Is The Fed Setting Up Trump To Be The Scapegoat?

Submitted by Shanmuganathan Nagasundaram,

In Greek mythology, Scylla and Charybdis are two mythical sea monsters guarding a narrow strait. Navigating the sail successfully would require not getting too close to one monster while trying to avoid the other. The job of the Federal Reserve has often been compared to (mistakenly, though) the above, wherein they have to navigate the economy on its dual mandate of maximum employment and price stability. The Phillips Curve is the most standard model that depicts this supposed inverse relationship between unemployment and price inflation.

Neo-Keynesian economics has broadened the interpretation of the Phillips curve from unemployment to include economic growth. So, the narrative is that if the economy is operating below potential in terms of GDP growth rate or employment, then the Federal Reserve would reduce the Fed Funds rate to stimulate the economy. If price inflation exceeds the 2% mandate, the Federal Reserve would raise the Fed Funds rate to dampen the price inflationary forces.

But what happens if the growth is below par or unemployment numbers are high, AND concurrently, price inflation numbers are high? Technically, the economic scenario is called “Stagflation”.

Just a year back, when Powell was quizzed about the possibilities, he quipped, “I don’t see the stag or the -flation, actually.”

A short twelve months later, that is precisely the situation in front of Powell.

How do the Keynesians explain “Stagflation”?

They don’t; they hope that it doesn’t occur during their tenures.

Paul Volcker was the last Fed Chairman who had to handle a similar situation, and even he would not want to step into the shoes of Powell today. The condition is much worse on a logarithmic scale. The solution though remains the same: dramatically hike interest rates. However, it cannot be implemented today, as it would collapse the system due to the substantial debt.

But let us step back a bit and examine the entire hypothesis of this employment-price inflation tradeoff.

At the outset, followers of Austrian Economics would know that this Phillips Curve and what it represents is almost as mythical as the sea monsters. It is the combination of Cantillon effects and the misrepresentation of price inflation that creates this illusion of trade-offs between employment and price stability.

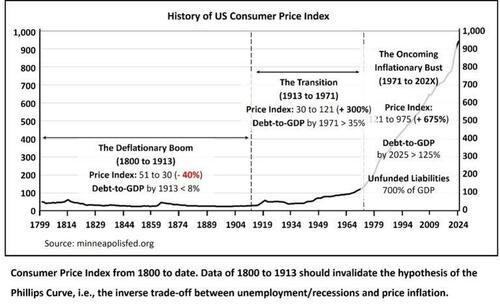

Examining the US price Index from the year 1800 to 1913 reveals a period of continuously falling prices. The price index was down by more than 40% by 1913, as compared to the starting year 1800. By some estimates, this fall in prices was even higher as the product basket was continuously becoming better and not even strictly comparable. Most major innovations we can think of – telephones, automobiles, airplanes, computers, mass production, modern medicine, military hardware, etc – happened during this period. The transition of the US from an erstwhile colony of the British Empire to the dominant superpower also occurred in this period. If falling prices had caused the Great Depression of 1929 to 1946, as is popularly believed, or as the Phillips curve implies, the entire 19th century (1801-1900) should have been an extended depression. Instead, what we actually witnessed was a boom of unparalleled proportions in modern history, except for what has happened in China starting in 1990 to date.

How does one reconcile the Phillips Curve, and indeed, Keynesian Economics, with the above? One simply cannot. So, what does all this have to do with today?

A note on the current stage, i.e., “The Oncoming Inflationary Bust,” would be in order before proceeding. The US Government has incurred unprecedented debt and liabilities since the 2008 GFC. The National debt is at $37 trillion and growing at $3+ trillion per year, while the unfunded liabilities are an additional $200+ trillion. If the Federal government were to pay its entire income towards servicing this debt (ignoring the interest part), it would take nearly 50 years to extinguish this debt. A sovereign credit rating of anything other than JUNK would be outright disregard for the fundamentals. The only way this debt is going to be resolved would be through a hyperinflationary meltdown of the economy. Barring a Milei-style presidency, that is the most probable outcome.

However, the mainstream media narrative even today is that Trump wants to lower interest rates to achieve even higher growth rates, from already what is the “best performing economy ever”. On the other hand, Powell intends to hold the rates steady to protect the purchasing power of the US Dollar. The economic truth is that both narratives are flawed.

-

Even a 0% rate today cannot prevent a bust of the financial systems that is floating on a sea of asset bubbles – an AI bubble that dwarfs the NASDAQ 2000 bubble; a housing bubble that is far bigger than the 2008 housing bubble; and a US bond bubble that is bigger than these two bubbles combined. The bust at this point is inevitable and imminent – the timeframes would be a few months and not a few years.

-

The current rate of 4.25% to 4.5% is way too low to contain price inflation meaningfully. The National debt is increasing at an even higher pace than before, and monetary inflation is a natural outcome, indicating that the rates are very accommodative.

