What Job Numbers This Friday Will It Take For The Fed To Cut by 50bps

Earlier this week, we laid out a case why the coming Sept 9 Preliminary Benchmark Announcement of labor market revisions could shock the Fed, and force a jumbo 50bps rate cut similar to last year for one simple reason: the revision could be just as big as last year, and as Powell explained, the massive 818K revision in 2024 was one of the primary reasons for the unexpectedly large rate cut 2 months ahead of the election. And the last thing the Fed chair would want, is to look political (cough) and prompt questions why he doesn’t do another jumbo rate cut if he is faced with a similar jobs revision.

But what is we don’t even need to wait until next Tuesday. What would it take to seal the deal and get the Fed to cut by 50bps just from this Friday’s payroll report (which as today’s JOLTs job openings report indicated could again come in well below estimates).

Luckily, we have answer: in a note from Standard Chartered’s head of global FX and titled just, Steve Englander calculates that investors would want to see NFP below 40k and the UR at 4.4% or more for a 50bps cut to be on the table.

Some more details: as Englander points out, the Bloomberg consensus for the upcoming NFP data has a median of 75k, but the distribution is tight by historical standards – of 54 forecasts, 48 are between 60k and 100k. This makes sense: after all, most projections of equilibrium NFP growth (especially now that there is an embargo on illegal immigrant workers) are between 50k and 100k. If revisions to prior months’ data are relatively modest (note Friday’s revisions will be different from those the BLS will announce next week), Englander believes that „any August NFP number below 40k would move markets towards a 50bps cut.”

Furthermore, in line with previous findings that that NFP revisions tend to be procyclical, a weak print for the headline month is likely to be associated (again) with downward revisions to prior months. So to take a cut off the table completely, NFP would have to rise to 130k or more, with positive revisions. Unlikely, especially now that the BLS no longer has a commissioner and whoever will end up in charge will want a kitchen sinking event that gets Trump the rate cut he desires.

Of course, NFP has to be looked at in conjunction with the unemployment rate (UR). The market forecast for the August UR is 4.3%, but this is not a big jump, as the unrounded UR for July was only slightly below 4.25%. Since the market is split between 4.2% and 4.3%, Englander thinks a cycle-high UR of 4.3% will not be enough to guarantee a 50bps cut unless NFP is very weak. Similarly, 4.4% would put 50bps in play unless NFP was particularly strong.

There is a catch

Englander – who broke down his note into two parts, the first dealing with what numbers will be sufficient to prompt a 50bps rate cut, and the second reiterating his view that the labor-market data that the Fed and markets focus on are highly misleading and understate the degree of slack – agrees with what we have been saying for the past five years, and notes that „it is rare that we disagree so vehemently with how markets and policy makers interpret data, but we do so now.”

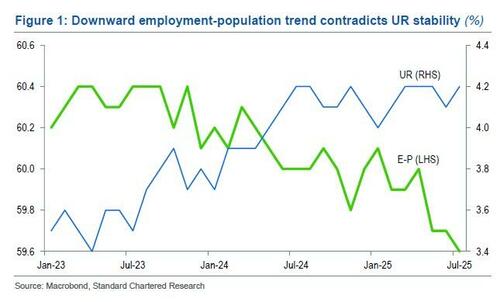

His first quarrel is easy to deal with. The Unemployment Rate has been at 4.1% or 4.2% for 13 of the last 14 months, so it doesn’t show any trend. In Englander’s view, this is misleading because the employment-population (E-P) ratio has dropped steadily over this period (Figure 1).

The cyclicality of participation rates is well established, so the E-P ratio pointing to labor-force softening is likely to be more indicative than the UR. To be clear, the latest data show nothing like the sharp labor-market deterioration of 2008-09 or 2020, but the decline is very visible

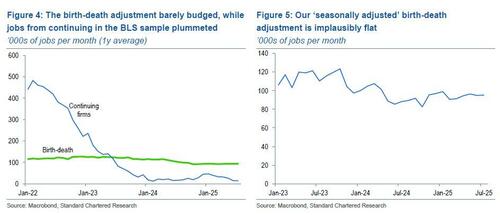

His view on NFP is more controversial, and similar to what we have complained about for years Englander thinks the birth-death adjustment is heavily distorting NFP outcomes. Consider the following:

- Since the beginning of 2024, the monthly birth-death adjustment has been out of sync with the accurate (but lagging) BLS Business Employment Dynamics (BDM) estimate of net new job creation from net new firm openings (Figure 2). The BDM numbers are based on the Quarterly Census of Employment and Wages (QCEW) so they are considered definitive.

- BDM data on jobs created by net new firm openings only go through end-2024, but historically they have tracked what is happening at continuously operating firms. Both have dropped sharply, which explains why there is such widespread expectation of a sharp downward benchmark revision based on QCEW on 9 September (Figure 3).

- It is possible to back out job creation from continuing firms in the monthly NFP survey. Continuing firms are those that appear in the BLS sample two months in a row; they drive the BLS sample estimates of employment growth, the birth-death adjustment is not based on any sample and is added to these sample-based estimates. Job growth at these firms has dropped sharply and has been close to zero or even negative in recent months (Figure 4). NFP growth from continuing firms dropped to a monthly average of 14k in the 12 months to July 2025 from more than 450k in the 12 months to early 2022, but the average birth-death adjustment only edged down to 94k from c.120k over the same period.

- This strongly implies that correctly measured net job creation from new firm openings is well below the BLS birth-death estimate of around 90k monthly.

Bottom line: Englander estimates that the birth-death adjustment has been overstating job creation by 70k monthly over the last year, which is in line with our estimates from one year ago. And, as we explained earlier, this will likely be the major source of the sharp downward benchmark revision, whose preliminary estimate through March 2025 is scheduled to be released on 9 September.

In conclusion, Standard Chartered estimates that actual monthly job creation among newly opened firms is no higher than 20k or so. So the published monthly NFP data have probably continued to overstate job growth. By this reckoning, a 100k published NFP growth number on 5 September would suggest an actual number closer to 30k; by the same calculation, even a 170k published NFP number would be only 100k (roughly equal to the estimate of equilibrium NFP growth) in reality.

Bottom line: sooner or later the BLS will have to come to terms with what are years of generously overestimated jobs numbers, and it behooves Trump to do so sooner rather then later in his term, especially when he can still take advantage of a jobs revision that puts most of the blame on his predecessor.

More in the full report available to pro subscribers.

Tyler Durden

Thu, 09/04/2025 – 06:55

2 miesięcy temu

2 miesięcy temu

![Ślubowanie kadetów i nowa strzelnica w Zespole Szkół numer 5 w Rybniku [FOTO]](https://www.naszrybnik.com/photos/176393477557-908806-.jpg)