Be Careful What You Wish For: Weaker Yen A Blessing And A Curse For Japan

By Simon White, Bloomberg Markets Live reporter and strategist

A weaker yen will boost inflation in Japan, but it may do so to an undesirable extent, especially as there are growing signs price growth is becoming embedded.

Be careful what you wish for. For years, Japan has yearned for sustainable inflation around 2%. Add a pandemic, a rise in energy prices and one of the most extensive and long-lasting loose monetary policies seen in the history of global central banking, and it may have got there.

However, stopping inflation at the right level is a bit like turning a cargo ship: you have to make the decision to turn long before you need to. Headline inflation in Japan is coming off recent highs, helped by subdued oil prices. But so-called core-core CPI (ex-fresh food and energy) is proving worryingly stubborn, still hovering within ~0.5% points of its all-time highs.

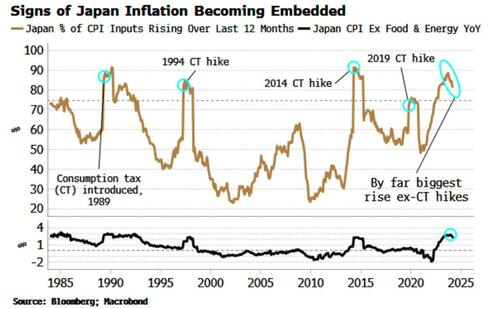

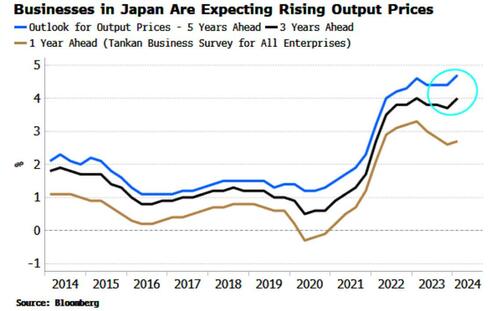

There are further signs of inflation becoming embedded. The percentage of inputs to the CPI basket (with over 650 of them, there is a Byzantine level of detail) rose to by far its highest level outside a consumption tax hike and remains elevated.

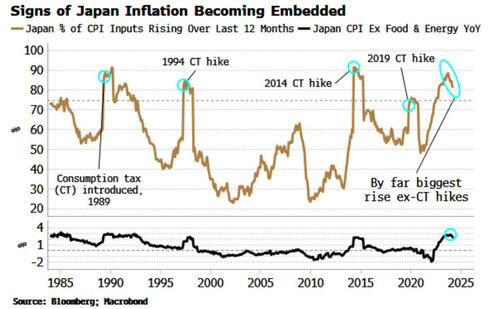

BOJ Governor Kazuo Ueda has been on the wires today, highlighting that FX is a vital factor effecting inflation. He is not wrong. The recent yen weakness will soon pressure CPI to move higher again.

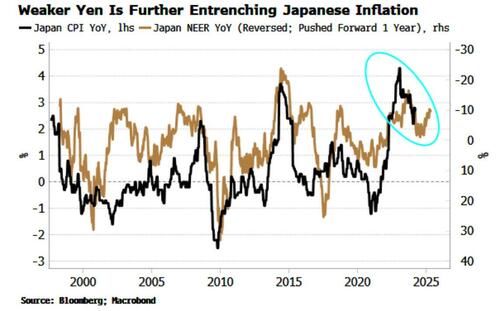

That’s at a time that longer-term inflation expectations are rising, based on the Tankan survey of businesses on output prices. Long-term household expectations of inflation are also sticky and near series highs.

Japan has not had to deal with persistently high inflation expectations almost within living memory. Ueda also highlighted the negative effects on the economy from an abrupt, one-sided weak yen. More pernicious is likely to be the further rousing of inflation that’s already looking like it’s going to be the gift to the BOJ that gives too much.

Tyler Durden

Wed, 05/08/2024 – 17:55

1 tydzień temu

1 tydzień temu