Japanese Carmakers Face Catastrophic Profit Hit From Trump’s Auto Tariffs

As the fallout from Trump’s tariff plans comes into relief, a harsh truth is emerging for the automotive industry: there are lots of losers and not many winners. But foreign automakers, those without US facilities, will be hit especially hard.

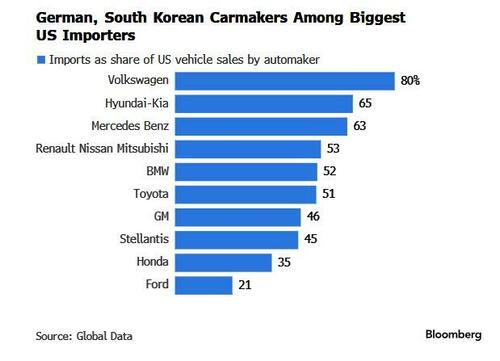

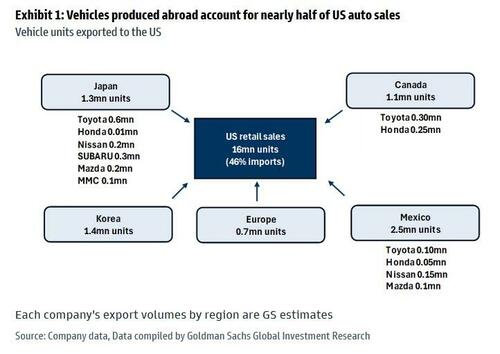

As Bloomberg notes, from South Korea’s Hyundai to Germany’s Volkswagen, and to a lesser extent America’s own General Motors, many of the world’s most prominent carmakers will soon face higher costs from Trump’s new levies on auto imports and key components. That’s because about 46% of all new cars sold in the US are imported.

“There are very few winners,” Sam Fiorani, vice president of global vehicle forecasting for AutoForecast Solutions, said in a phone interview. “Consumers will be losers because they will have reduced choice and higher prices.”

One notable winner in the tariff chaos is Elon Musk. His Tesla, which has large factories in California and Texas, churns out all the electric vehicles it sells in the US, although as Elon noted late on Wednesday, the company will also not remain unscathed.

Important to note that Tesla is NOT unscathed here. The tariff impact on Tesla is still significant.

— Elon Musk (@elonmusk) March 27, 2025

Ford could also face a less-severe impact than some rivals, with about 80% of the cars it sells in the US being built domestically.

Others will be less lucky: starting April 2, the new 25% tariffs will apply to all imported passenger vehicles and light trucks, as well as key parts like engines, transmissions.

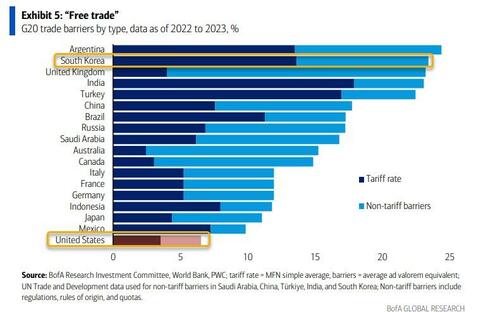

Not surprisingly, the tariffs give automakers that heavily source parts in the US an edge, and Trump also allowed an exemption: the new levies will only apply to the non-US share of vehicles and parts imported under a free-trade agreement with Canada and Mexico. That may soften the blow for vehicles whose supply lines zig-zag across the continent.

Tariffs on parts from Canada and Mexico that comply with the trade deal also won’t take effect until the US sets up a process to collect those levies. The US neighbors could use that window to try to stave off full implementation, even if it’s a long shot.

And while NAFTA, pardon USMCA, nations will do everything in their power to be loopholed out, foreign brands heavily reliant on imported vehicles are fresh out of luck. South Korea’s auto giant Hyundai risks being among the hardest hit: although the carmaker and its affiliate Kia have plants in Alabama and Georgia, and just yesterday announced a $21 billion US expansion plan, it imported more than a million vehicles to the US last year, accounting for more than half of its sales in the country, according to figures from Global Data.

Hyundai “remains committed to the long-term growth of the US automotive industry through localized production and innovation,” the company said in a statement, noting it employs 570,000 people in the US. Unfortunately, according to Trump, it should employ many more, and if the company – which imports almost 60% of the cars it sells in the US – wishes to avoid tariffs, it will have to not only hire more American workers, but build many more US plants. Oh, and this is just the beginning: once the reciprocal tariffs kick in next week, South Korean exporters will find themselves in a world of pain.