Why Rate Cuts are Imminent

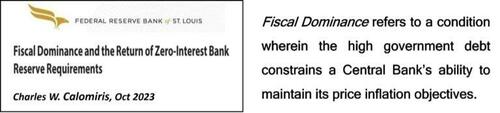

Whether Trump is aware of the above is debatable, but unquestionably, Powell understands the deep crisis the US Economy and the US Dollar face in the months ahead. The Fed even telegraphed the oncoming crisis in one of its own publications.

For more than 50 months in a row, the core inflation rate – the Fed’s preferred measure – has been above the target 2%. The June 2025 number was 2.82% and under normal conditions, the US Fed would have aggressively hiked the rates. The only reason why they do not do so is “Fiscal Dominance”.

What is Fiscal Dominance? It is easy to understand through the actual scenario in front of the Trump administration today. The expected National Debt by the end of FY2026 would be $40+ trillion. A 5% rate on the National rate would imply an interest outgo of more than $2 trillion, and this would be more than 40% of the expected Federal income of nearly $5 trillion. The above 5% rate would be a very low figure by historical standards, and it’s only in the post-2008 GFC that this would be considered high.

This would mean that nearly 40% of the Federal Income goes towards servicing the interest if the interest rate were just 5%. A couple of years down the line, and even without a major crisis, we could be looking at close to 50%. Given that any crisis would be a double-whammy, i.e., the Federal revenue will decline dramatically and the debt will skyrocket, this 50% is almost guaranteed under Trump 2.0.

This is Fiscal Dominance, and is the primary reason why Trump wants a reduction of 300 bps in the Fed Funds rate and why Powell will agree at least to a limited extent. Actually, “is agreeing” is a better way to look at it, as the price inflation is well above the Fed mandate for more than four years now, and Powell, despite a series of hikes, is nowhere close to meeting the target.

The National Debt on ARMS

It is now almost sure that the 10-year and 30-year treasuries will diverge from the direction of the Fed Funds rate. So even if Powell indulges in 2 or 3 cuts during the rest of 2025, the direction of the long-term treasuries is unlikely to reverse and will continue to move higher. The Trump administration seems to understand this all too well. As Treasury Secretary Bessent suggested, the plan seems to involve placing the National Debt on floating rates, with the “hope” that the US Fed will not have to contend with price inflation over the next three years under Trump 2.0.

But what in effect they are doing is the equivalent of putting the National Debt on an Adjustable Rate Mortgage System (ARMS). This would effectively remove the legs from which a significant uptick in price inflation can be handled.

Despite the seeming differences, both Trump and Powell are working towards destroying the US Dollar, with Trump decidedly at a more frenzied pace than would otherwise be the case. With Trump upping the ante and threatening to fire a voting member, Ms. Lisa Cook (who, not coincidentally, is opposed to a reduction in rates at this juncture), it would not be entirely surprising if the Fed pretends to oppose the cutting of rates at a pace that would be acceptable to Trump. Trump, who can never back out of a challenge, would stage a coup of the US Fed by stealth, and the supposed independence would then appear to be compromised.

Looking ahead – What this means for different Asset Classes.

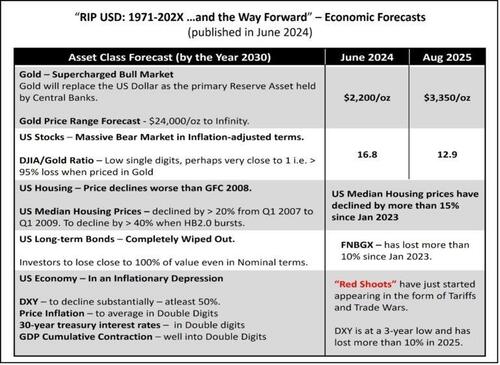

More of what has been happening since 2022, and at an accelerated pace as well. I had outlined the impact of the fiscal and monetary policies in my book, and that is summarized below.

Trump is unwittingly setting himself up to be the fall guy for what has essentially been the blunders of the US Federal Reserve.

It would be uncharacteristic of the Fed not to utilize the opportunity and pass the buck, as it has almost always done.

What about the supposed critical issue of the Fed’s Independence?

Truth to be told, the independence of the Free World’s monetary system was eliminated in 1913 with the formation of the Federal Reserve.

The Independence of the Fed was effectively abolished in 1971 when Nixon closed the Gold Window.

What Trump is doing today is just putting the final nail in the coffin of the US Dollar.

Shanmuganathan Nagasundaram is an Austrian/Libertarian Economist based in India. His latest book is ‘RIP USD: 1971 – 202X …and the Way Forward’

Tyler Durden

Wed, 09/03/2025 – 16:20

3 miesięcy temu

3 miesięcy temu