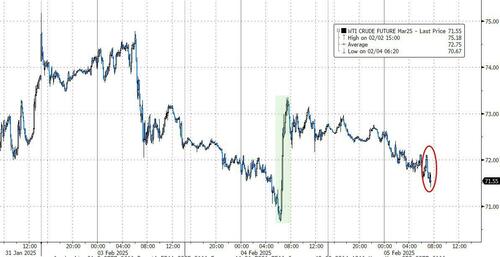

WTI Extends Losses After Biggest Crude Inventory Build In A Year

Oil prices are leaking lower this morning after surging yesterday on Trump’s „maximum pressure” plan for Iran as traders weigh the effect of a US-China trade war on demand.

“Trump tariff chaos and trade war is no good for global growth and oil demand growth,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “But supply disruptions, as so often before, can then rapidly and suddenly turn everything around.”

API reported yuuge builds for Crude and gasoline overnight but a large draw for Distillates (cold weather?)…

API

-

Crude +5.025mm

-

Cushing +110k

-

Gasoline +5.4mm

-

Distillates -7.00mm

DOE

-

Crude +8.64mm – biggest build since Feb 2024

-

Cushing -34k

-

Gasoline +2.23m – 12th straight weekly build

-

Distillates -5.47mm – biggest draw since March 2021

Some massive swings in the inventory data last week with a huge crude build and large distillates draw…

Source: Bloomberg

Including the 250k addition the SPR, last week saw the biggest crude inventory build since Feb 2024

Source: Bloomberg

US Crude production rebounded from the cold-weather impacts…

Source: Bloomberg

WTI extended its loses after the big crude draw…

Crude prices have retreated significantly from a high above $80 a barrel last month. While much of that retreat has been spurred by Trump-led market volatility, pockets of the physical market are also showing signs of softening.

Finally, Brent’s nearest timespread – a premium on immediate delivery over futures for the next month that signals market health – closed at its softest level in four weeks on Tuesday.

Tyler Durden

Wed, 02/05/2025 – 10:41

10 miesięcy temu

10 miesięcy temu