Solid 2Y Auction Stop Through Despite Weak Foreign Demand

With attention firmly on the equity meltup which has sent the S&P 1% higher and the Nasdaq looks like it will close in record territory, moments ago we had the week’s first Treasury coupon auction when some $69BN in 2 Year notes were sold to what was a very smooth reception.

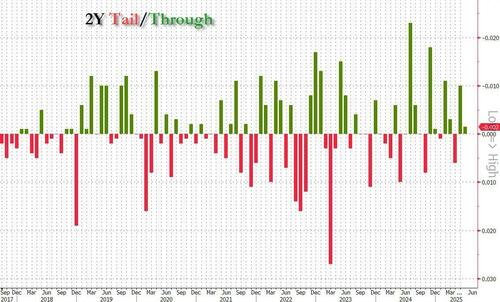

The high yield of 3.786% was down from 3.955% in May and the lowest since Sept 2024. It also stopped through the When Issued 3.787% by 0.1bps, which was the 4th through auction in the past five for the tenor.

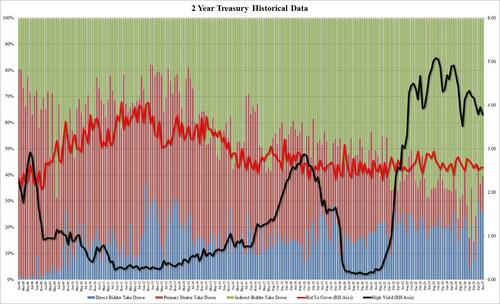

The bid to cover was 2.576, effectively unchanged from 2.567 last month, if just below the six-auction average of 2.61.

Internals were slightly weaker, with Indirects awarded 60.5%, down from 63.3% in May and clearly below the recent average of 71.3%. And with Directs taking down 26.3%, or flat from last month’s 26.2%, Dealers were left with 13.2%, higher than last month’s 10.5% and the 11.2% recent average.

Overall, this was a solid auction, which is to be expected on the back of dovish Fed speak in recent days and even though Powell tried to keep a hawkish facade today, he too hinted that rate cuts are coming, especially now that oil is once again tumbling and does not threaten to push gas prices sharply higher. As for the market reaction, there was none indicating that the auction was largely as expected.

Tyler Durden

Tue, 06/24/2025 – 13:19

5 miesięcy temu

5 miesięcy temu