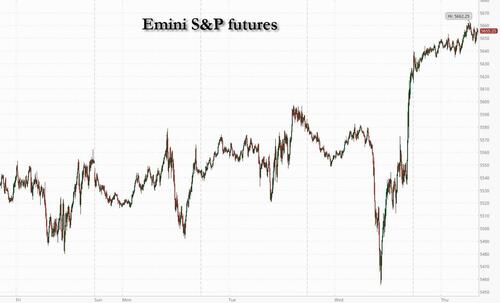

US Futures Surge On Blowout Tech Earnings, Erasing April’s Losses

US equity futures are sharply higher, erasing all of April’s losses on blowout earnings from MSFT and META, and relief over signs the Trump administration is stepping back from its harshest tariff threats. As of 8:00am ET, S&P futures rose 1.2% to 5655, the highest level since before Trump’s Liberation Day announcement and pointing to an eighth consecutive session of gains for the cash index; Nasdaq futures gained 1.7%, as META and MSFT added +6.3% and +7.8%, respectively; most Mag 7 names, NVDA (3.7%) and semis are higher given META’s CapEx increase and MSFT’s reiteration on CapEx guidance. The dollar is higher after the BOJ finally flipped dovish and slashed its growth target pushing USDJPY to 144.5 this morning. It’s light on overnight news as most of Europe is closed today ex-UK along with China; US/Ukraine signed an agreement over the country’s natural resources, UK Manf PMI printed better but remained in contraction, and Trump reiterated that there is a “very good chance” of a deal with China on NewsNation last night. Commodities are mostly lower: WTI -1.2%; Gold -1.7%. The US economic calendar includes weekly jobless claims (8:30am), April manufacturing PMI (9:45am), ISM manufacturing and March construction spending (10am). Fed’s external communications blackout ahead of the May 7 FOMC meeting. Apple and Amazon results are due after the market close.

In premarket trading, the Magnificent Seven are mostly higher: Microsoft (MSFT) gains 8% after the company reported stronger-than-expected quarterly sales and profit growth. Meta (META) jumps 6% after the company’s advertising sales quelled Wall Street concerns about the impact of the Trump administration’s trade war. Apple was the only tech giant in the red, falling 1.4% after a federal judge said in a ruling that it violated a court order requiring it to open up the App Store to third-party payment options (other Mag7s are up Nvidia +4.6%, Amazon +3.7%, Alphabet +1%, Tesla +0.7%).

McDonald’s Corp. (MCD) declines 1.4% as sales fell in the first quarter, reflecting a deterioration in consumer sentiment that’s making it harder for restaurants to lure in diners. Eli Lilly & Co. (LLY) drops 5% after the company cut its earnings outlook. Here are some other notable premarket movers:

- Align Technology rises 10% after the Invisalign company reported quarterly shipments that beat the average analyst estimate.

- Confluent Inc. falls 10% after the provider of a streaming platform gave an outlook for second-quarter subscription revenue that fell shy of expectations. First quarter results showed a slowdown in additions of customers with $100,000 in annual recurring revenue.

- CVS Health rises 8% after the company boosted its adjusted earnings per-share-guidance for the full year and reported better-than-expected results for the first quarter

- E2open shares are up 34% after WiseTech Global, in response to media reports about its being in discussions to acquire E2open, said it was participating in a strategic review process.

- KKR & Co. rises 2% after the investment firm reported assets under management that beat the average analyst estimate. Fee-related earnings also came in above analysts’ expectations.

- Qualcomm falls 5% as the biggest maker of chips that run smartphones gave a tepid revenue prediction for the current quarter, underscoring concerns that tariffs will hurt demand for its products.

- Robinhood gains 4% after the trading platform’s earnings largely beat expectations, with analysts highlighting positive trends in April amid market volatility and a boost from a lower tax rate.

- Shake Shack falls 3% after posting first-quarter results.

- Wayfair gains 5% after posting adjusted earnings per share for the first quarter that beat the average analyst estimate.

