Core Producer Price Growth Slides To Lowest Since August As Companies Eat Tariff Costs

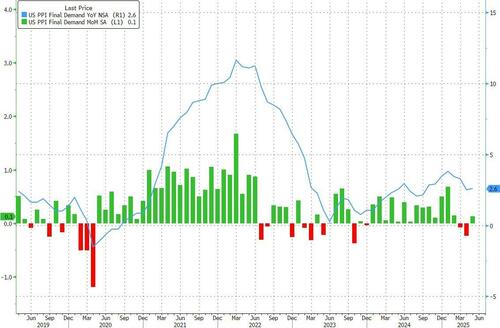

Following another month of cooler than expected CPI, US Producer Prices followed and printed well below expectations in May (if not quite the plunge observed last month), rising only 0.1%, below the +0.2% MoM exp (but we note that just like March’s 0.4% MoM decline was revised up to unchanged, so May’s -0.5% drop has been also revised higher to -0.2%). Meanwhile, the headline print posted a modest increase, rising from an upward revised 2.5% in April (from 2.4%) to 2.6% in May.

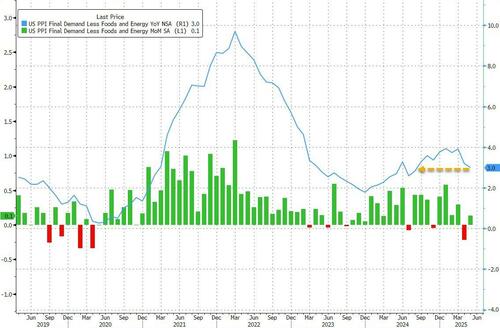

But while headline PPI posted a modest annual increase, core PPI continued to slide, rising just 3.0% in May, the lowest since August 2024 (below the 3.1% estimate), down from an upward revised 3.2% in May, as a result of a 0.1% monthly increase in core PPI, which also missed expectations of a 0.3% increase.

Looking at the PPI components that matter for PCE calculation, airline passenger services contracted another 1.1% m/m in May, after a 1.8% decline in April. Portfolio management contracted 1% after a 7.1% decline in April. Home health and hospice care flat, and hospital outpatient care contracted 0.3% m/m in April.

Under the hood, prices for final demand services rebounded 0.1% in May, reversing the 0.7% plunge in April which was the largest (pre-revision) decline since the index began in December 2009, driven by portfolio management services.

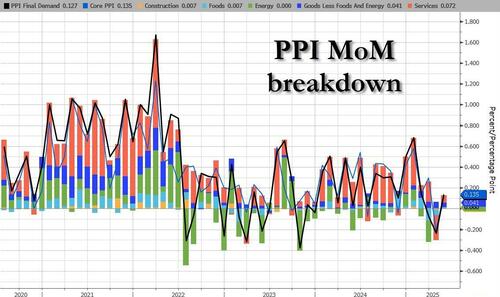

Taking a closer look at the components:

- The index for final demand services inched up 0.1% in May following a 0.4% decrease in April. The advance was attributable to a 0.4% rise in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.) In contrast, prices for final demand transportation and warehousing services declined 0.2 percent, while the index for final demand services less trade, transportation, and warehousing was unchanged.

- Product detail: Leading the increase in prices for final demand services in May, margins for machinery and vehicle wholesaling jumped 2.9 percent. The indexes for traveler accommodation services; apparel, footwear, and accessories retailing; alcohol retailing; and system software publishing also moved higher. Conversely, prices for airline passenger services fell 1.1 percent. The indexes for furniture retailing; securities brokerage, dealing, investment advice, and related services; and portfolio management also decreased.

- Product detail: Leading the increase in prices for final demand services in May, margins for machinery and vehicle wholesaling jumped 2.9 percent. The indexes for traveler accommodation services; apparel, footwear, and accessories retailing; alcohol retailing; and system software publishing also moved higher. Conversely, prices for airline passenger services fell 1.1 percent. The indexes for furniture retailing; securities brokerage, dealing, investment advice, and related services; and portfolio management also decreased.

- Prices for final demand goods rose 0.2% in May after edging up 0.1% in April. Over 80% of the May advance can be traced to the index for final demand goods less foods and energy, which climbed 0.2%. Prices for final demand foods increased 0.1%, while the index for final demand energy was unchanged.

- Product detail: Within the index for final demand goods in May, prices for tobacco products rose 0.9 percent. The indexes for gasoline, processed poultry, roasted coffee, residential natural gas, and oilseeds also increased. In contrast, prices for jet fuel declined 8.2 percent. The indexes for pork and for carbon steel scrap also fell.

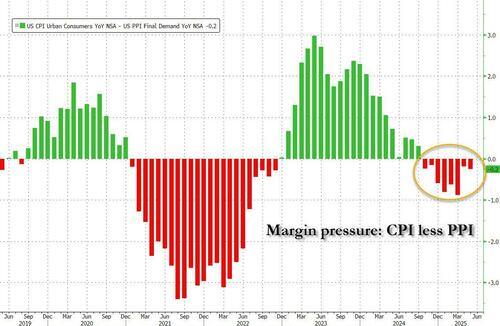

Margin pressure remains on American corporations, which confirms that companies are eating tariff costs.

In other words, despite all the FUD, companies are soaking up any tariff price increases and NOT passing them on to customers.

Tyler Durden

Thu, 06/12/2025 – 09:00

5 miesięcy temu

5 miesięcy temu