Broadcom Jumps Most In Months After $10 Billion OpenAI Chip Order

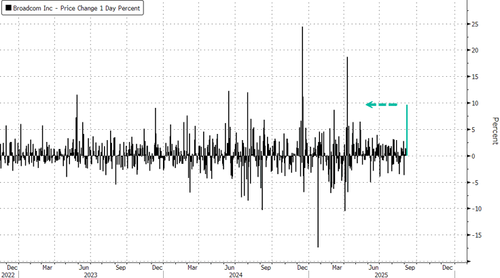

Broadcom shares jumped the most since April in premarket trading, assuming the gains hold into the cash session, after a Financial Times report earlier said the chipmaker will produce a line of artificial intelligence chips for OpenAI. The new chips, set to enter series production next year, will reduce the ChatGPT maker’s reliance on Nvidia.

On Thursday, Broadcom CEO Hock Tan announced that a new customer had placed a $10 billion order for AI chips. While Tan did not disclose the customer’s identity, FT sources confirmed it was OpenAI, noting that the new chips are scheduled to ship in 2026.

The market reaction in premarket trading sent Broadcom shares in New York up by more than 9%. If these gains are held into the cash session, this would make the largest daily increase since shares jumped nearly 20% in early April. Year-to-date, shares are up 32% (as of Thursday’s close).

Shares are headed for the largest daily increase in months.

Rally continues.

FT sources said OpenAI plans to use the new chips internally. The move mirrors strategies by tech giants such as Amazon, Google, and Meta, which have all developed their own chips to handle massively increasing AI workloads.

Here’s more from the outlet:

On a call with analysts, Tan announced that Broadcom had secured a fourth major customer for its custom AI chip business, as it reported earnings that topped Wall Street estimates.

Broadcom does not disclose the names of these customers, but people familiar with the matter confirmed OpenAI was the new client. Broadcom and OpenAI declined to comment.

Tan said the deal had lifted the company’s growth prospects by bringing „immediate and fairly substantial demand”, shipping chips for that customer „pretty strongly” from next year.

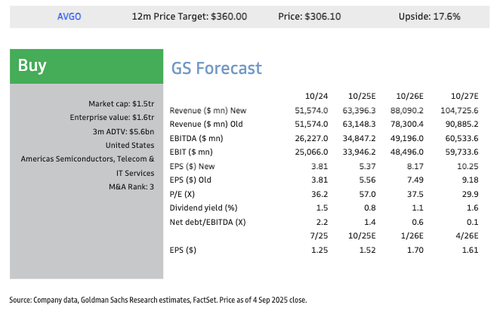

Commenting on Broadcom’s earnings and new AI chip customer, Goldman analyst James Schneider told clients that third-quarter results were solid with upside guidance, and that securing OpenAI as a customer is a huge win that reinforces the bull case:

Key stock takeaways: We expect the stock to trade up following a solid quarter with guidance above the Street, despite elevated expectations heading into the quarter. We believe the most significant development was Broadcom’s announcement that it has converted another new custom silicon customer focused on inference, which is expected to help drive „material” upside to management’s prior expectation of AI Semiconductor revenue growth of ~60% in 2026. The company’s AI Networking prospects remain compelling heading into 2026 with significant scale-up and scale-out opportunities driven by its Tomahawk 6 and Jericho 4 products. Management noted that it currently has a total backlog of over $110bn, which implies significant business visibility over the next two years. Finally, the company announced that CEO Hock Tan has announced his intention to remain CEO through at least 2030. We remain Buy rated on Broadcom as we see the company remaining the leader in AI custom compute and merchant networking silicon (which is likely to grow in importance), and we believe the company’s enterprise software portfolio is under-appreciated.

Quarterly results were in line with the Street: Broadcom reported revenue of $16.0 bn, above GS and the Street (Visible Alpha) at $15.9 bn. Gross margin of 78.4% was in line with GS at 78.5% and modestly above the Street at 78.2%. Operating margin of 65.5% was in line with GS and the Street at 65.4%. Operating EPS of $1.69 was modestly below GS at $1.73 and above the Street at $1.67. AI Semiconductor revenue of $5.2 bn was in line with GS at $5.2 bn and above the Street at $5.1 bn. Semiconductor Solutions revenue of $9.2 bn was in line with GS at $9.2 bn and modestly above the Street at $9.1 bn. Infrastructure Software revenue of $6.8 bn was above GS and the Street at $6.7 bn.

Other analyst commentary on the Street (courtesy of Bloomberg):

Bloomberg Intelligence

- „Broadcom’s strong fiscal 3Q and 4Q guidance beat across all metrics, but more specifically its AI revenue, suggests better- than-anticipated AI custom application-specific integrated circuit (ASIC) ramp-ups at its two large customers”

JPMorgan (overweight, PT to $400 from $325)

-

Broadcom reported better-than-expected 3Q results and issued solid 4Q revenue outlook „driven by accelerating AI demand”

-

„This performance puts Broadcom on track to drive ~$20B in AI revenues for FY25”

Bernstein (outperform, PT $400)

-

Broadcom’s 3Q earnings were good „with both semis and software better than expected”

-

„While non-AI semis remain slow to recover AI semis revenues were quite strong”

CFRA

-

„AI momentum remains robust with 11 consecutive quarters of growth and hyperscaler infrastructure investments driving sustained demand for custom accelerators”

-

„We expect continued outperformance through CY 2026”

Evercore ISI (outperform, PT $342)

- This was a beat-and-raise report, with AI revenue ahead of Evercore’s expectations

Meanwhile, OpenAI’s deal with Broadcom means less reliance on Nvidia’s graphics chips. Shares of Nvidia fell about 1% in premarket trading.

Tyler Durden

Fri, 09/05/2025 – 07:07

3 miesięcy temu

3 miesięcy temu