Incoming: „Big Dumps Of Cold Air. Reminiscent Of 2013/14 Winter”

US natural gas futures spiked to an intraday high of $4.279/MMBtu during Sunday evening trading, driven by forecasts of another round of cold air set to sweep through next week.

„The pattern ahead is about as favorable as it gets for big dumps of cold air. Reminiscent of 2013/14 Winter at times in terms of the cold set up. Most of the country in the deep freezer by Day 8,” private weather forecaster BAMWX wrote on X.

The pattern ahead is about as favorable as it gets for big dumps of cold air. Reminiscent of 2013/14 Winter at times in terms of the cold set up. Most of the country in the deep freezer by Day 8. pic.twitter.com/bv5nFotnr7

— BAM Weather (BAMWX) (@bamwxcom) January 13, 2025

BAMWX said the „major cold shot” will be the „coldest air yet this year” and „extend all the way to the Deep South.”

„One feature that has continued reoccur throughout this winter has been what we call the +TNH or the Hudson Bay Vortex,” the private weather forecaster said, adding, „We haven’t had a consistent +TNH pattern through winter in several years. The only recent year that had a strong +TNH was 2022.”

One feature that has continued reoccur throughout this winter has been what we call the +TNH or the Hudson Bay Vortex.

We haven’t had a consistent +TNH pattern through winter in several years. The only recent year that had a strong +TNH was 2022. pic.twitter.com/YrCCzcthjg

— BAM Weather (BAMWX) (@bamwxcom) January 13, 2025

BAMWX noted, „This type of pattern was more common in the early 2010s/late 2000s.”

This type of pattern was more common in the early 2010s/late 2000s.

Interestingly, years on here like 2014, 2011 and 2009 had similarities to the QBO/ENSO pattern we have this year. pic.twitter.com/f9EBKicI7O

— BAM Weather (BAMWX) (@bamwxcom) January 13, 2025

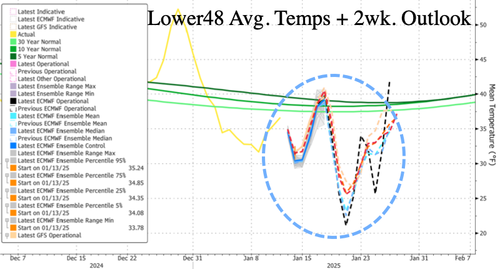

According to data compiled by Bloomberg and several weather models, average temperatures across the Lower 48 are forecasted to plunge early next week. Depending on the model, temperatures could range between 20°F and 30°F, remaining well below the 5-, 10-, and 30-year averages through the end of the month.

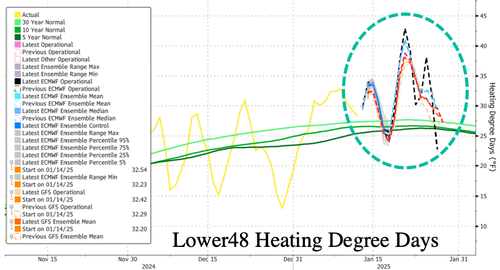

Heating degree days, a measurement of how cold the temperature is and how much energy is needed to heat a building, for the Lower 48, is expected to soar. This is an indication energy demand will jump even higher.

The continued cold blast and another round of frigid temperatures sent US NatGas prices as high as $4.279/MMBtu in the overnight hours.

Last week, Goldman Sachs co-head of Global Commodities Research Samantha Dart explained more about the next round of cold plus elevated LNG exports that forced her to revise her Henry Hub summer 2025 $2.90/mmBtu forecast to $3.30/mmBtu. The prospect of rising LNG exports leaves the analyst’s 2026 target of $4/mmBtu „skewed to the upside.”

Goldman: „Cold January” & „Record LNG Demand” Drive Upside Risk In Natty Prices https://t.co/jWUNtTZlMQ

— zerohedge (@zerohedge) January 11, 2025

BAMWX’s meteorologist Bret Walts provides clients this morning with a long-range forecast for the Lower 48:

All eyes are on the $4/mmBtu level.

Tyler Durden

Mon, 01/13/2025 – 14:27

7 miesięcy temu

7 miesięcy temu

![Popularny pisarz Max Czornyj odwiedził Świdnicę. Spotkanie tuż przed premierą thrillera „Skrzywdzona” [FOTO]](https://swidnica24.pl/wp-content/uploads/2025/08/Max-Czornyj-spotkanie-autorskie-festiwal-literacki-iKropka-2025.08.26-30.jpg)