„Thank F**k February’s Over!” – Rate-Cut Hopes Jump As Stocks & Crypto Dump

„Thank f**k February’s over,” was the irreverent message from one trader as he reflected on this month’s more technical (less fundamental) driven collapse in everything that was seemingly going to the moon without hesitation.

-

The economy – growth expectations stalling

-

Inflation – disinflationary path is over

-

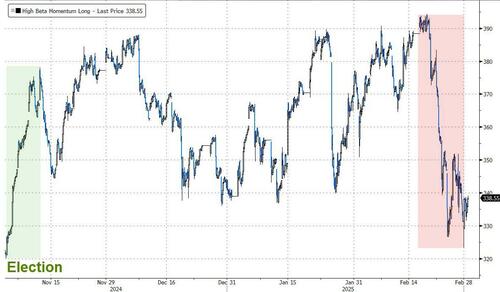

AI/Meme/Momo/Tech stocks – clubbed like a baby seal as CTA thresholds hit and revenues disappoint

-

Crypto – carnage as cash-and-carry trade unwinds

-

Bond yields – plunged as growth fears rise

-

STIRs – rate-cut hopes soared.

Still, could be worse, you could be President Zelensky!!

And that bust up in The Oval Office sparked some chaotic moves in stocks today… but month-end pension rebalancing lifted stocks to the HoD by today’s close…

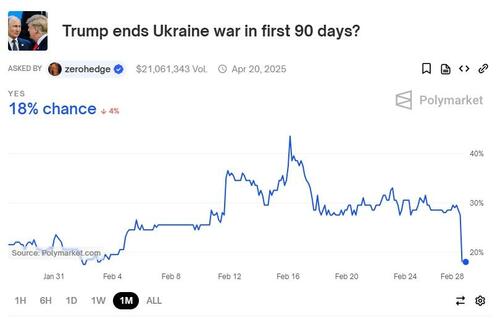

Even as PolyMarket bettors faded their initial Ukraine war optimism…

But taking a step back, the major issue for the market is more top-down macro than geopolitical. The policy mix is driving the market to price what looks like a growth shock. Tariff headlines yesterday with implementation of Mexico and Canada meant to hit in early March + the suggestion of tariffs on Europe + European autos + increased China tariffs weighed on risk. Whether tariffs are delivered or not they are quite likely impacting confidence/injecting uncertainty and that hurts capex/spending/forward planning.

As Nomura’s Charlie McElligott summarized:

„the Market is coming-around to understand that the early Trump 2.0 policy mix is a Growth DRAG because it HAS TO BE (’Engineering a Mild Recession’) in the mind of POTUS and his Administration, in order to achieve the tectonic shift he is seeking…

And that is to rebalance Economic Growth and Labor AWAY FROM dependency upon perpetually higher long-term U.S. Govt spending and hiring-trends, and instead attempt to flatten / bend the trajectory of each back towards the Private-sector, which he can then later stimulate with easier FCI via lower Rates and weaker US Dollar (BUT YOU GOTTA MAKE IT THERE ALIVE FIRST…hence, THE FATTER LEFT TAIL in the meantime)…

…

Dangerously for “market status quo” purposes, and in order to achieve this long-horizon goal of “Re-Privatizing the U.S. Economy,” the theory then becomes that the Administration KNOWS they are gonna have to pump the breaks on the “Perpetual (Money) Machine” of Govt Spending and Employment, which HAS TO crack some eggs (LOL) in an attempt to readjust for the past “Sins of Excess,” particularly via hypothetical Govt Spending cuts and Federal Worker layoffs, along of course with these monster Tariffs (which are WAY over anything we saw in Trump 1.0 – most critically, yesterday’s additional 10% Tariff on all Chinese goods effective March 4th, coming 1 month after his initial 10% tariff increase and raising the cumulative to 20%, as a new round of escalations which hadn’t previously been signaled and taking the estimated average U.S. tariff rate on Chinese goods to approx 33% per Ting Lu) as the blunt-force tools used to reset Global Trade and hit Growth, leading to Disinflationary Impulse which will eventually bring the lower Rates and weaker US Dollar he wants for the Economy in Phase 2…

…

Of course, this theme re. “Growth Scare / Repricing the Left Tail Accident” can of course ALSO overshoot…