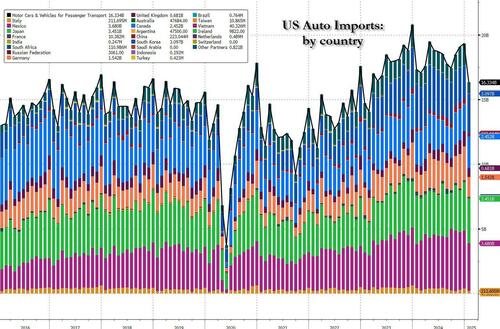

What about Japan? Let’s take a closer look at the country which historically has been the biggest global auto maker, and which produces 1.3 million (and another 0.4 million tolled in Mexico) of the 16 million annual car sales (Toyota 0.6mn, Subaru 0.3mn, Nissan 0.2mn, Mazda 0.2mn, MMC 0.1mn, Honda 0.01mn). For Japan, autos account for >30% of Japan’s exports to the US, which imports about 46% of all autos sold each year.

Based on an average sales price of US$45,000, the value of imports would exceed US$330 billion, and US import tariffs could have a major impact on sales prices and auto demand. All else equal, they would raise about $100 billion in annual tax revenues. But all else will certainly not be equal, especially once exporting nations slide into recession, and their export industries are crippled.

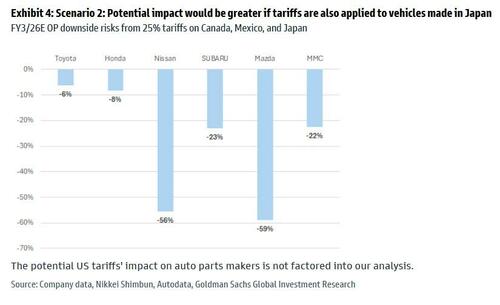

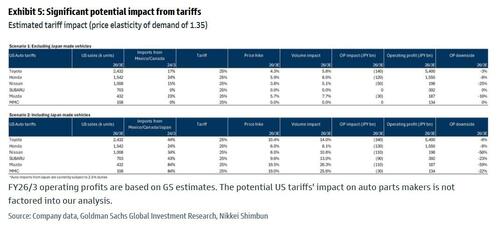

In an analysis published three weeks ago (report available to pro subs), Goldman looked at one scenario where Japanese cars are hit with 25% tariffs, along with imports from Mexico and Canada. The results were dire. According to Goldman analyst Kota Yuzawa, the potential impact on Japanese auto companies’ operating profit – assuming a tariff of 25% on Japan in line with that imposed on imports from Canada and Mexico – is shown below. In this scenario Goldman assumes that sales volumes decline as a result of price hikes made by each company in order to offset the negative impact of tariffs (volume decline of 8-26% based on a 25% price hike for Canada/Mexico/Japan-made vehicles). In that scenario the profit hit will be anywhere between 6% for Toyota to 59% for Mazda.

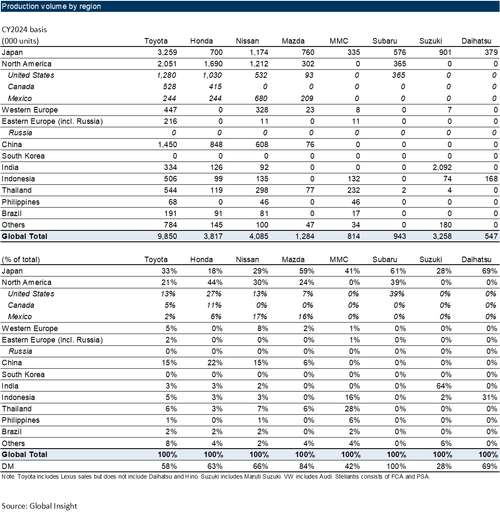

In terms of exposure, Yuzawa calculates that production volume in US is largest for Subaru (39%), Honda (27%), Toyota (13%), Nissan (13%), Mazda (7%).

