„Widespread Freezes”: Trump’s Tariff Blitz Sends US Import Bookings Crashing, Global Supply Chains Crack

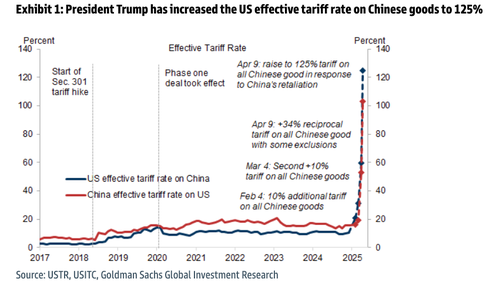

Global trade may be in danger of a disruption following President Trump’s „Liberation Day” tariff blitz on Beijing.

The latest high-frequency data on container freight bookings reveals that Chinese shippers rushed shipments to the U.S. over the last year to front-run the trade war—but have now abruptly paused shipments amid sky-high levies.

Freight data firm Vizion published a new report Friday titled „Tariff Shockwave: U.S. Import Bookings Collapse After Q1 Surge. „

Here are snippets from the alarming report that warns about „widespread booking freezes” and unfolding global trade turmoil:

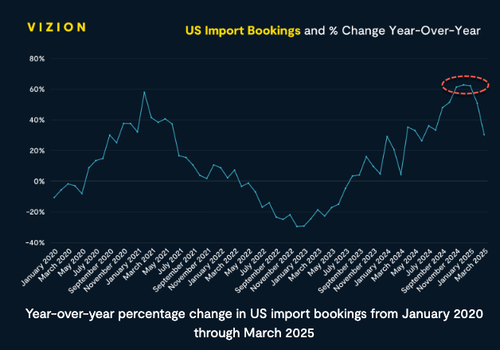

U.S. Import Bookings YoY % Change: 5-Year View

The chart below illustrates year-over-year changes in U.S. import bookings, highlighting key shifts over the past five years. After a surge during the pandemic that peaked in 2021, booking volumes declined sharply through 2022. A steady recovery began in 2023 and gained momentum through 2024, leading to a strong start in early 2025.

But that momentum didn’t last. March 2025 bookings fell 20% from January peaks, even though volumes were still 30% higher year-over-year compared to 2024. The most likely explanation? Shippers moved quickly to front-load shipments ahead of anticipated tariff increases.

A Sudden April Crash in Bookings

As tariff-related uncertainty intensified, booking volumes collapsed in real time. Comparing the week of March 24–31, 2025 to the following week, April 1–8, 2025, we saw sharp declines:

-

Global TEUs Booked: ↓ 49%

-

Overall U.S. Imports: ↓ 64%

-

Overall U.S. Exports: ↓ 30%

-

U.S. Imports from China: ↓ 64%

-

U.S. Exports to China: ↓ 36%

This dramatic drop aligned with two key developments: the April 4th U.S. tariff announcement, followed by China’s retaliatory measures announced on April 5. The result? A widespread booking freeze, as shippers paused mid-shipment cycle to reassess costs, timelines, and broader trade strategy.

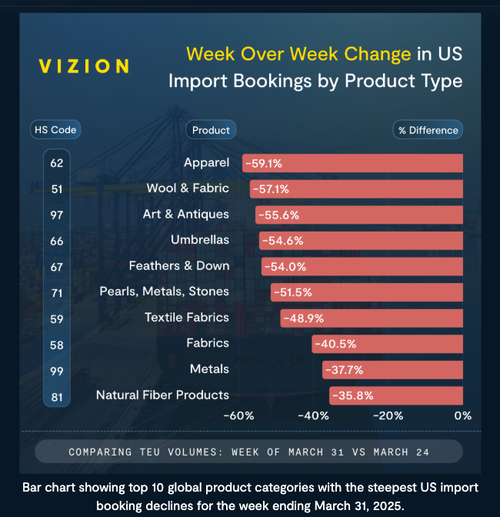

Week-over-Week Drop in U.S. Imports by Product Type

Zooming in on product-level trends between March 31-April 6, 2025, and the prior week (March 24-30) reveals sharp booking declines across several categories:

-

Apparel & Accessories: ↓ 59%

-

Wool, Fabrics, and Textiles: ↓ 57%

-

Art, Antiques, Umbrellas, Feathers: ↓ 50%+

These are largely discretionary or seasonal categories, often the first to react to rising costs, demand shifts, or trade policy changes. Many of these goods also fall under one of many tariff adjustments, making them more sensitive to uncertainty and pricing volatility in the short term.

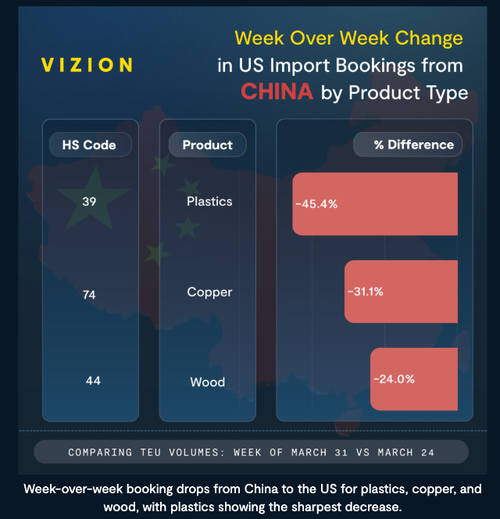

Week-over-Week Drop in U.S. Imports from China by Product Type

Imports from China showed similar pain, particularly in foundational manufacturing inputs:

-

Plastics: ↓ 45.4%

-

Copper: ↓ 31.1%

-

Wood Products: ↓ 24.0%

These categories are deeply tied to industrial and manufacturing supply chains and now face significant tariff pressure. On April 10, the White House clarified that tariffs on Chinese goods now total 145%, combining the previously announced 125% rate with an additional 20% import tax tied to other enforcements. This sharp increase in effective duty rates has already created significant hesitation in forward bookings from China, especially in high-volume, high-cost raw material categories.

The analysts at Vizion summed tariffs have sparked vast amounts of uncertainty:

The message is clear: Shippers moved early to get ahead of tariffs, and then hit the brakes as conditions changed. This behavior, visible in booking data weeks before it shows up at the port, shows just how critical forward-looking logistics intelligence has become.

With tariffs from other trade partners currently on a 90-day pause, shippers are navigating a highly uncertain and fast-changing trade environment. The rest of 2025 is likely to bring continued volatility marked by demand swings, accelerated ordering patterns, and a re-evaluation of sourcing strategies the global response to these trade actions continues to unfold.

Emerging signs of trade disruption on major maritime shipping lanes between China and the U.S. come as Chinese suppliers are being swamped with canceled or reduced orders from U.S. companies…

-

Amazon Cancels Orders, Walmart Pulls Forecast As Tariffs Take Hold

-

Chinese Sellers On Amazon Panic After Trump’s Tariff Bazooka

We previously noted that the latest high-frequency indicators from Goldman—dated April 3 and covering Chinese consumption, mobility, production, investment, and broader macro activity—show that Trump’s tariff blitz has not yet impacted the real economy, particularly in terms of traffic congestion.

- Are China Road Traffic Indicators Set To Collapse As Tariff War Cancels Factory Orders

However, as we also pointed out, with suppliers pulling back on orders and container shipments declining, these high-frequency indicators could be on the verge of deteriorating…

Tyler Durden

Sun, 04/13/2025 – 20:15

8 miesięcy temu

8 miesięcy temu