Ghost Of Ghosn? New Nissan CEO Pitches Massive Restructuring That Will Slash 15% Of Global Workforce

Nissan’s newly minted CEO Ivan Espinosa wasted no time making waves, bluntly admitting at a recent press conference: “The reality is clear. We have a very high cost structure.” He’s not sugar-coating the company’s woes either: “We see that our company is really struggling.”

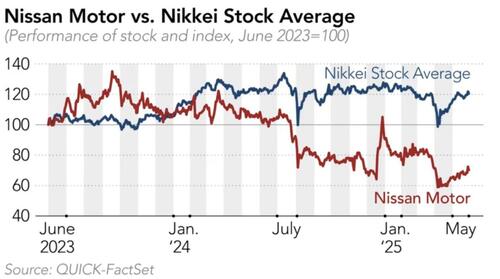

Since taking the reins in April, Espinosa has rolled out a massive restructuring plan, “Re: Nissan,” that slashes 20,000 jobs—15% of its global workforce—and cuts its production capacity by nearly a third, according to Nikkei.

“The urgency for us is now to bring stability back into the company,” he insisted. “We are doing [the reform] because it is truly necessary and it is something that is truly painful for us to do, but unfortunately, it is one of the only ways to save our company.”

His plan smacks of déjà vu: Carlos Ghosn’s 1999 turnaround saw similar layoffs and plant closures. But Espinosa insists it’s not a Ghosn rip-off: “I think they didn’t imitate or were not conscious of Ghosn’s plan,” said Takaki Nakanishi, a top analyst, adding, “It’s just that their KPIs ended up being similar.”

Nikkei writes that unlike Ghosn’s days of a “treasure trove” of competitive products and a helpful yen, Nissan now faces Chinese EV juggernauts, a battered product lineup, and a messy divorce from Renault. “Renault no longer wants Nissan,” Nakanishi deadpanned.

Analysts say Espinosa’s plan looks good on paper—Kota Yuzawa of Goldman Sachs calls it “significant progress on structural reforms”—but Nakanishi warns that Espinosa might need an unconventional partner, even musing: “Nissan could even use Toyota’s [software] platform.” Everything, it seems, is on the table—except an easy road ahead.

Nissan swung from a 148.2 billion yen surplus to a 217.5 billion yen ($1.5 billion) cash outflow in fiscal 2024, mainly due to its struggling auto business. Back in 1999, it actually had a positive cash flow of 111.6 billion yen.

Tyler Durden

Thu, 06/05/2025 – 20:30

5 miesięcy temu

5 miesięcy temu