Is Trump Trying To Push The US Into A Recession?

One month ago, when we first realized just how much fat Elon Musk’s DOGE was slashing from the government money-laundering apparatus, we made a controversial (at the time) observation: so much (deep state laundered) money was about to come out of the economy, the US would enter a recession, first in Washington DC (something which Michael Hartnett and others have since confirmed) and then across the US.

Here’s the bigger play at hand, and why there is only token pushback to DOGE.

You cut enough spending – even if it’s all grift and fraud – you eventually get a recession, guaranteed. That’s all Congress is waiting for cause then they use the „emergency” to vote through a far…

— zerohedge (@zerohedge) February 8, 2025

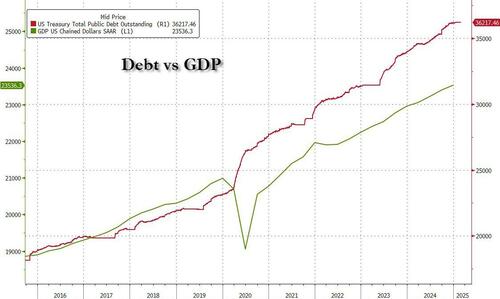

We were surprised at how much pushback we got, especially from supporters of Trump. But this wasn’t meant to be a judgment call against the new administration which had only been in power for a few weeks. If anything, we had explained long ago that the only reason the US economy hadn’t collapsed into a recession long ago is because of Biden’s unprecedented debt issuance spree which we first described in the summer of 2003 (see „Here Is The $1 Trillion „Stealth Stimulus” Behind Bidenomics”), and which had sent US debt soaring by $1 trillion every 100 days.

But now that particular debt party appears to be ending.

Understandably, defusing this debt time-bomb is precisely what Elon Musk has undertaken, and the process of undoing all the catastrophic trends that culminated under the Biden administration would inevitably result in a recession (just as allowing the debt pile up to continue its record meltup was the only thing that delayed the inevitable economic slowdown).

Still, our observation came at a time when the „US exceptionalism” trade was still all the rage if only for a few more days, and thus few were willing to accept it.

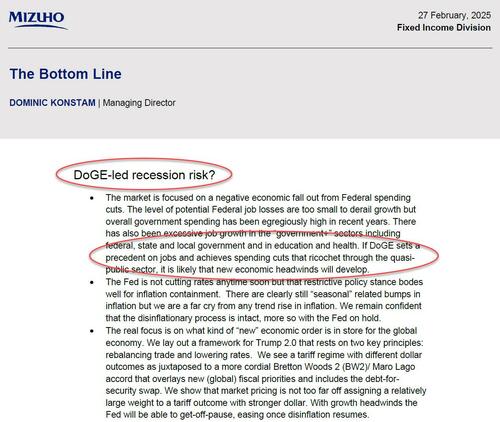

Then little by little sentiment turned, and just a few weeks later, Wall Street was full of reports such as this one from Mizuho’s Dominik Konstam (available to pro subs)”discovering” what we had said weeks earlier, namely that the efforts of DOGE would spark a new recession, first in the government and then everywhere else.

This was quickly followed by formerly euphorically bullish Wall Street firms such as Goldman (full report here)…

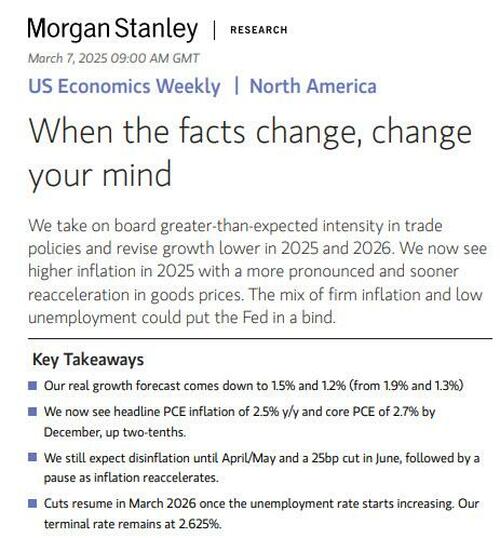

… and Morgan Stanley (full report here), both slashing their GDP outlooks.

So slowly but surely, Wall Street admitted we were right. But what about the administration: would Trump be surprised to learn that Musk’s austerity push plus the admin’s tariff policies would lead to a recession? We wondered and then we start paying closer attention to what Trump and his closest lieutenants were saying.

First, there was Trump’s Treasury Secretary Scott Bessent who (correctly) explained last week on Face the Nation how the media was misleading people that the economy was doing just great under Biden, and how the mood suddenly changed when Trump came in power. His point, of course, is that Trump has not been nowhere near long enough in power to slam the economy himself.

