SEATTLE- Alaska Airlines (AS) and Hawaiian Airlines (HA) submit two crucial applications to the US Department of Transportation (DOT) as they prepare for their planned merger.

These filings aim to facilitate a smooth transition and ensure uninterrupted service for customers once the merger receives approval.

Photo: Cado Photo

Photo: Cado PhotoAlaska Hawaiian International Routes

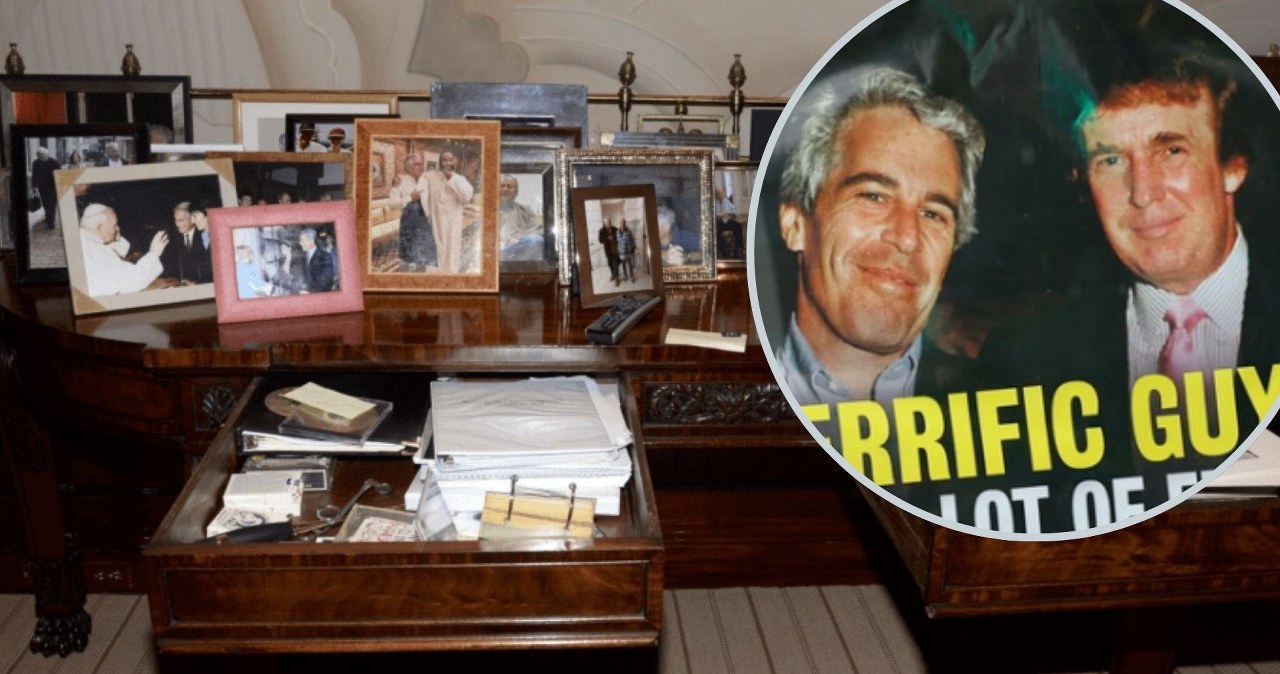

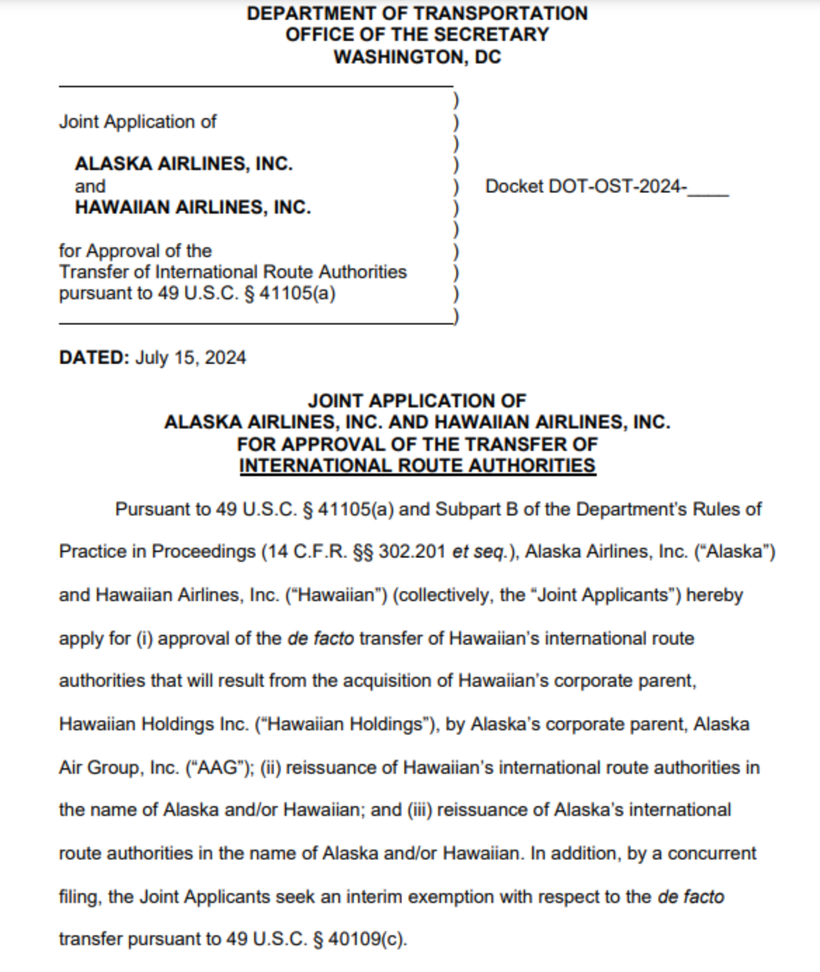

The first application requests a “de facto transfer of Hawaiian’s international route authorities” to Alaska Air Group. This transfer would allow Alaska Airlines to operate Hawaiian’s international routes.