Tech giants added to investor optimism that deals between the US and its partners would limit the damage from Trump’s trade war. Wall Street ended a tumultuous month on a day in which the S&P 500 erased an intraday drop of more than 2% to close 0.2% higher. Traders sought reassurance in bets on Federal Reserve easing after the US economy contracted for the first time since 2022.

“So far we’re seeing big tech companies deliver on earnings, which is reassuring, and it’s this reassurance which is supporting equity market futures,” said Georgios Leontaris, chief investment officer for EMEA at HSBC Global Private Banking. “The other element of the story beyond earnings is obviously the ongoing debate as to whether we’ve seen peak tariff noise or not.”

Apple results are due after the market close. Analysts will be listening closely for any further detail on how the company, whose supply chain is reliant on China, Vietnam, and India, views the impact of tariffs

The White House said it was nearing an announcement of a first tranche of trade deals with partners that would reduce planned tariffs. Sentiment was also helped by a report that the US has been proactively reaching out to China through various channels. At the same time, Trump said he would not rush deals to appease nervous investors.

The US and Ukraine reached a deal over access to the country’s natural resources, offering a measure of assurance to officials in Kyiv who had feared Trump would pull back his support in peace talks with Russia.

Elsewhere, most markets in Europe and many in Asia are shut for holidays. The UK’s FTSE 100 index was steady, following 13 days of gains, the longest winning streak since 2017. Gains in material and industrial names are offset by losses in energy and health care.

In FX, the Bloomberg Dollar Spot Index rises 0.3%. the yen is the weakest of the G-10 currencies, falling 0.9% against the greenback after the Bank of Japan pushed back the timing for when it expects to reach its inflation target and slashed its growth forecasts. The pound and euro are little changed.

In rates, treasuries climb, pushing US 10-year yields down 2 bp to 4.14%. Treasury spreads remain within a basis point of Wednesday’s close, as gains remain broad-based across the curve. Gilts are steady, with UK 10-year borrowing costs flat at 4.44%. Treasury futures edge higher into the early US session, on the day’s highs with yields lower by 1bp to 2bp across the curve. US session focus includes weekly jobless claims along with both ISM and PMI manufacturing reports.

In commodities, oil prices decline, with WTI falling 2.3% to below $57 a barrel; the drop followed the biggest monthly drop since 2021, as signs that the Saudi-led OPEC+ alliance may be entering a prolonged period of higher output added to concerns the trade war will hurt demand. Spot gold is down $65 at $3,223/oz, falling for a third day on signs of potential trade-talk progress between the US and several other nations, quelling demand for havens even as signs of slowdowns have emerged in the largest economies. Bitcoin rises 1% and above $95,000.

Looking at today’s calendar, we get the April Challenger job cuts (7:30am), weekly jobless claims (8:30am), April manufacturing PMI (9:45am), ISM manufacturing and March construction spending (10am). Fed’s external communications blackout ahead of the May 7 FOMC meeting

Market Snapshot

- S&P 500 mini +1.2%

- Nasdaq 100 mini +1.6%

- Russell 2000 mini +0.3%

- Stoxx Europe 600 little changed

- DAX +0.3%

- CAC 40 +0.5%

- 10-year Treasury yield -2 basis points at 4.15%

- VIX -0.9 points at 23.85

- Bloomberg Dollar Index +0.2% at 1226.38

- euro little changed at $1.1324

- WTI crude -2% at $57.02/barrel

Top Overnight news

- The US and Ukraine signed an agreement over access to the country’s natural resources. The deal will see the US will get first claim on profits transferred into a jointly managed investment fund that’s intended in part to reimburse the US for future military assistance. BBG

- House Republicans are seriously considering proposals to further limit tax deductions that companies can take for their highest-paid workers’ compensation, expanding restrictions that now apply only to a handful of current or former executives making more than $1 million, according to people familiar with the discussions. WSJ

- US President Trump said we are going to have 'Made in the USA’ like never before and he stated give us a little time to get moving regarding the economy. Furthermore, Trump said interest rates should go down and reiterated that „he (Powell) should reduce interest rates, I understand them better than him”, as well as noted it would be nice for people wanting to buy homes and things.

- There was some chatter that the House Ways and Means Committee is going to mark up their tax package on May 8th: Punchbowl.

