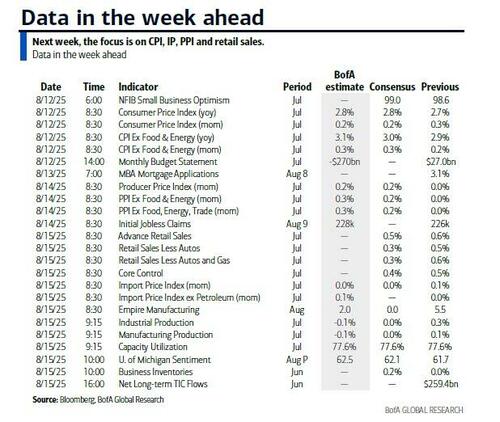

Key Events This Week: CPI, PPI Retail Sales, Trump-Putin Summit

As we move into mid-August, markets are bracing for a surprisingly busy week, with several key events and data releases likely to shape sentiment; of these, the most closely watched will be tomorrow’s US CPI report, which after the last week of July which had both the jobs report and the Fed meeting, could prove to be one of the larger events of the summer for markets, according to Deutsche Bank’s Peter Sidorov.

And as DB’s Jim Reid notes, also on the radar is Friday’s high-stakes meeting between Donald Trump and Vladimir Putin in Alaska as the US has pushed for a ceasefire in Ukraine. Last Friday Trump said a deal would involve “some swapping of territories” with reports suggesting that it would see Ukraine ceding Russia the parts of Donbas that it still controls. Ukraine’s President Zelenskiy was quick to reject the idea and European leaders have called for any peace talks with Russia to include Kyiv. Bloomberg reported yesterday that European leaders are seeking to speak with Trump before his meeting with Putin.

Elsewhere, tomorrow marks the deadline for the pause in levies between the US and China, and markets will be watching closely to see whether the truce is extended. There are also expectations that the long awaited pharmaceutical and semiconductor sector tariffs will be announced by the US.

Beyond geopolitics, the economic calendar is busy even beyond the CPI release. In the US, we’ll also get PPI data on Thursday, retail sales figures that may show a boost from Amazon’s extended four-day Prime Day event (up from two days previously), and industrial production numbers on Friday.

Internationally, Japan’s PPI is due Wednesday, while China’s monthly data dump arrives Friday. Tomorrow also brings Germany’s ZEW survey and UK labor market statistics, followed by Q2 GDP releases for the UK on Wednesday and Japan on Friday.

Central banks will also be in focus. Australia announces its rate decision tomorrow, with Deutsche Bank expecting a cut, while Norway follows on Thursday, after CPI releases today from both Denmark and Norway.

Turning to tomorrow’s US CPI, DB economists expect a 2.4% decline in seasonally adjusted gas prices to weigh on the headline figure, forecasting a +0.24% monthly increase versus +0.29% previously. In contrast, core CPI is expected to rise +0.32%, up from +0.23%. This would push year-over-year growth rates for headline and core CPI up by a tenth to 2.8% and 3.0%, respectively, with a risk that core rounds up to 3.1%.

Shorter-term trends for core inflation are expected to be mixed. The three-month annualized rate is projected to rise three-tenths to 2.7%, while the six-month rate is seen falling by the same amount to 2.4%. DB Economists also anticipate a notable increase in core goods categories (+0.42% vs. +0.20%), which are already showing signs of tariff-related price pressures. This impact is expected to extend to vehicle prices as well. It’s worth recalling that last month’s headline CPI appeared soft, but rates still sold off as the underlying details revealed growing evidence of tariff-driven inflation.

Thursday’s PPI report is expected to show a +0.2% increase for both headline and core, with attention focused on categories feeding into core PCE. Deutsche Bank is currently tracking a +0.31% increase for July’s core PCE, which would lift the year-over-year rate to 2.9%, with rounding risks toward 3.0%.

