Bitcoin’s Hidden Scarcity: Lost Coins And The Silent Supply Shock

Submitted by Ronan Manly of the Sound Money Report

While Bitcoin’s fixed 21 million coin cap was designed to counteract fiat inflation and mirror gold’s scarcity, a massive pool of permanently lost coins further tightens supply.

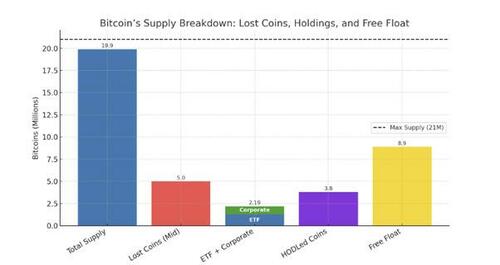

Estimates from on-chain analyses suggest that between 2.3 million and an incredible 7.8 million BTC (roughly between 11—37% of total supply), may have vanished forever, trapped in lost wallets, forgotten keys, or in addresses abandoned due to unexpected deaths. These ‘zombie’ or ‘ghost’ coins then effectively reduce Bitcoin’s effective circulating supply from the current 19.9 million to as low as a range of 12.1—17.6 million BTC.

A Donation to Everyone

As well as intensifying Bitcoin’s existing inherent scarcity, coins that permanently vanish boost the true value of all remaining Bitcoins. As Satoshi Nakamoto, Bitcoin’s pseudonymous creator/creators, stated in a foresightful observation in April 2010 in a post on the BitcoinTalk forum: “Lost coins only make everyone else’s coins worth slightly more. Think of it as a donation to everyone.”

The lost coin range estimate (2.3—7.8 million) also comfortably exceeds the combined total of Bitcoin ETF and corporate treasury holdings which together total approximately 2.2 million BTC, a point rarely highlighted by a mainstream financial media fixated on the latest Blackrock Bitcoin ETF inflows and [Micro]Strategy’s latest BTC purchases.

No Keys, No Coins

Bitcoin’s rarity is thus magnified by these permanent losses, as the lost coin supply shock increases the value of every remaining coin, in contrast to traditional centralised assets such as stocks or bonds, In Bitcoin, there is no safety net. Once access is gone, the coins are effectively removed from circulation.

With a self-custodial architecture of ‘be your own bank’ but on an immutable blockchain, any lost and inaccessible coins on the Bitcoin network remain visible but untouchable. There is no bank and no bailout – only the owner and their private keys.

The familiar warning about exchange-held BTC of “not your keys, not your coins” now becomes the even more dramatic “no keys, no coins” in the off-exchange world.

Bitcoin relies on private keys (unique 256-bit cryptographic strings) to control and transfer ownership between addresses. Forgotten passwords, lost seed phrases, overwritten files, corrupted drives, or discarded hardware all result in irreversible inaccessibility.

Real-World Losses

Real-world cases highlight the dramatic scale and drama of lost Bitcoin. In 2013, the now infamous Welsh IT engineer James Howells accidentally discarded a hard drive containing private keys to 8,000 BTC in a landfill, worth roughly USD 900mn at current prices. But local city council rulings about environmental regulations prevent the obsessed Howells from launching a search for the lost hard drive.

Stefan Thomas, former Ripple CTO, lost access to 7,002 BTC (circa USD 777mn today) after forgetting his IronKey hard drive password, which locks permanently after 10 failed guesses. In January 2021, with two attempts left, Thomas described to the New York Times his repeated, desperate, and unsuccessful efforts to regain access.

Deaths also contribute to Bitcoin inaccessibility when holders die without succession plans. Gerald Cotten, CEO of Canadian crypto exchange QuadrigaCX, allegedly died in 2018 without revealing how to access USD 190mn in client funds, which included substantial Bitcoin holdings.

Romanian early Bitcoin miner Mircea Popescu drowned off a Costa Rica beach in 2021, widely rumoured to have left up to 1 million BTC inaccessible. (potentially worth USD 111bn). While the size of Popescu’s BTC holdings is unproven, he was known to have had sizeable holdings.

And then there’s Bitcoin’s creator, Satoshi Nakamoto, who pulled his own vanishing act in April 2011, leaving behind an estimated 1 million BTC mined between 2009— 2010. This Satoshi stash is now possibly ‘lost’ forever, or has been left intentionally dormant as a ‘donation’ to the network.

Estimating the Extent of Loss

But just how many coins may be gone forever? Numerous studies have utilised blockchain analytics, wallet inactivity metrics, and even factor in human behaviour to try and pin down the extent of lost and inaccessible Bitcoins.