SEC. BESSENT: „What I find interesting is, for the past year & a half, & during the campaign, most of the media said, 'Oh, the economy is great. It’s just a vibecession.’ Now that President Trump’s in office, there’s an 'economic problem.'”

„It took 4 years to get us here.… pic.twitter.com/ubVwhjSCQA

— Breaking911 (@Breaking911) March 2, 2025

Some days later Bessent also explained why the economy had been doing so „great” during Biden’s last years – he basically echoed what we said two years ago in „Here Is The $1 Trillion „Stealth Stimulus” Behind Bidenomics”, in which we explained that the only reason the US economy hadn’t collapsed is because the government was issuing $1 trillion in debt every 100 days, or as Bessent put it, „the market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.”

Scott Bessent on Squawk Box:

“Look, there is going to be a natural adjustment as we move away from public spending to private spending. The market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.” pic.twitter.com/rFI0N4vylD

— DOGE NEWS- Department of Government Efficiency (@realdogeusa) March 8, 2025

That also explains why, to avoid a technical recession, Trump’s Commerce Secretary Howard Lutnick told Fox News the Trump admin was considering separating government spending from GDP reports, in response to questions – first posed here – about whether the spending cuts pushed by Elon Musk’s DOGE could possibly cause an economic downturn: „You know that governments historically have messed with GDP,” Lutnick said on Fox News Channel’s Sunday Morning Futures. “They count government spending as part of GDP. So I’m going to separate those two and make it transparent.”

Lutnick’s remarks echoed Musk’s arguments on X that government spending doesn’t create value for the economy: „A more accurate measure of GDP would exclude government spending,” Musk wrote on X. “Otherwise, you can scale GDP artificially high by spending money on things that don’t make people’s lives better.”

Lutnick’s take was a bit more nuanced but leaned in the same direction saying “if the government buys a tank, that’s GDP. But paying 1,000 people to think about buying a tank is not GDP. That is wasted inefficiency, wasted money. And cutting that, while it shows in GDP, we’re going to get rid of that.”

And then there was Trump himself who during his speech to Congress, issued the most explicit warning yet, saying to expect „a little disturbance” on tariffs, echoing what he said back in February when the president posted (in all caps) on his Truth Social account that „THIS WILL BE THE GOLDEN AGE OF AMERICA! WILL THERE BE SOME PAIN? YES, MAYBE (AND MAYBE NOT!)” adding “WE WILL MAKE AMERICA GREAT AGAIN, AND IT WILL ALL BE WORTH THE PRICE THAT MUST BE PAID.”

But the clearest indication that Trump is now eager to push the US economy into a recession – one which he can correctly blame on Biden’s drunken-sailor spending ways – and that the „Trump put” is now a „call”, came from the president himself when in another interview over the weekend with Maria Bartiromo, the president was oddly defensive, and saying “I hate to predict things like that,” when asked if he expected a recession this year. “There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing. And there are always periods of — it takes a little time. It takes a little time. But I think it should be great for us. I mean, I think it should be great.”

As for stocks, don’t expect Trump to jump in and seek a bailout: “There could be a little disruption. You can’t really watch the stock market. If you look at China, they have a 100-year perspective… we go by quarters. What we’re doing is building a foundation for the future.”

Bartiromo: Are you expecting a recession this year?

Trump: There is a period of transition because what we’re doing is very big. pic.twitter.com/VY8PozpVrk

— Acyn (@Acyn) March 9, 2025

And if that wasn’t clear enough, his Treasury Secretary Scott Bessent was about as explicit as possible predicting that the US is headed for a „detox period” and warning ”could we be seeing that this economy that we inherited starting to roll a bit? Sure.” He also ruled out policy shifts to prop up the market, confirming that at least for now, the Trump put is dead and buried.

BESSENT: “Look, there is going to be a natural adjustment as we move away from public spending to private spending. The market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.”

pic.twitter.com/tBWbQeo41E

— Election Wizard (@ElectionWiz) March 8, 2025

Commenting on these pre-recessionary soundbites, Goldman’s head of Delta One trading Rich Privorotsky said that „while commendable to attempt to address the long term imbalances of debt sustainability and spending (which accelerated during covid) it’s hard to see how these won’t have short term economic implications” effectively echoing what we said a month ago.