Fed commentary will also be in the spotlight: Richmond Fed President Thomas Barkin (non-voter) speaks tomorrow following the CPI release. On Wednesday, Chicago’s Austan Goolsbee (voter) and Atlanta’s Raphael Bostic (non-voter) will share their views. Bostic recently reiterated his expectation for one rate cut this year, despite increased risks to the labour market outlook following the July employment report. Markets are likely to pay closer attention to Goolsbee, given his voting status at the upcoming September 17 FOMC meeting and his previous concerns about the inflationary impact of tariffs.

Rounding out the week, corporate earnings in the US will feature Cisco, Applied Materials, Deere and CoreWeave. In China, investors will be watching results from Tencent, JD.com and Lenovo.

Courtesy of DB, here is a day by day list of key events

Monday August 11

- Data: Italy June trade balance, Denmark and Norway July CPI

- Earnings: Barrick Mining, AST SpaceMobile

Tuesday August 12

- Data: US July CPI, NFIB small business optimism, federal budget balance, UK June average weekly earnings, unemployment rate, July jobless claims change, Japan July M2, M3, Germany August Zew survey, June current account balance, Eurozone August Zew survey, Canada June building permits

- Central banks: Fed’s Barkin speaks, RBA decision

- Earnings: CoreWeave, Circle Internet Group, On Holding, Cava

Wednesday August 13

- Data: Japan July PPI, machine tool orders, Germany July wholesale price index

- Central banks: Fed’s Barkin, Goolsbee and Bostic speak

- Earnings: Tencent, Cisco, E.ON, Venture Global, Straumann, Vestas, Coherent, Lenovo

Thursday August 14

- Data: US July PPI, initial jobless claims, UK Q2 GDP, July RICS house price balance, Italy June general government debt, Eurozone June industrial production, Q2 employment, Australia July labour force survey

- Central banks: Fed’s Barkin speaks, Norges bank decision

- Earnings: Applied Materials, Deere, Adyen, JD.com, Tapestry

Friday August 15

- Data: US July retail sales, industrial production, capacity utilisation, import price index, export price index, August University of Michigan survey, Empire manufacturing index, June business inventories, total net TIC flows, China July retail sales, industrial production, home prices, property investment, Japan Q2 GDP, June capacity utilisation, Canada July existing home sales, June manufacturing sales

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and the University of Michigan reports on Friday. There are a few speaking engagements by Fed officials this week.

Monday, August 11

- There are no major economic data releases scheduled.

Tuesday, August 12

- 06:00 AM NFIB small business optimism, July (consensus 99.0, last 98.6)

- 08:30 AM CPI (MoM), July (GS +0.27%, consensus +0.2%, last +0.3%); Core CPI (MoM), July (GS +0.33%, consensus +0.3%, last +0.2%); CPI (YoY), July (GS +2.80%, consensus +2.8%, last +2.67%); Core CPI (YoY), July (GS +3.08%, consensus +3.0%, last +2.93%): We estimate a 0.33% increase in July core CPI (month-over-month SA), which would raise the year-over-year rate by 0.2pp to 3.1%. Our forecast reflects a rebound in used car prices (+0.75%) reflecting an increase in auction prices, a decline in new car prices (-0.2%), and a decline in the car insurance category (-0.1%) based on premiums in our online dataset. We forecast an increase in airfares in July (+2%) but see two-sided risk to the component, reflecting a headwind from seasonal distortions but a larger increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.12pp on core inflation in addition to the 0.02pp boost from autos inflation, and a 0.01pp drag from this year’s longer-than-usual Amazon Prime Day. We expect the shelter components to be roughly unchanged on net (primary rent +0.25%; OER +0.26%). We estimate a 0.27% rise in headline CPI, reflecting higher food prices (+0.3%) but lower energy prices (-0.6%). Our forecast is consistent with a 0.31% increase in core PCE in July. We will update our core PCE forecast after the CPI is released.

