2 In 5 Young Adults Are Taking On Debt For Social Image, To Impress Peers, Study Finds

You can thank the Tik Tok, Instagram world we live in…

Money may not buy love, but for many young adults, it’s still the ticket to attention. A new study shows that two in five Gen Zers admit going into debt just to impress others — often in dating and social situations, according to Credit One Bank.

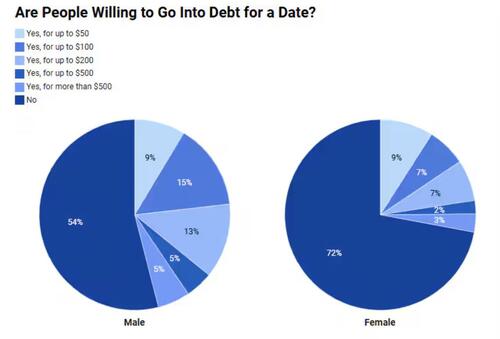

The pressure to perform financially is high among younger generations. Half of Gen Z and millennials (51%) say they’ve faked wealth or success, with Gen Z leading at 54%. Nearly 38% admit they’ve damaged their credit score or gone into debt to impress someone, and 37% say they’d even overdraft their accounts for a date. Men feel that pressure most: 46% would go into debt for a single date, compared to just 28% of women.

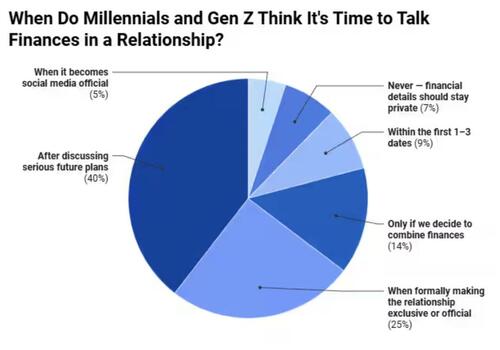

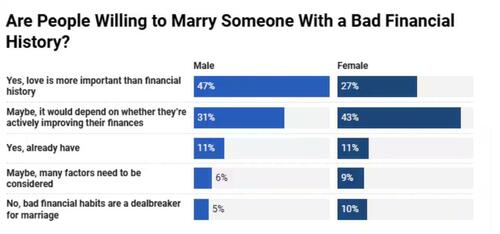

Credit One Bank writes that more than half of consumers say a high credit score makes someone more attractive, while nearly 70% would lose confidence in a boss with bad credit. Still, disclosure is rare: 54% of Gen Z and millennials prefer not to share their financial details with a partner until things get serious. Only 8% call poor financial history a marriage dealbreaker. Nearly half (48%) say they’d marry someone with a shaky financial past, especially if that person was improving. Gender gaps persist: men (47%) are more forgiving, while women are twice as likely to reject a partner over money issues (10% versus 5%).

Money talk remains awkward in friendships. Over 70% of women almost never discuss finances with friends, compared to about 60% of men. Yet with romantic partners, the story changes: 67% check in at least monthly, and 10% do so daily. Despite the discomfort, loyalty runs deep. More than half (51%) would help friends in financial crisis, though one in three say they’d stay cautious after receiving bad advice.

The study says financial independence is a top priority for many. Fifty-three percent say they’re determined to go it alone, while others admit they’d lean on family (27%) or even a partner (20%) for help. Gen Z often turns online for advice — even 21% from ChatGPT — but parents remain the leading source at 60%. Millennials, meanwhile, rely less on family (44%) and more on professionals (43%).

Finances don’t just influence relationships; they impact workplace credibility. Forty-three percent say they’d lose confidence in a boss with bad credit, while one in five would admire the honesty. When asked how they’d feel if loved ones knew their financial details, only a third felt proud. Men are more likely than women to feel confident, while higher earners are far prouder than those making under $50,000.

The bottom line: personality may still matter most in relationships, but today’s singles are swiping with one eye on the credit score. Between debt-fueled dating, social media pressures, and the drive for independence, money isn’t just part of the conversation — it’s often the deciding factor.

Read the full study here.

Tyler Durden

Sat, 09/13/2025 – 18:05

2 miesięcy temu

2 miesięcy temu