…

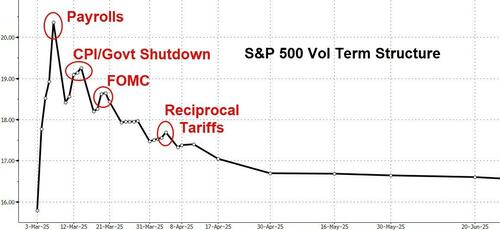

And there IS a “Put Strike” for Trump with Equities in there somewhere, just not here and not yet, because the threats for tariffs hitting next week then seemingly increases the risk that the following April 2nd reciprocal tariffs will be chunky as well—as such, Vol in SPX today is not really giving back much of anything, despite the Spot rally…

February was a one-way street lower in macro-economic data with almost serial disappointments as DOGE’s impact is felt…

Source: Bloomberg

But under the surface, it’s even more problematic as growth expectations plunge while inflation keep surprising to the upside…

Source: Bloomberg

But the market is focused on one thing – growth scare – and that smashed STIRs to price in almost 3 cuts now in 2025 (from just 1 cut 10 days ago)…

Source: Bloomberg

All the US Majors are lower in February with Small Caps the biggest loser and Trannies the least ugly horse in the glue factory…

Source: Bloomberg

Year-to-date, the situation turned red…

Source: Bloomberg

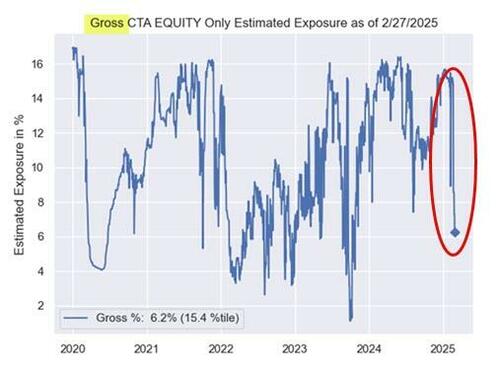

CTAs have seen massive De-Grossing during February — as we went from record highs to max pain in 9 days…

Source: Nomura

All the US Majors broke below critical technical levels…

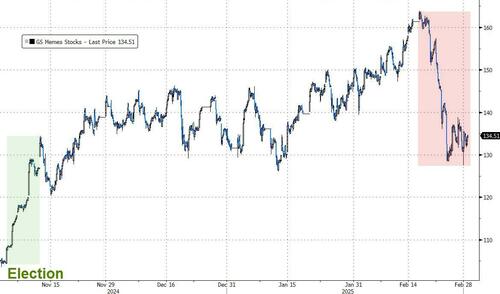

Of course, the big moves were in the highest beta, momo stocks…

Source: Bloomberg

Retail was wrecked as Meme Stocks suffered their biggest monthly decline since last April…

Source: Bloomberg

The 'Lagnificent 7′ basket of stocks plunged in February, down a stunning $2.2 Trillion in market cap from the December highs, testing its 200DMA… This was the second biggest monthly drop in Mag7 market cap ever (April 2022 only one bigger)…

Source: Bloomberg

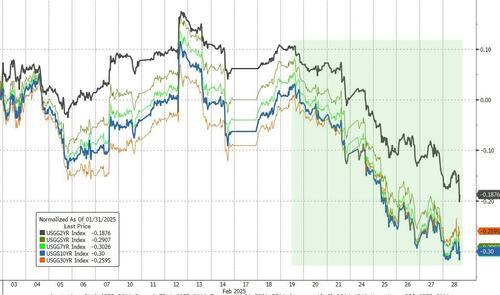

Treasury yields collapsed over the last two weeks to end dramatically lower (25-30bps) on the month…

Source: Bloomberg

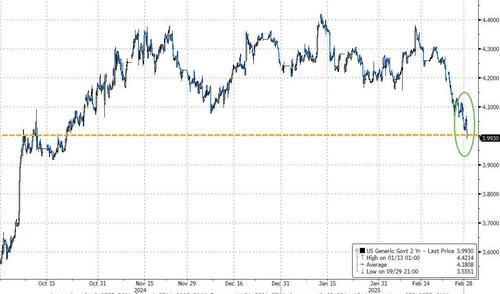

The 2Y Yields plunged back below 4.00%…

Source: Bloomberg

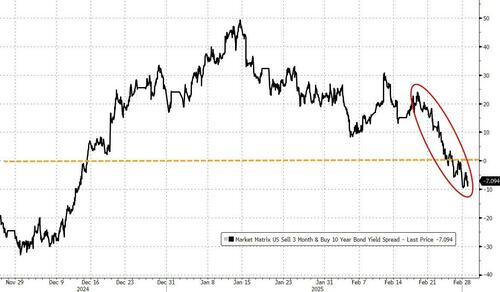

The yield curve re-inverted significantly in Feb, screaming policy error time and/or stagflation…

