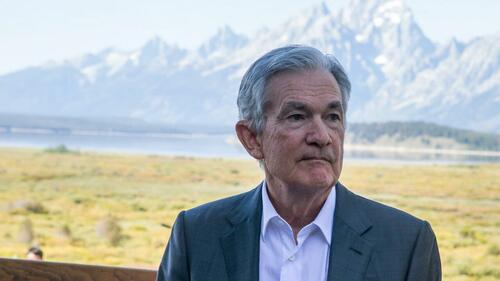

Watch Live: Fed Chair Powell Delivers His Final Remarks From Jackson Hole

The big day has finally arrived as Fed Chair Powell delivers what will be his last speech from the wilds of Wyoming.

The big question here is whether he will specifically set up a September rate cut. At his last press conference, on July 30, Powell declined to tip his hand on whether he expected to move in September.

At that July press conference, Powell highlighted that several economic reports were due before the September meeting.

“We’ll be taking that information into consideration and all the other information we get as we make our decision at the September meeting,” he said back then.

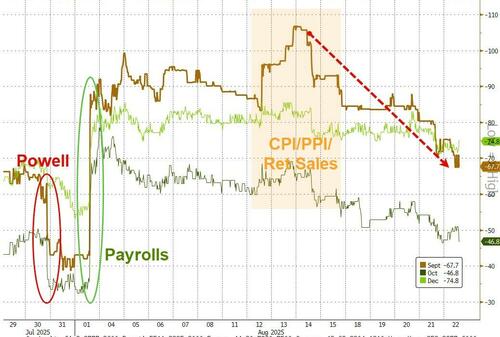

What have the reports shown?

Most memorably, that the job market looks much weaker than it did on July 30.

Major data revisions showed the average three-month payroll gain went from 150,000 before the July employment report to just 35,000.

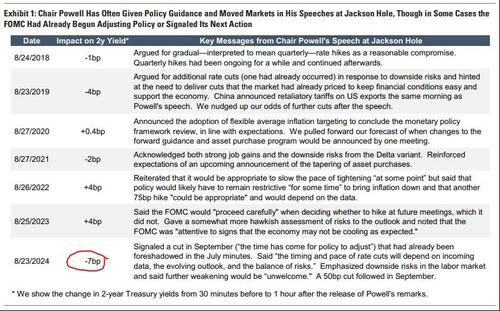

Amid much speculation of what he will offer up to the market gods amid the summer doldrums, Goldman Sachs expects Powell to modify his statement from the July FOMC press conference that the FOMC is “well positioned” to wait for more information.

Instead, he might note that the FOMC is well positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We expect the FOMC to partially reverse some of the changes it made in 2020, as it has foreshadowed in the minutes to its recent meetings.

Specifically, we expect the FOMC to return to saying that it will respond to “deviations” from maximum employment in both directions rather than just to “shortfalls” or to at least water down the shortfalls language and to return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy while retaining the option to use a make-up strategy at the zero lower bound.

Additionally, Academy Securities, Peter Tchir expects Powell to push back on the „labor market is weak” narrative (which Tchir continues to believe is true and why the Fed should be cutting in September).

Economists seem to be honing in on a “replacement rate” level of hiring, in the 50k to 80k range.

That seems low and if discussed, will likely agitate the President as numbers less than 100k as the level of hiring required to keep the unemployment rate stable, just don’t seem that exciting.

Even if the Fed plans to cut, they would like it to be a bit of a surprise (keeping the probability of a rate cut at the next meeting closer to 50 than 100 likely suits them best).

If Powell is able to convince markets jobs are comfortable but inflation isn’t, look for bond yields to go higher, dragging stocks down with them.

Some of this already has been priced in, so the move should be “normal” in size, rather than some outlier.

Recent news on the AI/Data Center side seems to have slowed the excitement for investing in those sectors a little this week.

The market’s reaction to Powell’s has been varied over the years…

Watch the full speech live here (due to start at 1000ET):

Tyler Durden

Fri, 08/22/2025 – 09:45

3 miesięcy temu

3 miesięcy temu