- Elon Musk said he’s considering sending DOGE to the Fed, citing a costly renovation of its headquarters as an example of potential government waste. BBG

- The yen dropped as much as 1.2% after the BOJ pushed back the timing for when it expects to reach its inflation target and Governor Kazuo Ueda spoke of uncertainties due to tariffs. For now, policymakers kept rates at 0.5%. BBG

- China feels the white house is “too divided” on trade policy and will hold off on entering serious trade talks with the US while it waits to see which of Trump’s advisors will have his ear and how other countries respond to the 90 day pause on tariffs. SCMP

- Saudi Arabian officials are briefing allies and industry experts to say the kingdom is unwilling to prop up the oil market with further supply cuts and can handle a prolonged period of low prices, five sources with knowledge of the talks said. This possible shift in Saudi policy could suggest a move toward producing more and expanding its market share, a major change after five years spent balancing the market through deep output as a leader of the OPEC+ group of oil producers. RTRS

- The EU is planning to share a paper with the US next week that will set out a package of proposals to kick-start trade negotiations with the Trump administration. The paper will propose lowering trade and non-tariff barriers, boosting European investments in the US, cooperating on global challenges such as tackling China’s steel overcapacity and purchasing US goods like liquefied natural gas and technologies. BBG

- Janet Yellen has warned that Trump’s tariffs will have a “tremendously adverse” impact on the US economy as they “hobble” companies that rely on critical mineral supplies from China. She added: “I’m not yet ready to say that I’m forecasting a recession, but certainly the odds have gone way up. FT

- Microsoft beat estimates and showed strong growth in its key Azure cloud business, while Meta also topped estimates and raised its full-year capex forecast as it continues to invest in AI. With first-quarter earnings in full swing the scorecard so far has shown resilience amid Trump’s trade war. The next big test comes after the close, when Apple and Amazon report. BBG

Tariffs/Trade

- US President Trump reiterated there is a very good chance that they will make a deal with China and any deal has to be on their terms, while he added that they are negotiating with India, South Korea and Japan.

- US President Trump said after a certain amount of time, there will be a tariff wall for pharmaceutical companies.

- USTR Greer said it is a matter of weeks not months to have initial trade deals announced and he is meeting with Japan, Guyana and Saudi Arabia on Thursday and with the Philippines on Friday. Greer added he wouldn’t say they are 'finish-line’ close on an India trade deal but noted he has a standing call with India’s Trade Minister and said they are working closely with the UK and moving quickly with countries ready to move forward on trade. Furthermore, Greer said Canadian PM Carney is a serious person and that President Trump wants a healthy relationship in North America, while he added there are no official talks with China yet and that harmful foreign trade practices, including those in China, need to be addressed.

- China is to hold off on entering serious trade discussions with the US while it waits to see which of US President Trump’s advisers will have his ear and how other countries will respond to the 90-day pause on tariffs, according to a source cited by SCMP

- US Senate narrowly rejected a bipartisan measure to block Trump tariffs with the vote count at 49-49.

Notable Earnings

- eBay Inc (EBAY): Shares +0.5% pre-market. Q1 profit beat estimates, and revenue also increased. The company announced that Peggy Alford was appointed CFO, replacing Steve Priest, as the company adjusts its leadership. It reported Q1 adj. EPS of 1.38 (exp. 1.34), Q1 revenue of USD 2.6bln (exp. 2.55bln). Q1 gross merchandise volume USD 18.75bln (exp. 18.52bln); International GMV USD 9.69bln (exp. 9.58bln); US GMV USD 9.07bln (exp. 8.92bln). In Q1, it had 134mln active buyers (exp. 134.17mln). Sees Q2 revenue between USD 2.59-2.66bln (exp. 2.60bln), and sees Q2 adj. EPS between 1.24-1.31 (exp. 1.29). (Newswires)