Source: Bloomberg

The dollar ended the month lower after spiking at the start on tariff tensions. The last few days have seen the dollar rising again on tariff talk…

Source: Bloomberg

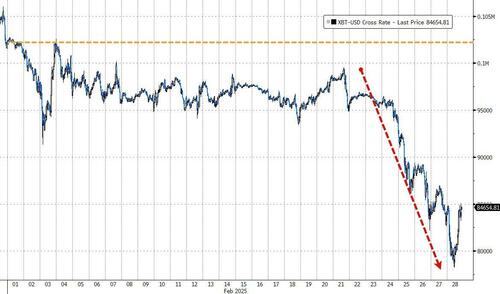

Crypto markets were a bloodbath in February (mainly driven by selling pressure in the last few days as the cash-and-carry trade unwound)…

Source: Bloomberg

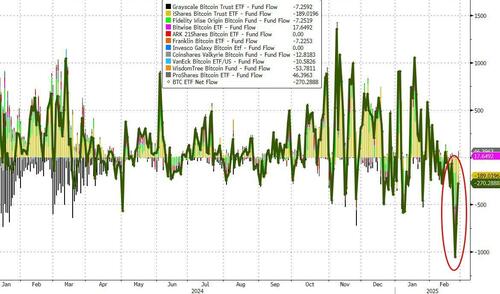

Evidence of the unwind of basis trade is written all over the ETF outflows…

Source: Bloomberg

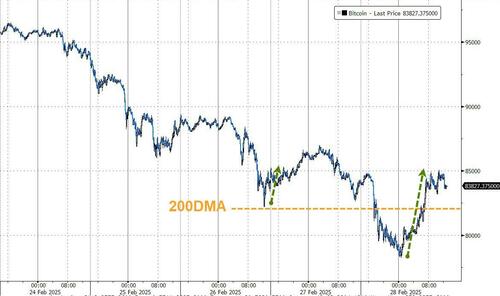

Bitcoin did bounce strongly off its 200DMA today though – is the worst of the unwind over?

Source: Bloomberg

Ether was even worse than bitcoin, dragging the ETH/BTC pair down to new cycle lows…

Source: Bloomberg

Gold managed to hold on to gains in February despite falling for the last few days as broad-based liquidations spread…

Source: Bloomberg

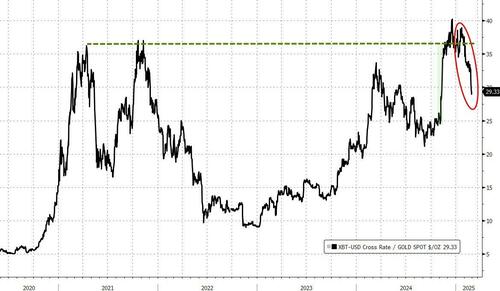

Gold outperformed bitcoin with the precious metal retracing almost all of the post-election relative outperformance of crypto. 1 Bitcoin can now buy ONLY 29 oz of gold (from 40 oz in December)…

Source: Bloomberg

Crude prices were lower on the month but WTI bounced back to $70 today as Ukraine chaos struck…

Source: Bloomberg

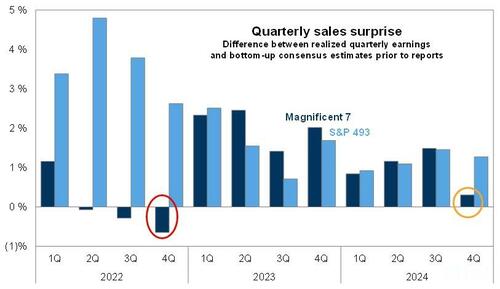

Finally, in case you were wondering, this earnings season was the first time in two years that the 'Magnificent 7′ stocks did NOT handily beat sales estimates…

Source: Goldman Sachs

This has clearly added to investor angst.

Tyler Durden

Fri, 02/28/2025 – 16:00

5 miesięcy temu

5 miesięcy temu