Stocks & Bonds Slammed After Q1 Employment Costs Rise More Than Highest Forecast

Highlighting just how sensitive the market is to any 'inflation/deflation’ narrative questions, the Q1 Employment Cost Index (ECI) – a data point that is typically of secondary import – printed hotter than expected this morning and sent markets reeling.

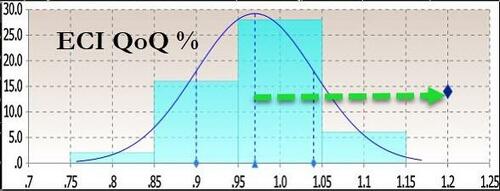

The ECI rose from +0.9% QoQ in Q4 to +1.2% QoQ in Q1 (well above the +1.0% QoQ expected). That is the biggest QoQ jump in a year…

That was higher than the highest forecast…

Which leaves the civilian worker ECI up 4.2% YoY, stalling the disinflationary path it had been on…

And guess who is to blame for the rise in employment costs! The Government, where compensation is up 4.8% YoY (re-accelerating back near its fastest in history)…

In other words, persistent wage pressures are keeping inflation elevated.

This sent stocks tumbling lower…

…and Treasury yields higher…

Just add this data point to the 'the disinflation narrative is dead’ side of the ledger.

Tyler Durden

Tue, 04/30/2024 – 08:43

2 tygodni temu

2 tygodni temu