Tesla Stock Flat After Q2 Earnings Light On Revenue And Earnings, Heavy On Vision, But Lacking Guidance

Beside all the things we noted in our Tesla earnings preview, one thing analysts will be watching out for is how executives address questions about tariffs. Tesla’s battery business has long been a sleeper success and growth driver for the company, but that may be affected by new duties on imports of Chinese battery components like graphite. Tesla and its key battery supplier, Japan’s Panasonic, were among companies pushing to block the new tariffs. Analysts will also watch how hard these tariff tensions will hit Tesla’s energy storage business. Cantor Fitzgerald analyst Andres Sheppard predicts the company will revise down its growth outlook for the energy division due to global trade policy.

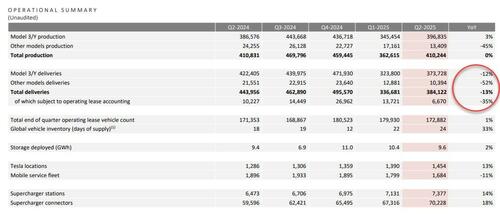

Additionally, investors are watching closely for Tesla’s updated annual sales outlook as the EV maker’s sales slump continues in the first half of the year. Earlier this month, the EV maker reported its delivery numbers were down 12% in the second quarter, as its aging vehicle lineup continues to face growing competition. The company has also experienced brand damage from Elon Musk’s politics and role in the Trump administration. In Q1, executives also partly blamed weak sales on factory shutdowns related to the refresh of the company’s most popular vehicle, the Model Y. But sluggish deliveries have continued, putting the company on track for a second year of declining sales.

With that in mind, here is what Tesla just reported for Q2:

- Adjusted EPS 40c vs. 52c y/y, missing estimate 42c (GAAP EPS 33c vs. 42c y/y). According to Bloomberg „investors may be relived it reported adjusted EPS just 2 cents below Wall Street estimates”

- Revenue $22.50 billion, -12% y/y, missing estimates of $22.64 billion

- Gross margin 17.2% vs. 18% y/y, beating estimates of 16.5%

- Automotive Gross Margin Ex-Regulatory Credits 15%

- Free cash Flow $146 million vs $664 million in Q1 and down 89% YoY from $1.34 billion in Q2 2024, and missing estimates of $760 million

Here is the financial summary for Q2:

And visually:

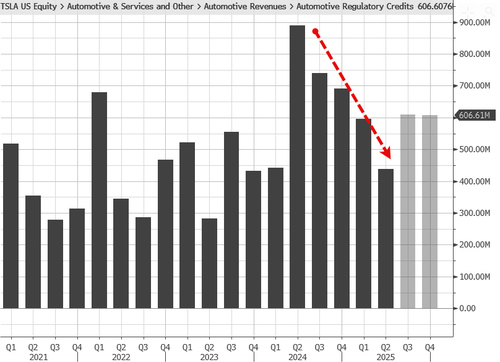

As has been the case in recent quarters, both revenue and profitability were hit by lower regulatory credit revenue. Tesla still recognized $439 million of automotive regulatory credits in the second quarter, down from $595 million in the first quarter and down from $890 million a year ago.

While the information was already reported previously, deliveries fell across models, but the hardest hit category was the one that includes the Tesla Cybertruck. Deliveries of Model 3 and Y cars dropped 12% from a year ago, compared to a 52% plunge for other models.

One bright spot is a 17% jump in “Services and Other Revenue” to $3.05 billion. Tesla attributed that, in part, to more revenue from its industry-leading Supercharging network. It said it added more than 2,900 Supercharger stalls on a net basis, an 18% increase from a year ago.

As an aside, gross profit for the energy generation and storage division reached a record $846 million.

Tesla says that it continues to expand its vehicle offering, „including first builds of a more affordable model in June, with volume production planned for the second half of 2025.” Additionally, the company continued development of Semi and Cybercab, both slated for volume production in 2026.

Commenting on the quarter, TSLA said that „Q2 2025 was a seminal point in Tesla’s history: the beginning of our transition from leading the electric vehicle and renewable energy industries to also becoming a leader in AI, robotics and related services.” The company also noted that its first Robotaxi service launched in Austin in June and „while the service is limited in initial scope, we believe our approach to autonomy – a camera-only architecture with neural networks trained on data from our global fleet of millions of vehicles – allows us to continually improve safety, rapidly scale the network and improve profitability.„

The company also took a veiled swipe at President Trump’s whipsawing tariffs and economic policies, citing a “sustained uncertain macroeconomic environment resulting from shifting, unclear impacts from changes to fiscal policy and political sentiment.”