Rabobank was even more explicit when it said that „Trump hasn’t mentioned stocks so far, and the word from D.C. is their focus is on Main Street, not Wall Street, with willingness to tolerate “disturbance” for at least the next six to eight months, while blaming it on Biden, in order to get a framework in place that allows for growth based on what Trump thinks GDP is for…”

But it was perhaps Nomura’s Charlie McElligott who laid it out best saying the US is now underoing a clear „Phase Shift”, one which will be very painful (full note available to pro subs in the usual place):

DON’T JUST TAKE MY WORD FOR IT—THEY’RE TELLING YOU THE PLAYBOOK, AND THE “PHASE SHIFT” WILL BE THE PAINFUL PART AS WE “ENGINEER A RECESSION”:

Treasury Secretary Scott Bessent at the NY Economic Club yday going even harder on the “Public to Private” and “Wall St >> Main St” U.S. Growth- and Wealth Inequality- reset themes (among other high quality insights into everything from sanctions to the role of banks and regulation…but that’s for another time):

POTUS has begun an “…aggressive campaign to rebalance the international economic system.” (tariffs, duh…)

“Access to cheap goods in not the essence of the American Dream…The American Dream is rooted in the concept that any citizen can achieve prosperity, upward mobility, and economic security. For too long, the designers of multilateral trade deals have lost sight of this.” (inflation risks are just not a priority or are overstated, once we hit you with the growth drag)

And the big one on the RESET from Growth dependency upon Govt Deficit Spending, and refocusing into Private Sector stim (Taxes and Dereg): “The first time I went to see President Trump he looked at me and said ‘How do we get this debt and deficit down without killing the economy?’…I’ve been thinking about this for 18 months and [the way to do it is] the transition from a public sector to private sector [driven economy]…25 percent of GDP goes through [Washington DC] Area code 202.”

And further signal of intent from Bessent this a.m. on CNBC…like, can we make this any clearer, people?!:

- BESSENT: WE COULD SEE INHERITED ECONOMY STARTING TO ROLL A BIT

- BESSENT: THERE’S GOING TO BE A DE-TOX PERIOD FOR THE ECONOMY

- BESSENT: THERE’S NO TRUMP PUT, BUT THERE’S TRUMP CALL UPSIDE

The issue is this: When running this Govt “FISCAL CONTRACTION” and DOGE attack on awful “spending” which has been conditioned into both parties for decades in order to reduce Govt expenditures meaningfully (think flow over stock, change of change or impulse…not absolute levels)—but at the same time that global trade “rebalancing” means “Tariff Wars” with your largest trading partners—there is simply no way to maintain current real GDP growth, let alone move it higher in the near-term…i.e. it’s going LOWER

AND THAT’S THE POINT: They understand this “Phase Shift” means pain, and that’s with intent to do it FAST and EARLY into his term, because you need to remove the sources of excess economic stimulation through “FISCAL CONTRACTION,” which then simultaneously will act to drain real economic demand via “NEGATIVE WEALTH EFFECT,” as Markets acknowledge the lower growth implications

This intentional growth drag and negative wealth effect—the “ENGINEERING A RECESSION” thesis—will act as a DISINFLATIONARY IMPULSE which then facilitates the shift into Phase 2, which is where thanks to the disinflation, you can then finally act to stimulate the PRIVATE SECTOR through EASIER MONPOL via Fed Cuts to “reduce the cost of money”….and then further escalate into Tax Cuts and MASS Deregulation

Yet as the will be the case in our debt-addled existence, enabled by both the perpetual deficit spending Politicians and Central Bankers who crossed the precipice into the “Moral Hazard” zone of the “QE Trap”—we, societally, have an EXTREMELY LOW TOLERANCE FOR PAIN…

So can the voting public, politicians, and central bankers ride out this consequences of this well-intended “rebalancing act,” or will the tantrums for MOAR overwhelm and force a “bending of the knee” back to the unsustainable status-quo Govt deficit spending economic dependency?

It will come down to the speed by which the Trump Admin’s intentional “CONTROLLED DEMOLITION” double-whammy “Growth Drag” and “Negative Wealth Effect” can lead to disinflationary impulse which allows for the EASING thereafter…otherwise it seems that Market forces are happy to “find the clearing level” on the Trump Put, which remains still-deeper Out-of-the-Money in Equities

Putting it all together, the emerging picture is clear: what we said a month ago was spot on, and while perhaps not actively pushing the US into a recession, Trump and Bessent certainly would welcome it (especially with the midterm elections fast approaching), knowing they still have the benefit of a few months in which to blame the Biden regime and its staggering debt incurrence, which as we first explained had kept the economy afloat for so long…

First reported here last July, back than it was – drumroll – a conspiracy theory.

Here Is The $1 Trillion „Stealth Stimulus” Behind Bidenomicshttps://t.co/OqgQIgN6MR

— zerohedge (@zerohedge) April 14, 2024

…. and once the economy and markets have had their reset, most likely with the benefit of another huge fiscal stimulus from Congress which will have no choice but to step in once there is a recession, the economy and markets will levitate straight into the Nov 2026 midterms, which will cements the Republican grip on power even more, even if it means some – rather acute – pain in the immediate future.

Tyler Durden

Mon, 03/10/2025 – 09:45

5 miesięcy temu

5 miesięcy temu