Dallas Fed Respondents Turn Apocalyptic Amid Trump Push To Hammer Oil Prices

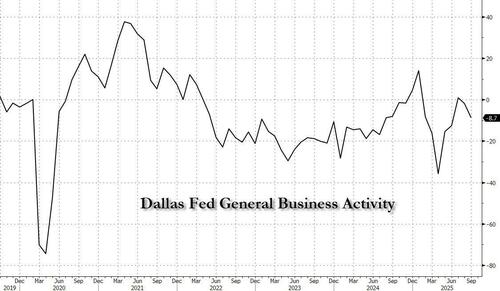

Just when it seemed that the Dallas Fed Manufacturing Activity index was set to emerge from its contractionary mire, having printed contractionary (i.e., sub zero) for much of 2025 until finally emerging into expansion in July with a modest 0.9 print, it has since resumed its slide dropping to -8.7 in September, from a -1.8 in August, and well below the median estimate of a -1.0 (which would have been an increase from August).

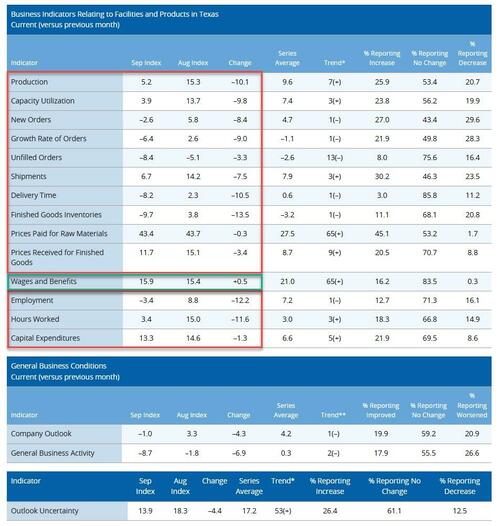

What happened? As the next table shows, there was a uniform deterioration across virtually every indicator, starting with New Orders, Shipments, Delivery times, Inventories and going all the way down to Prices for Finished Goods, Employment and Hours worked. In fact the only indicator that posted an improvement from August was Wages and Benefits, which at 15.9 (up from 15.4) is still below the series average of 21.0

So what changed and why did the mood deteriorate rapidly once more?

For the answer straight from the horse’s mouth we present you with the always entertaining comments from the respondents which speak for themselves and hardly need commentary, suffice it to say that the locals are hardly delighted with either tariffs, high interest rates, falling demand or general economic malaise, which is to be expected from a regional Fed that is largely dependent on the US energy industry (read Texas shale) which in turn has been crippled by Trump’s demands to keep oil prices as low as possible if not lower, and has hammered the US oil E&P industry.

Computer and electronic product manufacturing

- I may have to close the company. Orders have stopped coming in, and we do not know why.

Fabricated metal product manufacturing

- Orders have been put on hold, and we are not receiving any new [purchase orders] since Aug. 15 on open RFQ’s [requests for quotation].

Food manufacturing

- Political and interest rate instability are killing us. We are fortunate that our raw ingredients are stable by price and supply chain availability. The non-profit food relief „business” is a train wreck.

- We are still concerned over employment and labor issues.

- Furniture and related product manufacturing

- We are seeing demand decline.

Machinery manufacturing

- We see the oil industry slowing and are more hesitant to invest in their business. We believe that the uncertainty of government decisions is affecting their business decisions, which in turn will affect our business.

- We should have our best month of the year in September. Orders are strong, plus we are working on some good new projects.

- Relief! Rates are easing, finally. Tariffs are of little consequence. Labor is steady. We might even turn a profit by year-end!

Nonmetallic mineral product manufacturing

- After careful evaluation of prevailing economic conditions, including the current level of interest rates and unpredictability of tariffs, our company continues to hold and not proceed upon our expansion plans. The cost of financing at existing rates has materially impacted the feasibility of these projects, and we believe it is prudent to delay implementation until interest rates are reduced to more sustainable and affordable levels.. We remain committed to our operations in Texas and to continued long-term growth. However, further expansion (building addition, inventory expansion, capital equipment acquisition) will be contingent upon a more favorable borrowing environment that supports capital investment and job creation.

- The interest rates for mortgages are keeping potential new homeowners out of the market. Homebuilders do not want to build up excess inventory, and therefore our business of producing materials for homebuilders has dropped off significantly. In addition, roughly 30 percent of buyers are falling out of the homebuying process due to inability to qualify for mortgages (credit card debt).

Paper manufacturing

- We are still neutral on our current status, but incoming orders are trending down when this time of year they should be up. A few tariff surcharges are starting to show up, but not enough to try to pass along. Competition in the packaging industry has prices declining somewhat.

Printing and related support activities

- We need interest rates to fall more than a quarter percentage point.

- Incoming orders have definitely slowed way down, and all we can attribute it to is the crazy tariff-induced environment we are living in. Instead of Washington, D.C. policies increasing business and making it better, they seem to be adding way too much uncertainty and making things worse. We have continued to be busy because of robust incoming orders earlier in the summer. If things don’t change quickly, we may soon be looking at reducing hours and possibly cutting back on the number of employees, which will be a shame given how hard it is to get good workers up to speed with your manufacturing processes.

Transportation equipment manufacturing

- The trucking industry has now reduced its production forecast for 2026 to essentially be flat with 2025. This remains at a depressed level versus industry averages.

Source: Dallas Fed

Tyler Durden

Mon, 09/29/2025 – 14:40

2 miesięcy temu

2 miesięcy temu