In a May 2025 report, Ledger cites analyst estimates of between 2.3—3.7 million lost Bitcoins, representing 11—18% of Bitcoin’s max 21 million coin supply. Cane Island Digital’s Timothy Peterson, in a June 2025 report, estimates over 6 million BTC irretrievably lost, potentially reaching 7 million by late 2025.

In 2023, Glassnode, the blockchain data and on-chain analytics platform, estimated approximately 7.8 million BTC or 39% of mined supply, were either “HODLed or lost coins”, although this may include dormant wallets held intentionally, which would overstate the estimate. This came from a Glassnode study in conjunction with ARK Invest, which used a metric of ‘Vaulted Supply’ aka “HODLed or lost coins,” which “multiplies outstanding supply times vaultedness to measure the number of coins that have not been moved. Either they are in strong hands, or they are lost.”

In June 2025, Fidelity Digital Assets estimated that Bitcoin’s ancient supply, defined as the amount of bitcoin that has not moved for 10 years or more, accounted for over 17% of total issued supply, which is terms of BTC is over 3.3 million coins. In late 2024, River Financial, a Bitcoin financial institution were citing 3-4 million BTC as lost.

Despite varying methodologies, these studies, as a group, converge on a range of 2.3—7.8 million BTC lost, with the higher estimates like Glassnode’s and Peterson’s potentially overstated due to combining dormant and truly lost coins. Whatever the exact number, this range highlights a substantial and growing loss of Bitcoin, which enhances the scarcity of the remaining supply.

Losses vs ETFs and Corporate Treasuries

Comparing this loss range to the high-profile holdings of Bitcoin ETFs and corporate treasuries is eye-opening. As of August 2025, spot Bitcoin ETFs collectively held about 1,036,000 BTC or 5–6% of the roughly 19.9 million BTC so far mined, with Blackrock’s IBIT holding approximately 555,000 BTC of that total.

Corporate and treasury holders add another layer, with the top 100 corporates holding a combined 988,000 BTC (5% of the mined total) according to the Bitcoin Treasuries website, chief among them MicroStrategy (rebranded as Strategy) with 632,457 BTC, and such well-known names as MARA Holdings (50,639 BTC), Riot Platforms (19,225 BTC), and Japan’s Metaplanet (18,113 BTC).

Combining ETF plus corporate BTC holdings yields approximately 2.2 million, which is even less than the lower bound for estimated lost BTC of 2.3 million, and is a vivid illustration of the sheer scale of inaccessible coins. In other words, there is a hidden supply shock that the market has not yet fully processed, one which dwarfs both the US Bitcoin ETF inflows and Michael Saylor’s buying sprees.

From a circulating supply of 19.9 million BTC, subtract 5 million lost coins (midpoint estimate) and 2.2 million institutional holdings to get 12.7 million BTC in individual hands. Assume 30% of this (~ 3.8 million) is HODLed by long-term investors, which tallies with Glassnode’s 70% ‘unmoved supply’, which includes institutional and some misclassified lost coins.

Shrinking Free Float

This allows us to calculate a Bitcoin “Free Float”, that may be available to trade in the public market:19.9 million BTC mined so far, minus 5 million (lost), minus 2.2 million (institutionally held), minus 3.8 million (HODLed by individuals) = a free float of just 8.9 million BTC, or 42% of the 21 million total supply, and 45% of circulating supply. That is far less than the free float of S&P 500 stocks, which have a free float of 70—90%, and where ‘lost’ shares don’t exist as the centralised system can reissue them, unlike Bitcoin’s unforgiving blockchain.

The reported Bitcoin market cap of over USD 2.1trn market cap (19.9 million * USD 109,000) then is also a mirage, and is overstated by ~USD 500bn due to counting lost ‘ghost’ coins. With 5 million coins lost, the true supply is ~14.9 million BTC, which results in a real market cap of ~USD 1.6trn.

Conclusion

Bitcoin is scarcer than the market realises. Lost Bitcoins of between 2.3—7.8 million (11—37%) reduce accessible supply from 19.9 million to between 12.1—17.6 million. Irrecoverable coins inflate the value of every remaining coin, and intensify Bitcoin’s narrative as a store of value even rarer than gold. The widely accepted market cap of USD 2.1trn is overstated by about USD 500bn, with the true market cap near USD 1.6trn.

This silent supply shock, which dwarfs institutional demand and is ignored and underestimated by the mainstream media, positions Bitcoin not just as digital gold but as an asset with unparalleled rarity. It also has the potential to trigger a seismic price surge as the market wakes up to the scarcer than realised reality, and a free float barely half its total supply.

Tyler Durden

Sun, 09/07/2025 – 15:10

2 miesięcy temu

2 miesięcy temu

![Ślubowanie kadetów i nowa strzelnica w Zespole Szkół numer 5 w Rybniku [FOTO]](https://www.naszrybnik.com/photos/176393477557-908806-.jpg)