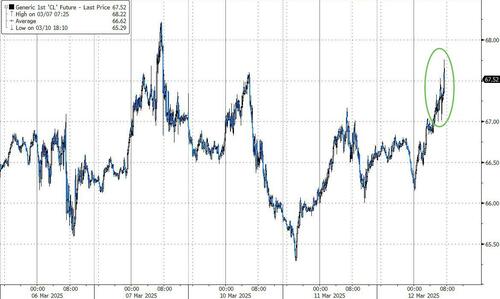

WTI is holding gains above $67 for now…

Source: Bloomberg

OPEC+ crude production surged last month as Kazakhstan, which has long flouted the cartel’s output quotas, further breached its agreed limit.

The alliance’s output climbed by 363,000 barrels a day to just over 41 million barrels a day in February, according to a report from OPEC’s secretariat on Wednesday, preempting the group’s supply revival by two months.

Last week, the coalition led by Saudi Arabia and Russia surprised oil traders by announcing it would press on with long-delayed plans to restore halted output amid pressure from President Donald Trump to reduce fuel prices.

…and as that chart shows, US inflation is set to drop further given the decline in energy prices.

OPEC+ has said it can “pause or reverse” the scheduled series of output increases depending on market conditions, and has just under a month to consider the next hike.

Tyler Durden

Wed, 03/12/2025 – 10:42

4 godzin temu

4 godzin temu