Nvidia & NikiLeaks Spark Surge In Stocks, Gold, & Crypto This Week

An event-full week (US CPI, US PPI, Presidential debate, ECB rate decision, and WSJ Fed whispers) left stocks, bonds, gold, crypto, and crude all higher in price, while the dollar was clubbed like a baby seal.

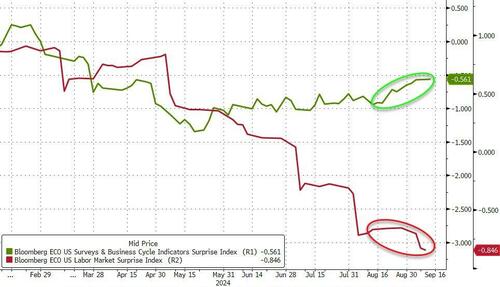

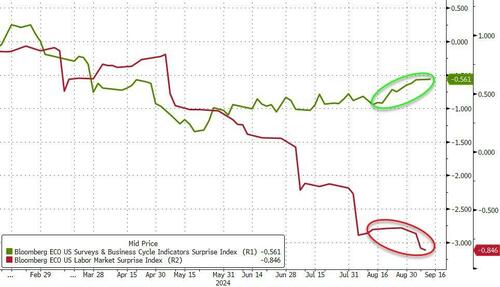

Soft survey data continues to rebound higher (full of hope) while hard data – most notably labor market-related – has been significantly lagging expectations…

Source: Bloomberg

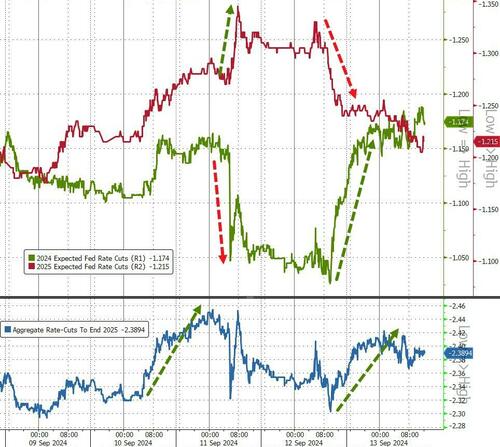

…which, along with comments from The Wall Street Journal’s Fed-Whisperer (NikiLeaks) on discussions about a 50bps cut next week, sent rate-cut expectations higher on the week (despite plenty of chop around the hotter-than-expected core CPI print)…

Source: Bloomberg

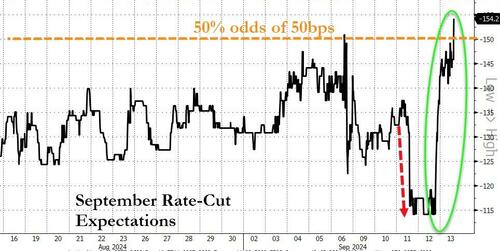

…and shifted the market’s expectations for a 50bps cut next week above 50%…

Source: Bloomberg

Treasury yields were all lower on the week, led by the short-end…

Source: Bloomberg

…but despite bonds being bid, US stocks snapped aggressively higher midweek (after NVDA CEO Jensen Huang said „demand was incredible” and the algos went wild) and extended that sudden squeeze into Friday (with Small Caps and Nasdaq leading). Nasdaq was up just under 6% this week – its best week since the Powell Pivot at the start of Nov 2023…

Small Caps soared 2.5% today as desk chatter was that we saw corporates scrambling to execute permitted buybacks before the blackout period begins (55% of SPX will be in a closed window by Monday)…

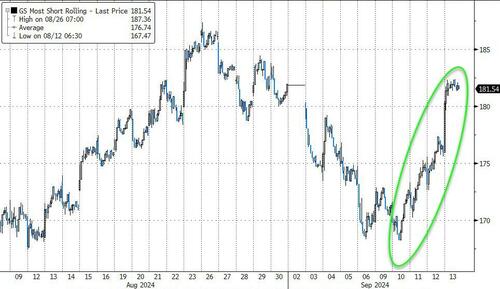

…as „Most Shorted” stocks soared all week…

Source: Bloomberg

…and Mag7 stocks were up 5 days in a row (soaring to their best week since March 2023)…