Turning to the cash flow statement, Tesla’s free cash flow moved into positive territory of $146M – the result of $2.4 billion in capex and $2.540 billion in operating income – but only because that $320M of “other income” saved the day. Also, Adjusted EBITDA of $3.4 billion got a $284 million boost thanks to $284 million gain in digital asset (aka bitcoin). Tesla’s slightly positive free cash flow is also owed to the company still underspending on capex relative to its full-year target of $10B. Hitting that will mean spending more than $3B in each of the next two quarters. It spent $2.4BN on capex in Q2 and $1.5BN in Q1.

Meanwhile over at the balance sheet, inventory rose slightly to 24 days, up from 22 days in 1Q. That’s the highest in several quarters.

Elsewhere, Gigafactory Shanghai remains the company’s main export hub and delivered record volumes in South Korea, Malaysia, the Philippines and Singapore. In the US, the company says its lithium refining and cathode production plants remain on track to begin production in 2025 and are set to begin domestic production of its first LFP cells for energy storage later this year.

The Outlook section of Tesla’s earnings deck is little changed from the previous quarter: “Our purpose-built Robotaxi product – Cybercab – will continue to pursue a revolutionary “unboxed” manufacturing strategy and is scheduled for volume production starting in 2026.” Here are all the aspects of the outlook:

- Volume: It is difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains, our cost structure and demand for durable goods and related services. While we are making prudent investments that will set up both our vehicle and energy businesses for growth, the actual results will depend on a variety of factors, including the broader macroeconomic environment, the rate of acceleration of our autonomy efforts and production ramp at our factories.

- Cash: We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period.

- Profit: While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software and fleet-based profits.

- Product: Our focus remains on prudently growing our vehicle volumes in a capex efficient manner by using our existing vehicle production capacity before building new lines. Plans for new vehicles that will launch in 2025 remain on track, including initial production of a more affordable model in 1H25. Our purpose-built Robotaxi product – Cybercab – will continue to pursue a revolutionary “unboxed” manufacturing strategy and is scheduled for volume production starting in 2026.

What is odd is that previously Tesla said it would „revisit our 2025 guidance” in our 2Q update, but there does not appear to be any guidance around volume in this shareholder deck. Maybe something for management to mention on the call.

Something interesting disclosed in the report is that Tesla’s customer service operation hasn’t been able to keep up with the size of the fleet, and now AI agents are being integrated into the operation:

“As we continue redefining the vehicle buying and ownership experience, we have integrated AI agents to help resolve customer queries, reduce wait times for service and even provide assistance when placing an order for accessories, parts and products without having to wait for a person. We are leveraging this same technology in our service technician workflow to help improve turnaround times for service.”

Page 12 of the shareholder deck shows the “Tesla Ecosystem,” which includes Optimus, pushing a baby stroller.

Commenting on the results, Vital Knowledge founder Adam Crisafulli writes that „Tesla earnings are always impossible to analyze because the debate isn’t ‘how did they perform fundamentally?’ but instead ‘what does the company do?’. If one thinks Tesla is at its core just an auto business, then the results were poor, and the stock is grossly overvalued. If one thinks Tesla is an AI/robotics juggernaut, then you will probably feel the same about its prospects after the Q2 release as you did before.”

And another reaction from a money manager, Dec Mullarkey at SLC Management: „There were no blockbuster twists in the earning’s release. It all comes down to execution. When will production ramp up on its cheaper model, and when will Cybercabs start to roam the streets.”

Following the earnings report, the stock first moved higher, then lower, and was flat at last check, which is why Bloomberg notes that „if it seems like the adrenaline rush typically associated with Tesla earnings is missing, you’re right: Tesla shares are currently down 0.2% in postmarket trading. If this move holds through regular trading tomorrow, that would be the smallest post-earnings move in either direction since September 2020.”

The full TSLA slidedeck is below (pdf link)

Tyler Durden

Wed, 07/23/2025 – 16:54

4 miesięcy temu

4 miesięcy temu