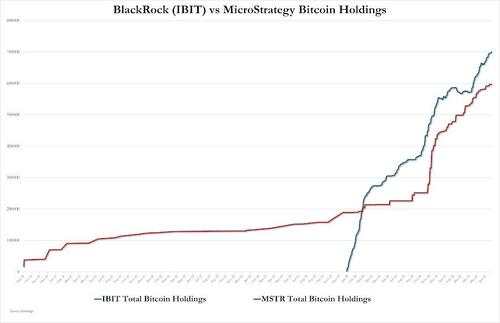

BlackRock’s ETF Holdings Top 700,000 Bitcoin; Far Above Saylor’s 'Strategy’

BlackRock’s spot Bitcoin exchange-traded fund has just crossed over 700,000 BTC in assets under management, far surpassing Michael Saylor’s stash at (Micro)Strategy…

„New milestone… iShares Bitcoin ETF now holds over 700,000 BTC,” Nate Geraci, president of NovaDius Wealth Management (formerly The ETF Store), said.

„*700,000* in 18 months. Ridiculous.”

ETF inflows continue to build…

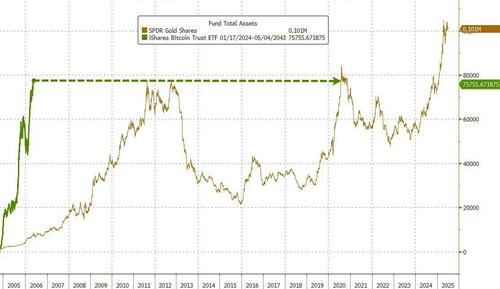

In just 18 months, IBIT’s AUM topped $75 billion; an achievement that took GLD (the gold ETF) over 15 years to achieve…

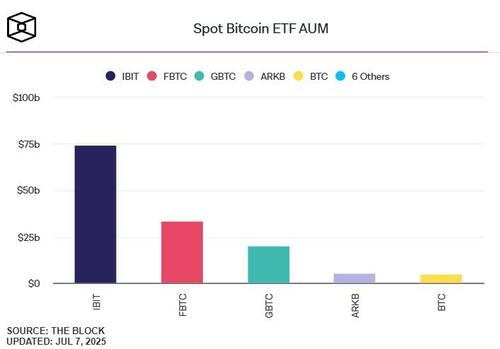

As The Block reports, the combined assets held by all U.S. spot bitcoin ETFs are now at approximately 1.25 million BTC ($135 billion), according to CoinGlass data – nearly 6% of bitcoin’s total 21 million supply.

IBIT accounts for approximately 56% of that AUM alone – greater than Strategy’s 597,325 BTC ($65 billion) stack, for comparison.

Meanwhile, as CoinTelegraph reports, US Bitcoin exchange-traded funds, combined with Michael Saylor’s Strategy, the largest corporate holder of Bitcoin, have purchased more Bitcoin than the supply generated by miners almost every month so far this year, according to Galaxy Research.

Strategy and the US Bitcoin ETFs have collectively bought Bitcoin worth $28.22 billion in 2025, while Bitcoin miners’ net new issuance has amounted to $7.85 billion during the same period.

As of June, the combined entities have bought more Bitcoin than the new supply being generated each month, except in February, when the combined entities sold Bitcoin worth $842 million.

All of which supports the trend higher in bitcoin along with global liquidity surging…

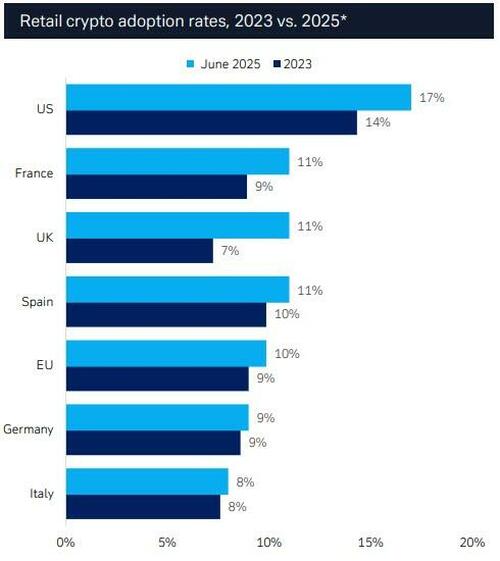

…and increased adoption, with US leading UK and EU…

Deutsche Bank’s recent survey shows younger, high-earning respondents continue to have the highest adoption.

Male consumers boast a higher adoption rate and believe they have a better understanding of crypto vs. female consumers.

But, despite regulatory breakthroughs, lack of understanding and high risk continue to rank as the top barriers for crypto usage.

Tyler Durden

Tue, 07/08/2025 – 14:40

5 miesięcy temu

5 miesięcy temu