American Eagle Shares Erupt As Sydney Sweeney’s „Great Jeans” Fuels Sales

American Eagle shares surged in premarket trading in New York after the clothing retailer reported second-quarter revenue that exceeded Wall Street consensus estimates, as tracked by Bloomberg. The stronger-than-expected results were primarily driven by buzz around the „Sydney Sweeney has great jeans” ad campaign launched in July.

„The fall season is off to a positive start. Fueled by stronger product offerings and the success of recent marketing campaigns with Sydney Sweeney and Travis Kelce,” AE CEO Jay Schottenstein wrote in a statement to investors.

AE reported same-store sales down 1% in the second quarter that ended August 2, exceeding the average analyst estimate. Revenue also outpaced expectations.

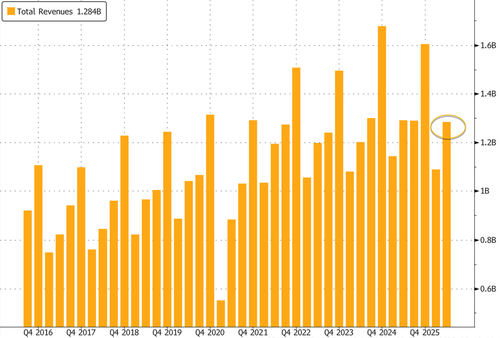

Here’s a breakdown of second-quarter results:

-

Revenue: $1.28B, down .6% YoY but above Bloomberg consensus of $1.23B.

-

Store Count: 1,185 total stores, up .8% QoQ and slightly above estimates (1,181).

-

AE Brand Stores: 829, down 1.7% YoY but ahead of consensus (820.5).

-

New Openings: 2 AE stores opened in the quarter, a 33% YoY decline.

-

Consolidated Stores: 1,176 at the start of the period, matching estimates. Square Footage: 7.27M sq. ft., up 0.5% QoQ, topping consensus (7.25M).

Total Revs 2Q

The third quarter forecast also topped consensus estimates:

- Operating income: $95M–$100M vs. $92.1M est.

Shares of American Eagle rose more than 24% in premarket.

Here’s what Wall Street analysts are saying (courtesy of Bloomberg):

Bloomberg Intelligence

-

Analyst Mary Ross Gilbert says American Eagle is poised to exceed low-single-digit comparable-sales growth in 3Q, with performance likely aided by its viral Sydney Sweeney campaign and Travis Kelce collaboration

-

„Operating income guidance, which is above consensus, also has upside amid more full-price selling”

Morgan Stanley (equal-weight, PT $10)

-

Analyst Alex Straton says the company „seems to have mostly corrected 1Q25 product mis-execution quickly”

-

„Higher campaign-related SG&A (selling, general, and administrative ) spend has not come with as much potential profitability degradation as we cautioned”

Jefferies (hold, PT $11)

-

Analyst Corey Tarlowe says AEO provided 3Q and FY guidance that exceeds the Street’s expectations for comp sales and operating income

-

„Overall, we are encouraged by the results and 2H guidance”

Vital Knowledge

-

AEO reported big upside on EPS, with the beat driven by higher GMs, cost controls, and better sales (comps were -1% vs. the Street -2.6%, w/particularly robust performance at Aerie, which posted comps +3% vs. the Street -1.8% while the AE brand fell a bit short with comps -3%),” writes analyst Adam Crisafulli

-

Says that while the FQ2 results are very strong, the shortfall in AE comps and the inline F25 guide could temper investor enthusiasm

Corporate America, take note:

. . .

Tyler Durden

Thu, 09/04/2025 – 07:45

2 godzin temu

2 godzin temu