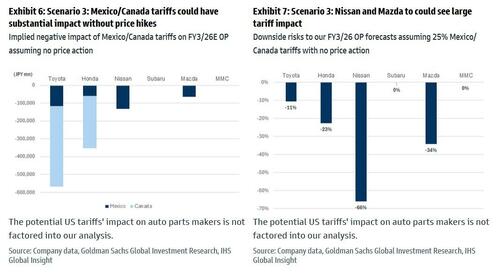

In another, far more draconian scenario, Japanese automakers are unable or simply refuse to hike prices to offset volume declines. The consequences are catastrophic and result in the following hit to operating profits: Toyota -¥570 bn, Honda -¥350 bn, Nissan -¥130 bn, and Mazda -¥60 bn. The implied impact on Goldman’s FY3/26 operating profit forecasts would be as follows: Toyota -11%, Honda -23%, Nissan -66%, and Mazda -34%, with Nissan and Mazda seeing relatively large impacts given their larger export mix from Canada/Mexico.

That’s just the start: in addition to the direct potential impact on finished vehicle exports described above, parts makers also have supply chains spanning multiple countries. Indeed, Toyota-affiliated companies that announced 3Q (October-December) results on January 31 referred to tariff risks. Denso’s sales from Mexico/Canada operations to the US total about ¥220 bn, while Aisin’s are about ¥60 bn. If a 25% tariff were also imposed on parts, Goldman warns forecasts potential profit declines of ¥55 bn/¥15 bn at Denso/Aisin. Toyota Boshoku did not disclose figures but noted a large potential impact, as much of its seat sewing is conducted in Mexico. Parts makers are working to pass on higher costs to automakers. Denso’s management expressed hope that tariff impact would be mitigated to some extent by the possibility of US corporate tax cuts and a weaker Mexican peso.

Ultimately, Goldman’s Yuzawa expects price increases to spread across the US auto industry, and after several years of pain, tariffed exports will find some parity with domestic producers: “Automobiles are essential goods, however, and in the longer term we expect demand for them to recover and the negative impact of tariffs on volume to gradually diminish as production of US-made models and procurement of US-made parts increases. In addition, the used car market is also robust. Higher new car prices are likely to lead to higher used car prices, which could also boost vehicle purchasing power through higher residual values. Our economists estimate price elasticity of demand at 1.2-1.5 in the short term and 0.2 in the medium term, and we use the midpoint of 1.35 in our scenario analysis in this report.”

The problem is what happens until the equilibrium point is reached over several years, and how painful will the looming Japanese recession be, because make no mistake: Japan is now almost certainly facing a recession: Takahide Kiuchi, executive economist at Nomura Research Institute (NRI), expects an 25% increase in U.S. auto tariffs to push down Japan’s GDP by at least 0.2%.

„The Trump tariff has the potential to immediately push Japan’s economy into deterioration,” he said.

But what is worst of all for Japan is that the so-called virtuous wage-price cycle in which the perenially deflating nation managed to find itself, is now also doomed. That’s because the auto industry has been the driver of recent wage hikes according to Reuters, as automakers distribute the huge profits they reaped overseas to their employees. Starting April 2, kiss those profits goodbye… and if Japanese automakers want to avoid plummeting stock prices, or worse, bankruptcy, what they will immediately do is announce that any future wage increases have been put on hold and, just as likely, are about to hit reverse.

Not surprisingly, Japan’s government has expressed serious concern over the potential fallout from newly announced US tariffs, warning of risks to both bilateral economic ties and global trade stability.

Chief Cabinet Secretary Yoshimasa Hayashi said on Thursday that Tokyo is closely monitoring the situation following Trump’s announcement of additional tariffs. Speaking at a press briefing, Hayashi cautioned that the broad-based nature of the U.S. trade measures could have far-reaching consequences.

“We believe that the current measures and other broad-based trade restrictions by the U.S. government could have a significant impact on the economic relationship between Japan and the U.S., as well as on the global economy and the multilateral trading system,” he said.

If only there was anything Japan could do to retaliate.

As forexlive notes, one thing Hayashi didn’t mention was that the new tariffs are likely to trim back the prospect of a May rate hike from the Bank of Japan, echoing what we said, namely that „these new tariffs will hit Japan’s auto industry hard, and thus economic data.”

More in the full Goldman note „Scenario analysis on US tariffs on Mexico/Canada for Japanese automakers” available to pro subs.

Tyler Durden

Thu, 03/27/2025 – 00:12

8 miesięcy temu

8 miesięcy temu