- Meta Platforms (META) – Shares +6.5% pre-market following a Q1 beat, while Q2 guidance was in line with expectations. Q1 revenue rose +16% to USD 42.31bln (exp. USD 41.4bln), with EPS of USD 6.43 (exp. USD 5.28); Q1 advertising sales were USD 41.39bln (exp. 40.55bln). Exec said daily users reached 3.43bln, while Threads has now has more than 350mln monthly active users. FY25 CapEx guidance was increased to USD 64–72bn for 2025 (prev. saw 60-65bln), and exec said that increased CapEx will bring data centre capacity online quicker. On AI, exec said its Meta AI app is focused on scaling and engagement this year, with business integration planned for next year; nearly 1bln monthly active users now use Meta AI across its apps. Exec also said that the EC’s ruling may hit its EU business, where it will need to make modifications to ads model which could have significant impact to European business and revenue as early as Q3, while Asia ad spend fell amid regulatory uncertainty. Sees Q2 revenue between USD 42.5bln-45.5bln (exp. 44.41bln), lowered its FY25 total expenses view to USD 113bln-118bln (prev. saw 114-119bln). (Newswires)

- Microsoft (MSFT) – Shares +8.1% pre-market following a beat on Q3 sales and profits, driven by 20% cloud growth amid strong AI demand. The tech giant reported Q3 adj. EPS of 3.46 (exp. 3.21), Q3 revenue USD 70.1bln (exp. 68.41bln); Q3 CapEx USD 16.75bln (exp. 16.28bln). Azure and other cloud services revenue (Ex-FX) surged +33% (exp. +31%), with Azure growth attributable to AI 16pts (exp. 15.6ppts); the majority of Azure outperformance in Q3 was in its non-AI business. Q3 Cloud sales USD 42.4bln (exp. 42.22bln), Q3 Intelligent Cloud sales USD 26.8bln (exp. 25.99bln). Exec said H2 total CapEx view remains unchanged vs January guidance. Sees Q4 revenue between 73.3bln-73.4bln (exp. 72.0bln), Q4 CapEx expected to increase on a sequential basis, Q4 cloud gross margin expected to be 67% (down Y/Y), Q4 Intelligent Cloud revenue seen between USD 28.75bln-29.05bln (exp. 28.52bln), while Q4 Azure and other cloud services revenue growth is expected to be 34-35% in constant currency. Exec said that FY26 CapEx is expected to grow at a lower rate than FY25. (Newswires)

- Qualcomm (QCOM) – Shares +5.7% pre-market after it topped Q2 top- and bottom-line estimates, but Q3 guidance was light, and it sees a sales hit from US tariffs ahead. It reported Q2 adj. EPS 2.85 (exp. 2.80), Q2 revenue USD 10.84bln (exp. 10.60bln); Q2 QCT revenue USD 9.47bln (exp. 9.23bln), Q2 QTL revenue USD 1.32bln (exp. 1.35bln); Q2 Internet of Things revenue USD 1.58bln (exp. 1.45bln), Handsets revenue USD 6.93bln (exp. 6.84bln), Automotive revenue USD 959mln (exp. 909.8mln). Sees Q3 adj. EPS 2.60-2.80 (exp. 2.66), Q3 revenue between USD 9.9-10.7bln (exp. 10.33bln), sees Q3 QCT revenue between USD 8.7-9.3bln (exp. 8.98bln), and sees Q3 QTL revenue between 1.15-1.35bln (exp. 1.3bln). (Newswires)

A more detailed look at global markets courtesy of Newquawk

APAC stocks traded higher but with gains capped in severely thinned conditions owing to mass holiday closures across the region and in Europe for Labour Day. ASX 200 eked mild gains as the outperformance in tech, real estate and consumer staples was offset by losses across the commodity-related sectors, while trade data was mixed as Australian monthly exports returned to growth but imports contracted. Nikkei 225 advanced at the open after having reclaimed the 36,000 level and with further upside seen after the BoJ policy announcement where the central bank kept rates unchanged at 0.50% and provided some dovish rhetoric despite maintaining its rate hike signal.