- 10:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will speak at the Health Management Academy in Chicago. Speech text and audience Q&A are expected. On July 15th, Barkin noted that it is still uncertain how much of the tariffs firms could pass along, as consumers may not be able to absorb more price increases.

- 10:30 AM Kansas City Fed President Schmid (FOMC voter) speaks: Kansas City Fed President Jeff Schmid will speak at the Southern Economic Development Council Annual Conference in Oklahoma City. Speech text and audience Q&A are expected. On June 24th, Schmid noted that “with all this uncertainty, the current posture of monetary policy, which has been characterized as ‘wait-and-see’, is appropriate.” He added that “the resilience of the economy gives us the time to observe how prices and the economy develop.”

Wednesday, August 13

- There are no major economic data releases scheduled.

- 08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will repeat the August 12th remarks at the Greenville Chamber of Commerce in Greenville, South Carolina. Speech text and audience Q&A are expected.

- 01:00 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will speak at the monetary policy luncheon hosted by the Greater Springfield Chamber of Commerce. Q&A is expected. On July 11th, Goolsbee noted that “new tariff threats could delay rate cuts” and justify the Fed’s ‘wait-and-see’ approach.

- 01:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will deliver a speech on the economic outlook at the luncheon hosted by the Atlanta Fed and the Franklin County Economic Development Authority. Moderated and audience Q&A is expected. On August 7th, Bostic said that there are reasons to be “somewhat skeptical” that the inflationary effects from tariffs will be temporary. He also noted that, while the last jobs report was a surprise, the fundamentals in the economy are still “quite solid” and that he still expects one rate cut this year.

Thursday, August 14

- 08:30 AM PPI final demand, July (GS +0.1%, consensus +0.2%, last flat); PPI ex-food and energy, July (GS +0.1%, consensus +0.2%, last flat); PPI ex-food, energy, and trade, July (GS +0.2%, consensus +0.3%, last flat)

- 08:30 AM Initial jobless claims, week ended August 9 (GS 231k, consensus 226k, last 226k): Continuing jobless claims, week ended August 2 (consensus 1,964k, last 1,974k)

- 02:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will participate in a webinar conversation with NABE President Emily Kolinski. Moderated Q&A is expected.

Friday, August 15

- 08:30 AM Retail sales, July (GS +0.5%, consensus +0.5%, last +0.6%); Retail sales ex-auto, July (GS +0.3%, consensus +0.3%, last +0.5%); Retail sales ex-auto & gas, July (GS +0.3%, consensus +0.3%, last +0.6%); Core retail sales, July (GS +0.4%, consensus +0.4%, last +0.5%): We estimate core retail sales increased 0.4% in July (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects strong measures of card spending but a headwind from potential seasonal distortions. We estimate headline retail sales increased 0.5%, reflecting an increase in auto sales but lower gasoline prices.

- 08:30 AM Import price index, July (consensus +0.1%, last +0.1%)

- 08:30 AM Empire State manufacturing survey, August (consensus flat, last 5.5)

- 09:15 AM Industrial production, July (GS -0.1%, consensus flat, last +0.3%); Manufacturing production, July (GS -0.1%, consensus flat, last +0.1%); Capacity utilization, July (GS 77.5%, consensus 77.6%, last 77.6%): We estimate industrial production declined by 0.1% in July, as slight increases in natural gas and electricity production were outweighed by weak auto production. We estimate capacity utilization edged down to 77.5%.

- 10:00 AM Business inventories, June (consensus +0.2%, last flat)

- 10:00 AM University of Michigan consumer sentiment, August preliminary (GS 62.0, consensus 62.0, last 61.7): University of Michigan 5-10-year inflation expectations, August preliminary (GS 3.4%, consensus 3.3%, last 3.4%)

Source: DB, Goldman

Tyler Durden

Mon, 08/11/2025 – 11:25

4 miesięcy temu

4 miesięcy temu