Source: Bloomberg

This week was not just AI stocks but the second-derivatives trades (like powering AI). Goldman’s Power-Up-America basket soared to its best week in the last two years…

Source: Bloomberg

Best on the week (rising tide lifts all boats): Bitcoin Sensitives, Most Short, Biotech, Momentum, Mag7… all up north +7%

Worst on the week: China ADRs, Nat Gas, Defense… unch to down small

Stocks notably decoupled from bonds this week…

Source: Bloomberg

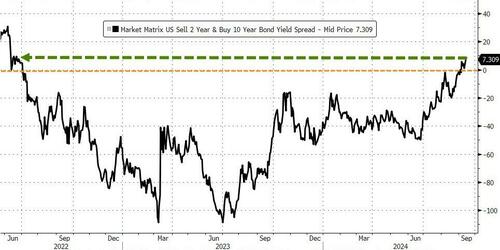

…as the Treasury curve (2s10s) steepened back into dis-inversion and its steepest since June 2022…

Source: Bloomberg

The dollar was slammed lower after the WSJ comments yesterday (its sixth down week in the last seven weeks), but remains in a relatively narrow band for the last four weeks…

Source: Bloomberg

The dollar’s weakness helped lift gold, which surged to a new record high with its best week in five months…

Source: Bloomberg

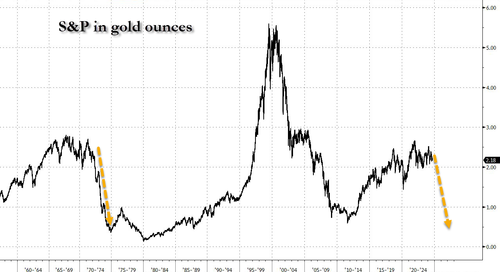

…and while we are on the topic of gold, would it be crazy this happened all over again?

Source: Bloomberg

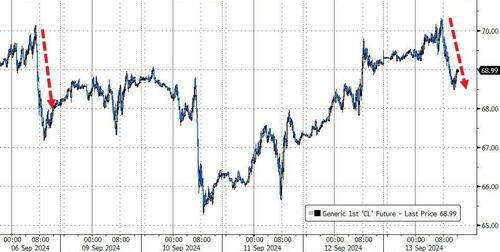

Oil prices ended the week higher (despite today’s pullback) but WTI remains below $70…

Source: Bloomberg

Which, along with the broad commodity space, is the only aspect of the markets that comes close to pricing in the 230bps of cuts priced into FF futures (a hard landing!!!)…

Source: Bloomberg

Finally, bitcoin surged to its best week in two months, testing back up to $60,000 today…

Source: Bloomberg

…as perhaps the lagged impact of the surge in global liquidity (money supply) is about to send it to the moon…

Source: Bloomberg

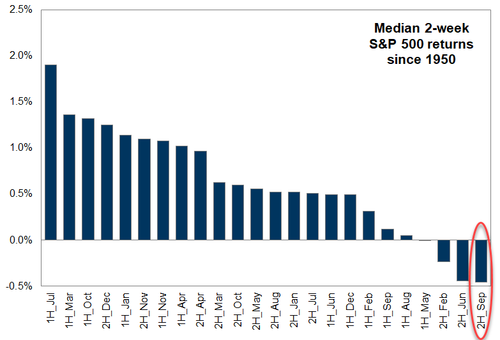

Gold and stocks are already there… and don’t forget – after Nasdaq’s best week since the Powell Pivot, we are entering the market’s worst two-week period of the year…

Will Powell let the market down?

Tyler Durden

Fri, 09/13/2024 – 16:00

1 rok temu

1 rok temu