Photo: Alaska Airlines

Photo: Alaska AirlinesAdditionally, the airlines seek to have their respective international route authorities reissued under each other’s names. This exchange of route authorities would enable both carriers to maintain their current international services while operating as a single entity.

Photo: DOT

Photo: DOTIn their second filing, Alaska and Hawaiian Airlines request “an interim exemption” to operate under common ownership. This exemption would permit the airlines to begin integrating their operations and planning joint ticketing before the merger’s final approval.

Such an arrangement would allow for a more efficient transition and minimize disruptions to passenger services.

Photo: Hawaiian Airlines

Photo: Hawaiian Airlines These applications demonstrate the airlines’ proactive approach to the merger process. By seeking these approvals in advance, Alaska and Hawaiian aim to streamline their integration and maintain operational continuity.

This strategy could potentially reduce the time required to fully merge the two airlines’ operations once they receive final approval.

Photo: Hawaiian Airlines

Photo: Hawaiian AirlinesFinal Decision on August 5th

Alaska Airlines and Hawaiian Airlines await the U.S. Department of Justice’s decision on their merger by August 5th. The merger faces opposition, including a lawsuit filed in Hawaii’s Federal Court in April.

Critics claim the merger violates federal law by reducing competition and potentially creating a monopoly.

Concerns about the merger include potential labor layoffs, higher prices, and reduced flight frequencies. Critics worry about impacts on interisland, mainland, and Asian routes from Hawaii.

Hawaiian Airlines CEO Peter Ingram asserts the merger will enhance competition, benefit customers and communities, and create job opportunities. Alaska Airlines CEO Ben Minicucci pledges to invest in Hawaiian communities and maintain robust Neighbor Island service.

The merger’s outcome remains uncertain, especially after the recent court decision blocking the JetBlue (B6)-Spirit Airlines (NK) merger. However, the Alaska-Hawaiian merger differs as neither airline operates as a low-cost carrier, which was a key factor in the JetBlue-Spirit Airlines case.

Photo: Alaska Airlines and Hawaiian Airlines

Photo: Alaska Airlines and Hawaiian Airlines Photo: Alaska Airlines and Hawaiian Airlines

Photo: Alaska Airlines and Hawaiian AirlinesIf approved, Alaska and Hawaiian will operate separately under common ownership until merging under a single operating certificate. Hawaiian Airlines will become a wholly-owned subsidiary of Alaska Air Group during the transition.

The airlines’ joint application to the U.S. Department of Transportation seeks approval for transferring international route authorities and permission to operate under common ownership during the transition period. These steps aim to facilitate seamless integration and maintain service continuity.

The merger’s fate hinges on regulatory approval and the resolution of legal challenges. Its outcome will significantly impact the U.S. airline industry, particularly in the Hawaiian market and West Coast-Hawaii routes.

You can read more about filings here:

- Joint Application of Alaska Airlines, Inc. and Hawaiian Airlines, Inc. for an Exemption

- Joint Application of Alaska Airlines, Inc. and Hawaiian Airlines, Inc. for Approval of the Transfer of International Route Authorities

Photo: By Adam Moreira (AEMoreira042281) – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=81045963

Photo: By Adam Moreira (AEMoreira042281) – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=81045963Previous Merger with Virgin America

Alaska Airlines’ merger history, particularly the Virgin America acquisition, provides context for the Hawaiian Airlines deal. Alaska initially celebrated Virgin America’s unique culture but ultimately eliminated the brand and Airbus fleet. This decision forced Virgin America pilots to retrain on Boeing 737s, reported Forbes.

Alaska’s legal obligation to pay $160 million for the Virgin trademark through 2039, despite not using it, highlights potential long-term financial consequences of brand decisions in mergers. The recent loss of an appeal in a UK court reinforces this obligation.

The Hawaiian Airlines merger agreement lacks similar legal protections for its brand icon, Pualani. However, eliminating this iconic symbol would likely be unwise for Alaska Airlines.

Brad Tilden, former CEO of Alaska Air Group, promised more flights, low fares, and enhanced rewards when announcing the Virgin America merger. Similar promises accompany the Hawaiian Airlines merger announcement.

Alaska’s “different works” approach in the Virgin America merger contrasts with its eventual standardization strategy. This history raises questions about the long-term preservation of Hawaiian Airlines’ unique identity and culture.

What are your thoughts on Alaska-Hawaiian Airlines Merger? DOJ should Approve it or Reject it? Let us know in the comments on our social media handles.

Also, Join our Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News.

Hawaiian Airlines CEO Share Insights on New 787, Alaska Merger

The post Alaska Airlines Requests US DOT to Transfer Hawaiian’s International Routes Ahead of Merger appeared first on Aviation A2Z.

1 rok temu

1 rok temu