Is Japan About To Hike Rates AND Restart Yield Curve Control?

By Elwin de Groot and Michael Every of Rabobank

Iran’s Khamenei said nuclear talks with US are unlikely to “lead to any outcome”… as US intel says Israel is preparing for a strike on Iran, seeing oil prices move higher. The Israeli press also says Iranian efforts to recruit Israeli agents have skyrocketed, Tehran trying to arrange high-profile assassinations inside Israel to mirror what Israel can do inside Iran, increasing the pressure further. That’s as President Trump is reportedly frustrated by Gaza war and wants PM Netanyahu to „wrap it up”; and the EU will review its association agreement with Israel, as their officials say diplomatic efforts stopped the EU from already halting the agreement; and the UK suspended trade talks with Jerusalem and attacked its ‘repellent’ extremism. Moreover, US Secretary of State Rubio said of Syria: “It is our assessment that, frankly, the transitional authority, given the challenges they’re facing, are maybe weeks —not many months— away from potential collapse and a full-scale civil war of epic proportions, basically the country splitting up,” which is justification for the US and EU removing sanctions on it. In short, the entire energy-rich region is in flux. And so is much else.

The IMF just asked the US to reduce its fiscal deficit as the Big Beautiful Bill will cut taxes and boost spending much further; and that’s as Reuters says the US ‘is preparing for a long war with China that could hit its bases and homeland’ and Trump is set to launch a „Golden Dome” missile defence system that will cost $175bn and almost certainly won’t be ready within his term of office, as promised. Trump reportedly also wants the UK to boost defense spending to 3% of GDP by 2029, so within the current parliament, increasing its fiscal deficit too.

Against that backdrop, the downgrade of the US by Moody’s last Friday may have not come as a huge surprise and its debt was already trading “as if” it no longer belonged to the AAA bucket. Still, the re-rating of US debt is having potential effects in corners of the market. Managers of Hong Kong’s Mandatory Provident Fund system are flagging they may be forced to sell their Treasury holdings, since the pension fund only allows them to invest more than 10% of their assets in Treasuries if the US has a AAA or equivalent rating from an approved rating agency. Japan’s Rating & Investment Information is the only approved agency left out there having the US at the highest rating level. The rating agency keeps the US’ rating on stable outlook and has indicated that the situation “hasn’t significantly changed” since it made its assessment in February.

But other scenarios could obviously play out. The US Congress is moving closer to endorsing Trump tax-cuts, leading to a significant increase in deficits and debt: with the IMF publicly calling for the US to reduce its deficit, such a scenario could lead to a gradual reduction in the share of Treasuries in various investment portfolios. Potentially, so could Trump considering an executive order to open US retirement plans to private equity, which would allow savers to access funds focused on “corporate buyouts and other high-octane deals” – so fewer US Treasuries(?)

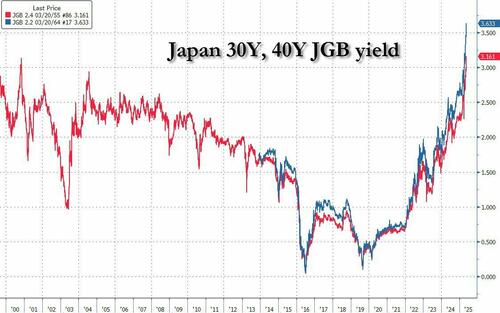

Meanwhile, whereas European/German long-term yields are trading at levels that are still some 30-40bp lower than in early March –when the EU’s and Germany’s defence and infrastructure spending plans startled markets– those in the US and Japan are trading close to or even higher than the levels seen in early March. A 20y bond auction in Japan saw the lowest demand since 2012 and this pushed the 30y Japanese yield to its highest level since its 1999 debut. It certainly doesn’t help when your own prime minister acknowledges the country’s fiscal situation is “extremely poor, and worse than Greece’s” – even if their intent is to signal opposition to fresh tax cuts financed by additional debt issuance.

Japan’s core inflation rate has come down from its peak levels of nearly 3% y/y in late-2023 to sit at just over 1.5%. That level, however, was only surpassed twice in the past thirty years: in 2014 and 1997. But in both instances the inflation spike was due to significant changes to the VAT system. If Japan has now entered (?) an episode of more ‘normal’ inflation, it could lead to more persistent upward pressures on (real) bond yields, which would raise interest costs.

And, like in the US and Europe, the central bank has been dialling down its bond purchases, which, next to weaker demand for bonds, could also be contributing to higher liquidity-risk premiums. Japan’s public debt ratio (214% in 2024) is the highest among developed economies. The BOJ still holds a staggering share (around 50%) of public debt on its balance sheet, but even if the central bank does not slow down its purchases, the ‘net’ amount of debt would still be in the 100%+ range and comparable to that of – indeed – Greece’s, back in 2007.

We want to avoid burning our fingers on the Japanese bond market – betting against it is commonly known as the widow-maker trade. But we ponder whether Japan could serve as an example for Europe or even, perhaps, the US – Japan, after all, has been the test case for many unconventional policies in recent (monetary) history.

First off, the country may be better placed than both of these peers to tackle bond market turbulence, and the impact of higher yields on governments’ financing costs. Only 12% of JGBs is owned by foreign parties. So, arguably, the government could introduce some form of wealth tax to claw back part of interest payments on its bonds. Note the similarities with the suggestions for a so-called Mar-a-Lago accord, in which the US could try to lessen its debt servicing costs by forcing its allies to term out their debt holdings at a below-market return, or by imposing some form of tax on foreign holders of Treasuries. The major difference is that Japan’s solutions could be less controversial, since domestic tax policies would suffice to achieve the desired outcome.

However, such a clawback only gets Japan so far. A wealth tax that offsets the higher debt servicing costs helps to contain the fiscal deficit and debt, but that does not provide the government with additional fiscal space to pursue its strategic goals, such as defence spending or reducing dependence on foreign inputs (note the similarities with the European situation here). Barring monetary support, more substantial tax increases or spending cuts in other areas would be required – and that could quickly erode support for the ruling party.

Alternatively, the BOJ could resume its government bond purchases. But this would arguably lead to higher inflation and would probably weaken the currency – at a time when the JPY is already under increased scrutiny of the US administration. Japanese finance minister Kato yesterday said that „[…] exchange rates should be set by markets, and that excessive volatility in currency moves has an adverse economic and financial impact.” Weakness in the yen could undermine any trade agreement between the US and Japan. So, to mitigate this impact of quantitative easing, could the BOJ simultaneously raise its policy rates in an attempt to achieve a currency-neutral policy mix of higher rates and de facto yield curve control?

Meanwhile, in trade: China’s Xi stepped up calls for industrial self-sufficiency –so, no rebalancing then?– and China said it will respond to US chip curbs; Malaysia is to press ahead with Huawei AI, testing the US position on that issue, as Nvidia’s CEO says US chip curbs on China are ‘a failure’; G7 countries are discussing tariffs on oversupplied, low-value Chinese products; the EU is considering a €2 de minimis charge on incoming Chinese packages; the EU is also expected to propose a quota for Russian gas, potentially offering companies a legal way to end their contracts; the US believes new sanctions on Russia may harm peace talks; India imposed restrictions targeting nearly 42% of inbound goods from Bangladesh; and Japan is taking a hardline position ahead of trade talks, demanding the US remove all reciprocal and sectoral tariffs on it.

So, yes, much is in flux.

Tyler Durden

Wed, 05/21/2025 – 10:20

4 miesięcy temu

4 miesięcy temu