In The Global Trade War „The EU Clearly Has Joined The US Camp”

By Bas van Geffen, senior macro strategist at Rabobank

Picking Sides

Yesterday, the EU and the US finally released a joint statement on trade. The statement further decreases trade uncertainty, as both sides were still locked into talks over some of the details. In the end, the EU did make several regulatory concessions to the US. However, European legislation on e.g. digital services was less of a blocking issue than some had feared.

The joint statement confirms that 15% is the base tariff, which will also apply to European pharmaceuticals and semiconductors from September 1. As we noted before, that’s a significant increase from the current 0% rate. Having said that, this coming into effect little over a week from now also reduces any lingering risk that these two sectors would temporarily be subject to much higher Section 232 tariffs that Trump is still due to announce.

The auto industry will have to wait a little longer: the US will cut the tariff on European cars only after the EU “formally introduces the necessary legislative proposal to enact the tariff reductions” on US industrial goods and certain food and agri exports – and extends the 2020 ‘lobster deal’ that expired July 31.

The statement also keeps the door open to quota for steel and aluminium exports, to safeguard US and EU supply chains. More importantly, Washington and Brussels will coordinate actions to “ring fence” their domestic steel and aluminium markets from overcapacity. That’s a thinly veiled way of not saying China?

If you need more proof of that, the two sides have also agreed to strengthen their cooperation related to export restrictions on critical minerals and similar resources by third countries, to address non-market policies of third parties, and to cooperate on inbound investment reviews as well as duty evasion.

Add to this the European commitment to align with US technologies and the purchase of US defense equipment, and the EU clearly has joined the US camp.

Although the joint statement further reduces trade uncertainty, we still expect foreign demand for European goods to be more muted in the coming quarters. Nonetheless, the European purchasing managers’ indices were better than expected. And the positive surprise in the August survey was entirely led by European manufacturing. It is somewhat remarkable that the manufacturing sector, which should be hardest hit by tariffs and trade uncertainty, has steadily improved since the start of the year.

Frontrunning of Trump’s tariffs may have helped European exports in the first half of the year, but the flipside of that frontloading should be weaker export performance in the coming period. In fact, the August survey suggests that the improvement was entirely home-grown. European manufacturers reported an increase in new orders for the first time in 14 months – despite a fall in new export orders.

Day ahead

Today’s key event is the Fed’s annual conference in Jackson Hole. Several central bankers have travelled to Wyoming, including ECB President Lagarde, the Bank of England’s Bailey and Governor Ueda from the Bank of Japan. But the key speaker is Fed Chair Powell.

Powell has so far maintained that more data is needed before the policy rate can be lowered further. And the minutes from the last FOMC meeting revealed this week that a majority of policymakers are still waiting for more clarity on the potential inflationary impact of Trump’s tariffs.

There is still no convincing evidence that consumer prices are being affected by the higher tariffs, but since the July policy meeting, the producer price index has shown the first signs of upward price pressures. It remains unclear to what extent this will be passed on to consumers, and how persistent these price pressures will be. But, since that meeting, it has also become evident that the labor market has been significantly weaker in recent months than previously thought.

So, the Fed is caught between inflation risks and concerns about the labor market. Driven by the weak jobs report, markets are pricing a 70% chance that the Fed will lower rates in September. Several FOMC members have recently hinted at this as well. But what does Powell think? If he still insists that more data is needed, the market may revise the probability of a rate cut.

But will Powell be very outspoken today? The Fed Chair is not only torn between the two objectives of its dual mandate; the Trump administration continues to chip away at the independence of the central bank.

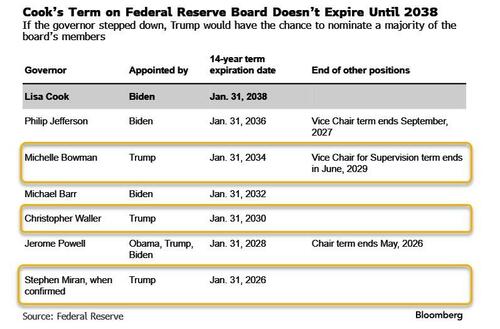

In addition to Trump’s verbal attacks on the Fed chair, the president is also trying to undermine Powell’s position from within the FOMC. Trump already has a some allies within the Fed. Bowman and Waller dissented in July, and he has nominated Miran, one of his confidants, to (temporarily) join the FOMC starting in September.

But Miran’s seat is the only one Trump can fill with certainty in the coming years, since Powell can technically stay on as a regular member of the FOMC after his term as chair ends. And that’s not enough for Trump to tighten its grip on the central bank.

So, Trump and his allies have now launched an attack on Lisa Cook. The Department of Justice indicated it plans to investigate her over alleged fraud. A DoJ official “encouraged” Powell to immediately remove Cook from the central bank’s board “before it is too late!” – but Powell does not have the authority to do so.

The ECB releases its estimate of Q2 negotiated wages. The Bundesbank reported a strong rebound in German wages. That should lift the eurozone average, which in turn should further reduce the prospect of additional monetary easing.

Tyler Durden

Fri, 08/22/2025 – 09:25

3 miesięcy temu

3 miesięcy temu