Top Asian News

- BoJ maintained its short-term interest rate target at 0.5%, as expected, with the decision made by unanimous vote, while it said it will continue to raise the policy rate if the economy and prices move in line with its forecast and will conduct monetary policy appropriately from the perspective of sustainably and stably achieving the 2% inflation target. BoJ said Japan’s economic growth is likely to moderate and underlying consumer inflation is likely to be at a level generally consistent with the 2% target in the second half of the projection period from fiscal 2025 through 2027, as well as noted that uncertainty surrounding Japan’s economy and prices remains high with risks to the economic outlook and inflation outlook are skewed to the downside. Furthermore, it lowered its evaluation of the economic outlook and warned that a prolonged period of high uncertainties regarding trade and other policies could lead firms to focus more on cost-cutting, and as a result, moves to reflect price rises in wages could also weaken. In terms of the Outlook Report projections, the Real GDP median forecast for Fiscal 2025 was cut to 0.5% from 1.1% and the Fiscal 2026 estimate was cut to 0.7% from 1.0%, while the Core CPI median forecast for Fiscal 2025 was cut to 2.2% from 2.4% and the Fiscal 2026 forecast was cut to 1.7% from 2.0%.

- BoJ’s Ueda Press Conference: Uncertainty from trade policy has heightened sharply. Expect to keep raising rates if the economy and prices move as projected. Timing to attain the underlying 2% inflation target will be delayed. Price goal timing delay doesn’t mean delay in hikes; timing of trend inflation does not necessarily correlate with the timing of a hike.

Due to Labour Day across Europe, cash and derivatives markets are closed across Euronext services and those run by other European exchanges such as Deutsche Boerse, SIX and Nasdaq (Scandinavia closed ex-Copenhagen). The UK’s FTSE 100 is one of the few indices in Europe which is open today; currently flat.

Top European news

- EU is to present trade proposals to the US next week, according to Bloomberg citing officials.

FX

- DXY is up for a third consecutive session with the USD firmer vs. all major peers. On the trade front, the White House administration continues to talk up the possibilities of imminent trade deals. Reports suggest that the US reached out to China recently for tariff talks. However, Chinese press notes that China is to hold off on entering serious trade discussions with the US while it waits to see which of US President Trump’s advisers will have his ear and how other countries will respond to the 90-day pause on tariffs. Ahead, Challenger layoffs, weekly claims and ISM manufacturing PMI are all due. DXY ventured as high as 100.08, but has recently waned off that high to a current 99.75 level.

- EUR is essentially flat vs. the USD with most of Europe away from the market on account of Labour Day. In terms of macro updates for the region, Bloomberg reported that the EU is to present trade proposals to the US next week. EUR/USD hit a trough overnight at 1.1288 before returning to the 1.13 handle.

- JPY is the clear laggard across the majors after the BoJ opted to stand pat on rates (as expected) whilst cutting its Real GDP and Core CPI estimates in its quarterly outlook report; the FY 2025 GDP estimate saw a sizable downgrade to 0.5% from 1.1%. At the follow-up press conference by Governor Ueda, USD/JPY continued its ascent to a peak at 144.75 with Ueda noting that the timing to attain the underlying 2% inflation target will be delayed. However, upside was trimmed after he stated that a delay in the timing of the price goal doesn’t mean a delay in hikes.

- GBP is flat vs. the USD with incremental macro drivers remaining light. On the trade front, USTR Greer said the US is working closely with the UK and moving quickly with countries ready to move forward on trade. Local elections are taking place in the UK today with a focus on the extent of Conservative losses, the performance of Labour and how much ground the Reform Party can make; not expected to be a market mover. Cable has delved as low as 1.3275 but has since reclaimed the 1.33 mark and now sits around 1.3320. UK Manufacturing PMI was subject to an upward revision, but ultimately had little impact on the GBP.

- Antipodeans are both softer vs. the broadly firmer USD and tracking losses in global peers. AUD saw little follow-through from mixed trade data as Australian monthly exports returned to growth but imports contracted.

Fixed Income

- The BoJ left rates unchanged as expected. JGBs were bid though as the accompanying forecasts were lowered for both Real GDP and Core CPI, pushing back the timing for when underlying inflation is likely to be at a level generally consistent with the 2% target. In totality, this lifted JGBs from 141.05 to 141.34 though the upside did dissipate almost entirely in the gap between the announcement and Governor Ueda. Ueda for the most part stuck to the script of the statement and made it very clear that the BoJ is facing significant uncertainty in its forecasts. Ueda’s reiteration that there will be a delay to attaining the underlying 2% inflation target sparked another bout of dovishness, lifting JGBs to a fresh 141.42 peak.

