Bureau Of Labored Statistics

By Bas van Geffen, senior market strategist at Rabobank

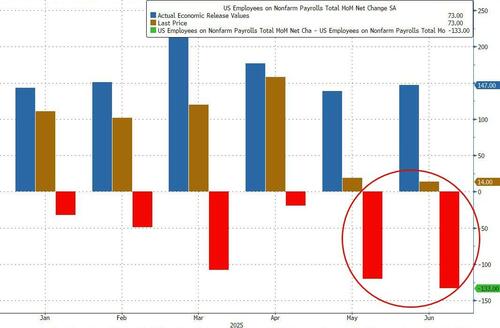

Non-farm payrolls came in at just 73,000 jobs last month. Moreover, revised estimates for May and June came in at just 19k and 14k. This means that 258,000 fewer jobs were created in those two months than initially estimated.

So, Friday’s employment report was very disappointing, to say the least. It supports the argument of the two dissenting FOMC members, namely that the labor market outlook may be weaker than the Fed thought. It certainly raises the probability of a rate cut when the Fed’s policymakers meet again in September – something the market had started to doubt after last week’s policy decision.

Yet, Trump wasn’t exactly happy. The US president wants the central bank to cut rates. But he does not want lower rates because of concerns that the economy is cooling down. In fact, Trump either does not believe the statistics, or he really does not want to hear them. Following the poor employment report, President Trump fired the Commissioner of Labor Statistics, claiming she was a political appointee by Biden.

In short, on top of threats to the Fed’s independence, the market may now have to start worrying about the reliability of US data – and not only because statistics agencies are running into capacity constraints as a result of budget cuts.

Because Trump will get an early opportunity to take more control of the Fed. On Friday, Kugler resigned from the board, several months before her term ended. The US president will reportedly appoint her replacement (who may just become the next Fed Chair when Powell leaves), and the next Commissioner of Labor Statistics, by the end of this week.

Equity markets fell on Friday, as Trump’s tariffs and the employment report suggested that global growth could be weaker than expected. Today, European markets are opening in the green, hoping that the weak data will elicit Fed easing. Indeed, EUR/USD rose 1.5 cents after the non-farm payrolls as the market revises its outlook for US monetary policy, and perhaps further boosted by concerns about the future independence of the central bank and statistics offices.

As damaging as the firing of the BLS head may be for the trust in US statistics, it wasn’t President Trump’s scariest social media post. Last Thursday, Medvedev, currently the deputy chairman of Russia’s Security Council, said that Trump’s new ultimatum to stop the war in Ukraine is “a threat and another step towards war.” The former president also reminded Trump of Russia’s nuclear strike capabilities. Responding to Medvedev, President Trump announced that he “ordered two Nuclear Submarines to be positioned in the appropriate regions, just in case.”

Russia and China have started joint military exercises in the Sea of Japan. These war games were planned well before the escalatory rhetoric between Trump and Medvedev, but they do underscore deepening Russia-China ties.

Meanwhile, China’s control over critical raw materials is biting the US’ military dominance. Even though Beijing has loosened export controls on rare earths after the US and China agreed to a trade truce, the Wall Street Journal reports that manufacturers of military equipment still struggle to source key inputs. This leads to significantly higher production costs, and –worse– production delays.

According to US Trade Representative Greer, talks on these rare earth flows are “about halfway there,” while Treasury Secretary Bessent expressed optimism about a near-term trade deal with China.

Canadian officials sounded equally optimistic about a deal to lower US import tariffs, after talks with the USTR and Secretary of Commerce. However, Greer suggested that many of the August 1 tariffs were unlikely to be lowered. Whether that also applies to Canada remains to be seen. The Canadians have a meeting with Commerce Secretary Lutnick this week, but they don’t expect a quick resolution. A follow-up meeting will reportedly be scheduled for late August.

Tyler Durden

Mon, 08/04/2025 – 10:15

4 miesięcy temu

4 miesięcy temu