Silver As A Hedge Against Market Chaos

Authored by Adam Sharp via DailyReckoning.co,

Headlines blamed yesterday’s crash on Trump. It’s the tariffs!

But I have a much simpler explanation: U.S. stocks have never been so overvalued. With stocks trading at nosebleed valuations, almost anything could catalyze a crash.

Sure, tariffs played a role, but the underlying problem is the bubble itself. American stocks are priced for perfection, so anything less than that is bound to disappoint.

If this is the beginning of a new bear market, gold and silver offer an excellent place to hide out, and even make some gains as the market falls apart.

Gold and Silver Shine

During bear markets in stocks, gold and silver almost always outperform.

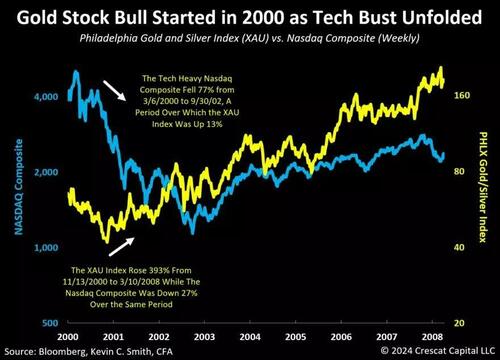

Take a look at the chart below, which shows how gold and silver miners performed compared to the Nasdaq Composite index from 2000-2008. Gold and silver miners are yellow, and the Nasdaq is blue.

Source: Crescat Capital

As you can see, as the Nasdaq fell 77% from 3/6/2000 to 9/30/2002, the XAU gold miner index was up 13% over the same period.

Over a longer stretch, from Nov 2000 to March of 2008, XAU rose 393% while the Nasdaq Composite fell 27%. As tech fell apart, gold and silver offered relief from the pain.

After bubbles pop, investors tend to rotate into precious metals and other hard assets. Part of the reason is that the Federal Reserve and other central banks tend to start printing a lot of money as stocks crash, in an attempt to save the market. But it’s also a cyclical thing, as I pointed out in The Gold Bull Cycle Has Just Begun.

Our situation today is not dissimilar to the 2000 internet bubble. We have stocks that are even more expensive, driven higher by tech breakthroughs which haven’t yet produced significant value in the real economy.

Don’t get me wrong, AI is going to change the world Just like the internet did. But that doesn’t mean stocks will continue to rise indefinitely.

Just like the period following the 2000 tech bubble bursting, I expect gold and silver will outperform by a large margin over coming years.

Eyeing Silver Miners

I own both gold and silver, and miners of both types, but lately I’ve been focusing more on the silver half of the equation. The reason is simple: I believe it has more upside.

As I write this near noon on Tuesday March 11th, silver is up about 2% on the day. And miners are up sharply, with the largest silver miner ETF (SIL) up 3.5%.

Meanwhile the largest junior silver miner ETF (SILJ) is up 4.9%.

If silver can break above the $35/oz range with force, I think we’re on our way to $50 and beyond. In the near future I’ll write an article dedicated to explaining my bull case more fully.

For now, my point is that this could be the start of a rotation from tech into precious metal miners. The stock pullback is spooking investors, and they’re desperately searching for alpha.

Precious metals look extremely attractive after a day like yesterday. Eventually investors will catch on to this fact, and even a small rotation from tech into metals will produce explosive results.

I don’t claim to know the future. But the risk/reward for precious metals here is outstanding. Especially compared to the overvalued stock market.

I sleep a lot better knowing 15% of my portfolio is in gold and silver investments.

Tyler Durden

Wed, 03/12/2025 – 12:05

6 miesięcy temu

6 miesięcy temu

![Nikt nie jest w pełni bezpieczny. Dramatyczne wnioski z najnowszego raportu [06.10.2025]](https://static.warszawawpigulce.pl/wp-content/uploads/2025/06/UwagaPolska-1.jpg)