- A very slow start to the session for USTs given the absence of European participants for Labour Day (China also away). USTs are firmer and at a 112-12 peak, but one that is shy of the 112-16 high from Wednesday. As was the case on Wednesday, any concerted move higher enters a patch of clean air before resistance at 114-03+ and 114-10 from early-April.

- Gilts opened higher by around 30 ticks before extending a handful more to a 93.86 peak, influenced by the upside seen in JGBs post-BoJ/Ueda. On the data front, April’s Manufacturing PMI was revised slightly higher (but still in contractionary territory) and a significant jump in Mortgage Lending during March; the latter comes alongside a 3bps drop in the effective rate on new and outstanding mortgages to 4.5% and 3.84% respectively during the period and ahead of Stamp Duty alterations which kicked in alongside the new FY in April.

Commodities

- Crude is on the backfoot and trading lower by around USD 1.00/bbl, in a continuation of the prior day’s downside. As a reminder, oil prices slumped on Wednesday following reports that Saudi officials briefed allies and industry experts that the kingdom can sustain a prolonged period of low oil prices.

- Gold is pressured given the positive risk tone in the US and as the Dollar makes modest gains. Yellow metal has been as low as USD 3.2k/oz, over USD 100/oz from the week’s opening levels despite the series of soft data for the US as the inflationary part of the stagflationary narrative and modest yield curve steepening weighs on XAU.

- Base metals were contained trade overnight given the mass holiday closures and absence of the metals largest buyer, China, for a long weekend (May 1st-5th). This morning, 3M LME Copper has picked up tracking the broader macro tone with US futures strong after earnings, 3M LME Copper back above the USD 9.2k mark.

Geopolitics: Middle East

- US Secretary of Defence Hegseth said Iran will pay the consequence for supporting Houthis.

Geopolitics: Ukraine

- US and Ukraine signed an agreement on access to natural resources and to establish a US-Ukraine reconstruction investment fund. It was also reported that the US Treasury said the Treasury Department and US International Development Finance Corporation will work with Ukraine to finalise programme governance and advance the partnership, while it added that the agreement signals clearly to Russia that the Trump administration is committed to a peace process centred on a free, sovereign, and prosperous Ukraine over the long term. Furthermore, Treasury Secretary Bessent said the US–Ukraine economic partnership agreement allows the United States to invest alongside Ukraine to „unlock Ukraine’s growth assets”.

- US Senator Graham, who is a close ally of President Trump, is forging ahead on a plan to impose new sanctions on Russia and steep tariffs on countries that buy Russian oil, gas and uranium, while the bill also would impose a 500% tariff on imported goods from any country that purchases Russian oil, gas, uranium and other products, according to WSJ.

US Event Calendar

- 7:30 am: Apr Challenger Job Cuts YoY, prior 204.8%, revised 204.78%

- 8:30 am: Apr 26 Initial Jobless Claims, est. 223k, prior 222k

- 8:30 am: Apr 19 Continuing Claims, est. 1864.5k, prior 1841k

- 9:45 am: Apr F S&P Global U.S. Manufacturing PMI, est. 50.5, prior 50.7

- 10:00 am: Apr ISM Manufacturing, est. 47.9, prior 49

- 10:00 am: Apr ISM Prices Paid, est. 73, prior 69.4

- 10:00 am: Mar Construction Spending MoM, est. 0.2%, prior 0.7%

Tyler Durden

Thu, 05/01/2025 – 08:26

7 miesięcy temu

7 miesięcy temu

![Nowa ustawa o opiece ma mylący tytuł. Nie przewiduje żadnych nowych świadczeń dla opiekunów albo osób niepełnosprawnych, seniorów, osób samotnych [projekt]](https://g.infor.pl/p/_files/38661000/paragraf-38661468.jpg)